Withholding Taxes in the Philippines All You Need To Know eezi

Whether your tax withholding is tabulated by you or an employer through a W-4 form, anything that changes the size of your tax liability, or the amount of taxes you owe, could change the amount of.

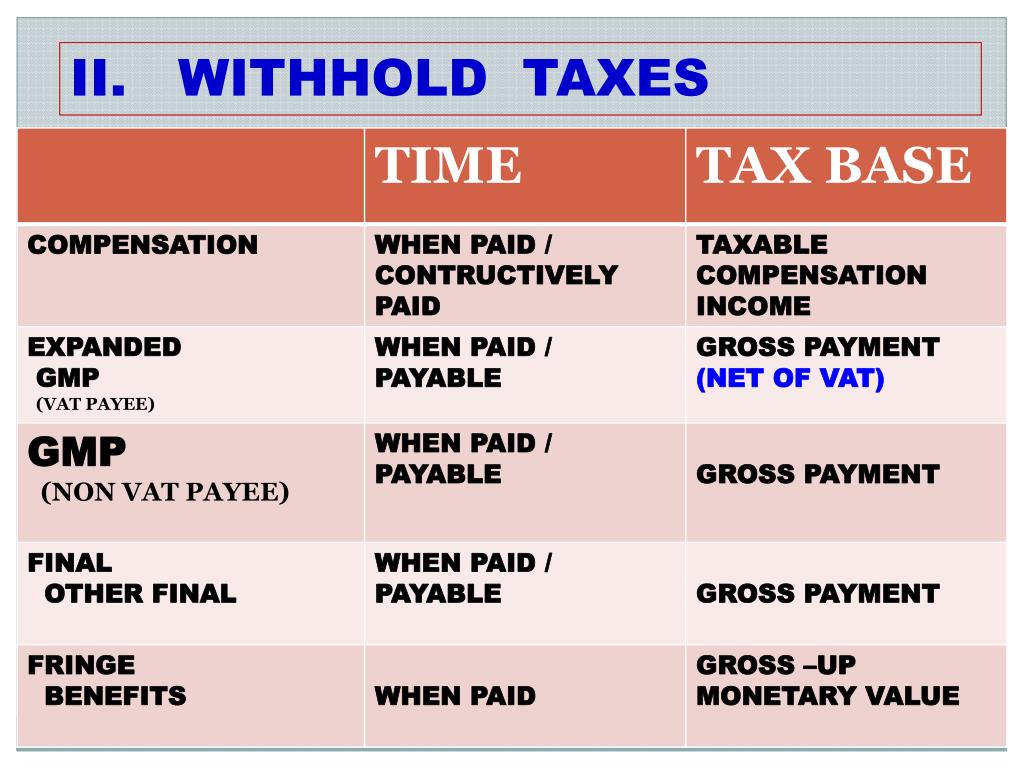

PPT WITHHOLDING TAX AT SOURCE PowerPoint Presentation, free download ID3912928

Tax Withholding. For employees, withholding is the amount of federal income tax withheld from your paycheck. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn. The information you give your employer on Form W-4. For help with your withholding, you may use the Tax Withholding.

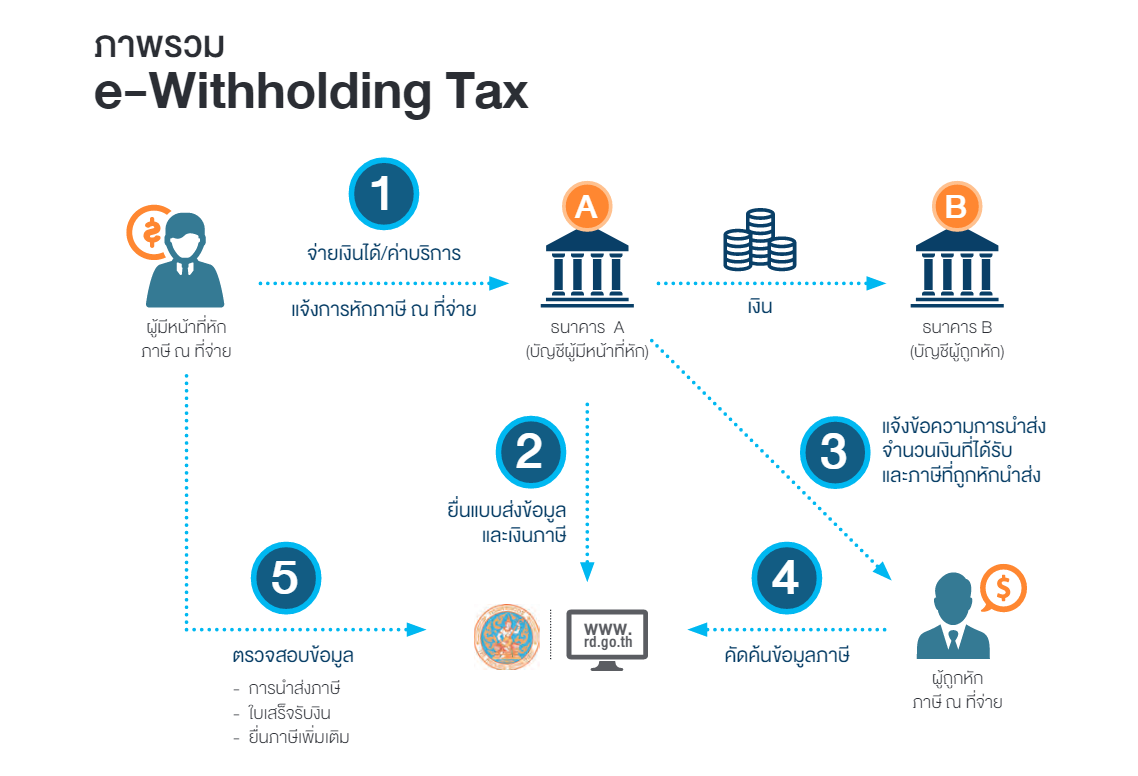

eWithholding Tax ทางเลือกใหม่ หักภาษี ณ ที่จ่าย จบ ครบ ง่าย ในที่เดียว smeone เพิ่มโอกาสให้

Here's what you need to know for the 2023 withholding tax tables: Increase in each income bracket. No withholding allowances for W-4s from 2020 or later. Computational bridge available for W-4s from before 2019. Backup withholding rate remains 24%. No change in the 22% supplemental tax rate.

What is Withholding Tax? Federal Tax ExcelDataPro

0.30%. Purchasing of gas fuel. 0.30%. Purchasing of lubricants. 0.30%. Manufacturers of cement, steel, automotive goods, paper and cigarettes. 0.1% to 0.45% when selling to agents or distributors. Goods that are classified as very luxurious are subjected to a withholding tax rate of 5% based on the selling prices.

Orientation on Withholding Tax for Job Order Contractors

Article 23/26 Income Tax (PPh 23/26) Domestic Article 23 WHT is payable at the rate of 2% for most types of services where the recipient of the payment is an Indonesian resident and 15% for a variety of payments to resident corporations and individuals. For non-residents, Art. 26 WHT of 20% is applicable.

:max_bytes(150000):strip_icc()/with-holding-tax-4186749-4d023b8133e443588c8ce795732df79c.jpg)

Withholding Tax Explained Types and How It's Calculated

Sedangkan withholding tax merupakan pemotongan dan pemungutan pajak melalui pihak ketiga. Artinya, sistem ini lebih mencakup dan ditujukan untuk semua penghasilan yang dihasilkan oleh para pelaku kegiatan usaha. Ini tercantum dalam Peraturan Direktur Jenderal Pajak Nomor PER-70/PJ/2007.

The Basics of Payroll Tax Withholding finansdirekt24.se

The Tax Withholding Estimator doesn't ask for personal information such as your name, social security number, address or bank account numbers. We don't save or record the information you enter in the estimator. For details on how to protect yourself from scams, see Tax Scams/Consumer Alerts. Check your W-4 tax withholding with the IRS Tax.

PPT WITHHOLDING TAX AT SOURCE PowerPoint Presentation, free download ID1098893

Perlu diketahui, sistem withholding tax di Indonesia dikenakan terhadap seluruh penghasilan dari kegiatan usaha, sebagaimana tercantum dalam Peraturan Direktur Jenderal Pajak Nomor Per-70/PJ/2007. Dalam konteks Undang-Undang (UU) Pajak Penghasilan (PPh), sebagaimana tercantum dalam UU Nomor 7 Tahun 1983, withholding tax diperlakukan sebagai:

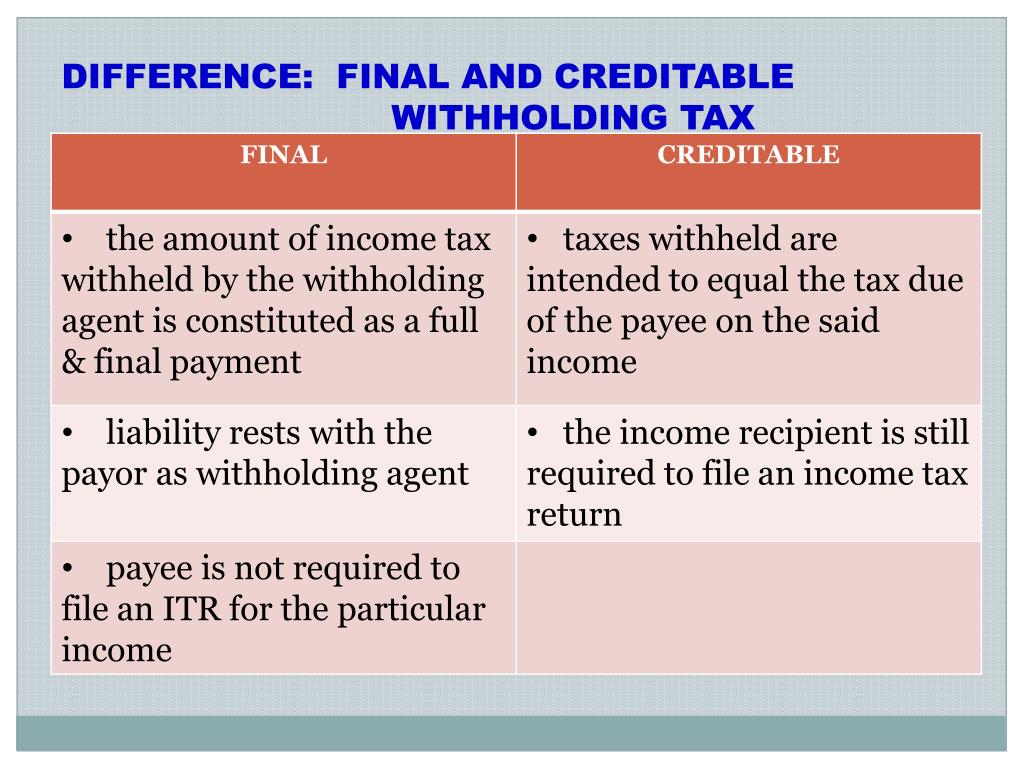

Creditable versus Final Withholding Tax YouTube

Pengertian Withholding Tax. Sistem withholding tax adalah sistem pemungutan pajak yang dilakukan oleh pemerintah kepada pihak wajib pajak, untuk melaksanakan kewajiban atas penghasilan yang telah dibayarkan kepada pihak penerima penghasilan sekaligus menyetorkannya ke kas negara Indonesia. Jika dijelaskan secara lebih singkat, maka istilah.

What is Tax Withholding? All Your Questions Answered by Napkin Finance

Withholding tax is an amount withheld by the party making payment (payer) on income earned by a non-resident (payee) and paid to the Inland Revenue Board of Malaysia. 'Payer' refers to an individual/body other than individual carrying on a business in Malaysia. He is required to withhold tax on payments for services rendered/technical advice.

Understanding Withholding Tax YouTube

Note: August 2019 - this Fact Sheet has been updated to reflect changes to the Withholding Tool. FS-2019-4, March 2019 The federal income tax is a pay-as-you-go tax. Taxpayers pay the tax as they earn or receive income during the year. Taxpayers can avoid a surprise at tax time by checking their withholding amount.

/GettyImages-942154464-05ea84f12d7e495ca4768ec673d6a7e5.jpg)

Withholding Tax คือ อะไร E Payment คืออะไร E Payment คือ อะไร EggThailan

If the business is not registered for Michigan taxes but is required to do so, contact the Michigan Department of Treasury's Business Tax Registration unit at 517-636-6925. Learn More About Registering a Business in Michigan

Withholding Meaning

The Maryland State income tax formula contains a computation for Maryland County tax. Refer to the withholding formula for information on the individual county rates. In the event an employee does not file a State withholding exemption certificate, then Single and zero (00) exemptions will be used as the basis for withholding.

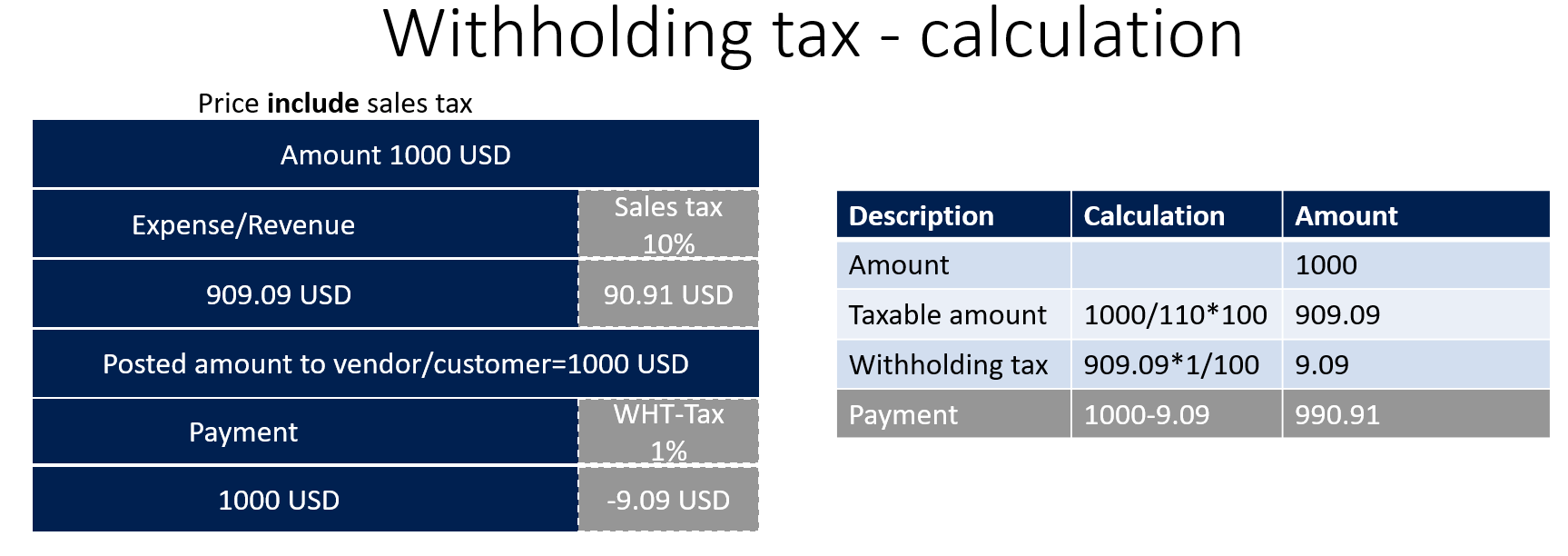

Understanding withholding tax Microsoft Dynamics 365 Enterprise Edition Financial Management

Withholding Tax atau yang sering disingkat dengan WHT adalah salah salah satu sistem pemungutan pajak yang diterapkan di Indonesia.. Artinya, tidak dapat digunakan sebagai pengurang atau kredit pajak di akhir tahun. Penerapan Withholding Tax di Indonesia. Penerapan Withholding Tax . Di Indonesia, penerapan withholding tax dilakukan dengan.

Revised withholding tax table for compensation Tax table, Tax, Compensation

Withholding tax is income tax withheld from employees' wages and paid directly to the government by the employer, and the amount withheld is a credit against the income taxes the employee must pay.

Revised Withholding Tax Table Bureau of Internal Revenue

Withholding tax adalah salah satu sistem pemungutan pajak yang diterapkan di Indonesia. Pada sistem ini, pihak ketika diberikan kepercayaan untuk melaksanakan kewajiban memotong atau memungut pajak sekaligus menyetorkannya ke kas negara, atas penghasilan yang dibayarkan kepada penerima penghasilan. Contoh sederhana dari implementasi sistem ini.