Definition Of Sunk Cost definitionjulh

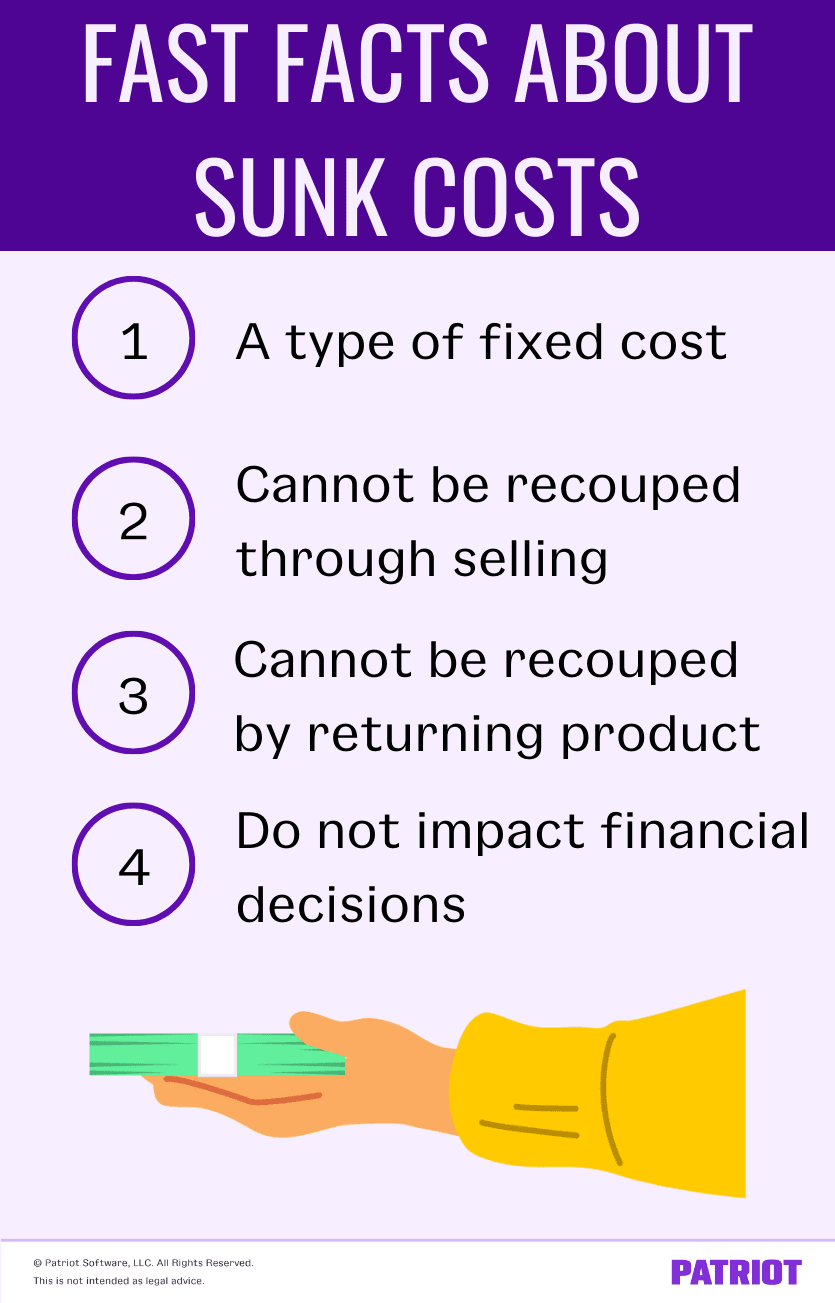

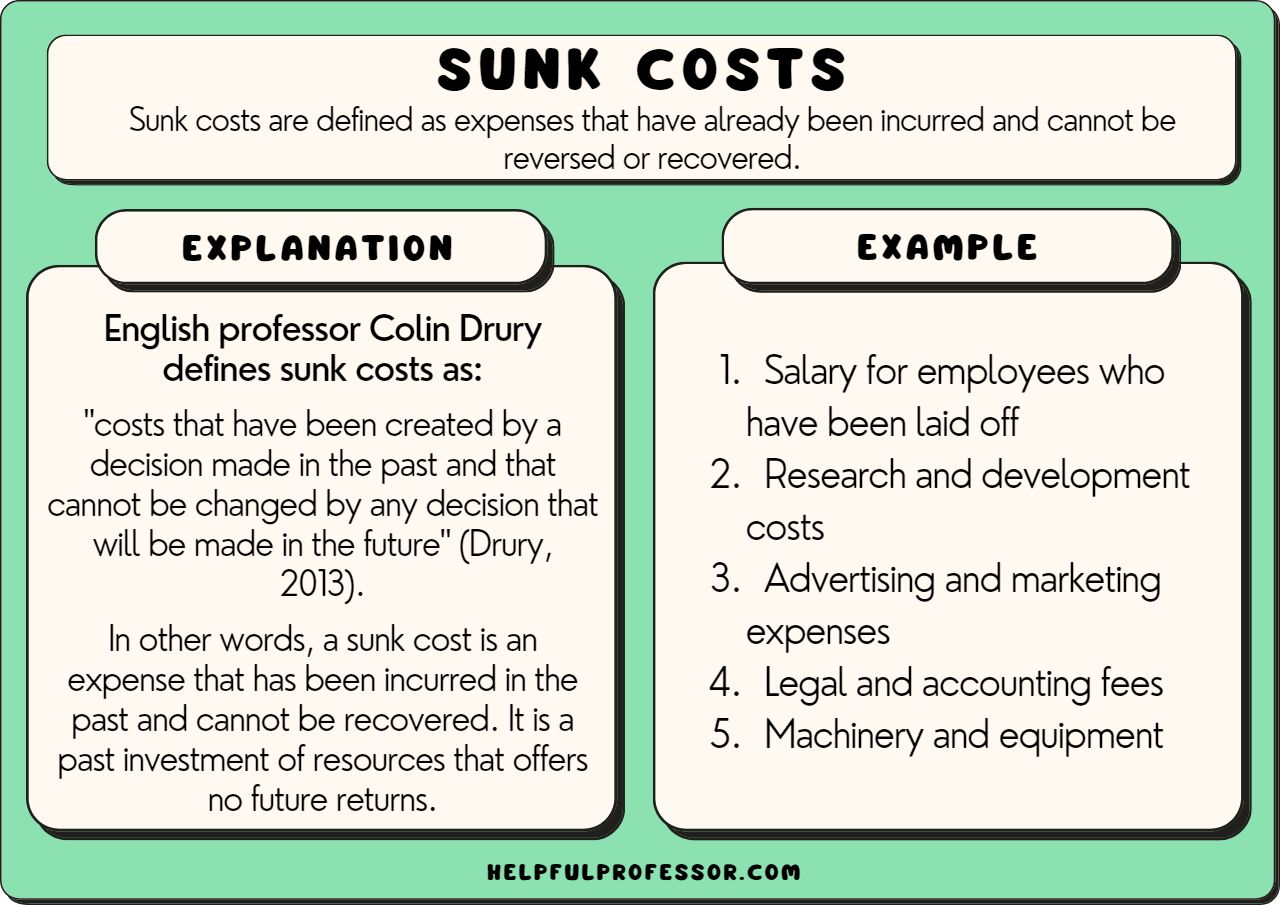

A sunk cost is a financial cost that cannot be recovered. This kind of cost often raises the question of whether or not to continue investing in the cost, project, or venture. Other characteristics of sunk costs include being unavoidable and remaining the same, making it a type of fixed cost. Sunk costs are an everyday financial occurrence and.

4 Tips Jitu Perusahaan Agar Terhindar dari Sunk Cost

JAKARTA, KOMPAS.com - Istilah sunk cost dan sunk cost fallacy banyak diperbincangkan di media sosial saat ini. Dalam ilmu akuntansi, sunk cost merujuk pada biaya hangus atau biaya yang terjadi di masa lalu dan tidak dapat diubah sekarang maupun di masa mendatang. Berangkat dari istilah tersebut, pada akhirnya muncul fenomena sunk cost fallacy.Sunk cost fallacy merujuk pada kekeliruan sikap.

Sunk Cost Fallacy Definition and Examples

How Sunk Costs Affect Firms' Investment Decisions January 23, 2023 • 5 min read. Research by Wharton's Marius Guenzel provides evidence that companies systematically fail to ignore "sunk.

Describe An Example Of A Sunk Cost Or Opportunity Cost 2022

The basic sunk cost meaning is that it has already been incurred and should not be a part of the decision-making process. However, sometimes, a company or an individual may stick to a decision (even when it may not be the most appropriate one) as the cost has already been incurred. The sunk cost fallacy states that making additional investments.

Sunk cost fallacy (The psychology of money series)

Jadi, sunk cost artinya biaya yang telah dikeluarkan dalam suatu bisnis dan tidak dapat dipulihkan kembali. Biaya-biaya yang tergolong sunk cost cenderung berhubungan dengan biaya prospektif seperti biaya yang akan dihadapi perusahaan di masa depan. Contoh biaya yang akan mengalami sunk cost misalnya biaya pembelian persediaan atau biaya bahan.

What is Sunk Cost Definition, Examples, FAQs

Sunk cost. In economics and business decision-making, a sunk cost (also known as retrospective cost) is a cost that has already been incurred and cannot be recovered. [1] [2] Sunk costs are contrasted with prospective costs, which are future costs that may be avoided if action is taken. [3] In other words, a sunk cost is a sum paid in the past.

What are sunk costs? Definition and meaning Market Business News

However, sunk costs aren't just useful for large companies deciding whether to enter new markets or close down factories. This principle can be applied in everyday life, and understanding it may impact how you make decisions. Feel free to leave the baseball game if it's raining. Some may call you a fair weather fan, but the cost became sunk.

Sunk Cost Definition, Examples, Sunk Cost Fallacy & More

Daftar Isi. Pengertian dan Contoh Sunk Cost Dalam Akuntansi dan Bisnis. Pada konteks akuntansi dan bisnis, terdapat suatu komponen pembiayaan yang tidak dapat kembali bagaimanapun caranya dan disebut dengan sunk cost. Sunk cost biasanya merupakan pengeluaran yang tidak dapat terhindarkan dalam setiap industri atau skala bisnis.

Sunk Cost

Examples of Sunk Costs. Suppose you buy a ticket to a concert for $150. On the night of the concert, you remember that you have an important assignment due on the same night. You must make a decision: go to the concert or finish your assignment. The $150 paid for the ticket is a sunk cost and should not affect your decision.

Apa itu Sunk Cost? Pengertian dan contoh 2023 RevoU

Sunk Cost Dilemma: A formal economic term that describes the emotional difficulty of deciding whether to proceed with or abandon a project when time and money have already been spent but the.

Understanding Sunk Cost Meaning Examples & How it works

Suppose that Sample Limited purchased a building for its showroom at a cost of $500,000 in 2024. The company is now considering a change to its product mix. The cost of the building and its depreciation will be the same regardless of the composition of the company's product mix. So, this cost—being unavoidable—has no relevance to the.

Sunk Cost Examples Top 3 Example of Sunk Cost with detail Explanation

The sunk cost fallacy and escalation of commitment (or commitment bias) are two closely related terms.However, there is a slight difference between them: Escalation of commitment (aka commitment bias) is the tendency to be consistent with what we have already done or said we will do in the past, especially if we did so in public.In other words, it is an attempt to save face and appear consistent.

Sunk Cost Pengertian, Contoh Kasus dan Cara Antisipasinya

Definition. A sunk cost is defined as "a cost that has already been incurred and thus cannot be recovered. A sunk cost differs from other, future costs that a business may face, such as inventory.

What is Sunk Cost Definition, Examples, FAQs

Several examples of sunk costs are noted below, covering four common situations in which sunk costs are incurred. Marketing Study Sunk Cost. A company spends $50,000 on a marketing study to see if its new auburn widget will succeed in the marketplace. The study concludes that the widget will not be profitable. At this point, the $50,000 is a.

10 Sunk Costs Examples (The Fallacy Explained) (2023)

Sunk Cost: A sunk cost is a cost that has already been incurred and thus cannot be recovered. A sunk cost differs from future costs that a business may face, such as decisions about inventory.

What Is a Sunk Cost? Definition, Examples & Fallacy TheStreet

Secara umum, seluruh biaya yang telah dikeluarkan dan tidak dapat kembali lagi dianggap sebagai sunk cost. Karena itu, sunk cost dapat berupa: Anggaran untuk mengembangkan produk atau layanan. Peralatan atau mesin yang telah dibeli atau disewa. Gaji yang dibayarkan kepada karyawan yang bekerja pada suatu proyek.