How to Boost Collection Rate with Instant Messaging? Ameyo

Why SMS Business Messaging for Debt Collection Matters. With so many people having access to smartphones and mobile devices, it's one of the easiest ways for businesses and people to communicate with others, no matter what device they are using. SMS is still a formidable and very reliable customer communication channel.

The Ultimate Guide to Using SMS for Debt Collection

Home > SMS Templates > Financial services. SMS templates for financial services Drive collections with SMS templates. Simplify sending payment reminders and debt collection text messages to your clients. Copy and edit, save for future use - and make sure your business gets paid on time.

The Importance of Conversational SMS Messaging in Debt Collection

The Role of SMS in Debt Collection. SMS (Short Message Service) has emerged as a highly effective communication tool in debt collection. Its instant and convenient nature allows debt collectors to reach debtors directly and promptly, bypassing the limitations of traditional communication methods. Debtors tend to carry their mobile phones with.

Steal These Free SMS Templates for Financial Services

As a company, there are many collection messages examples you can use with your clients: 1 The first alternative is to notify the client about the invoice to pay. You can even attach the invoice from an external link or a file. For example, "Dear (client), this is a reminder that you have the last invoice available and you have until "x.

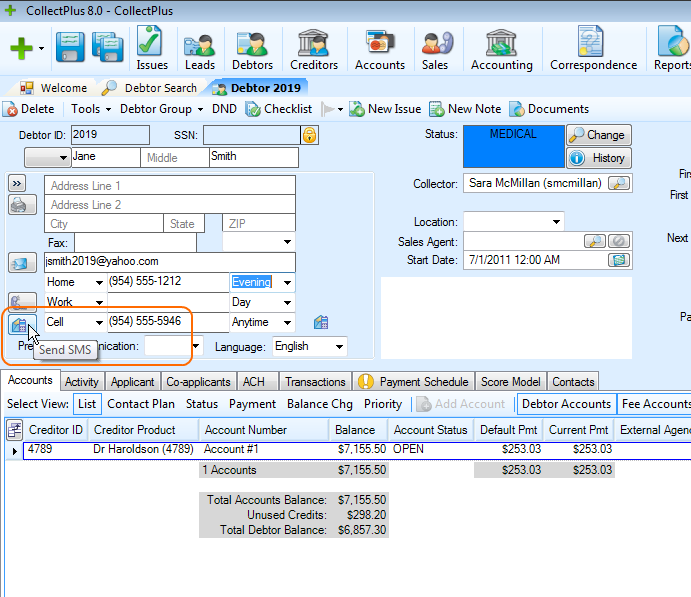

CollectPlus Debt Collection Software Text Messaging (SMS)

Utilize SMS to collect debts by sending automated messages at strategic local times, such as after payments are due or when the debt is past due. Customize the notifications to address each debt holder by their name and offer assistance and payment options to help them with the debt. 2. Offer Options for Repayment.

Late Payment SMS Strategies for Debt Collection CloudContactAI

Recovery Made Simple. CloudContactAI is a multichannel communication platform that enables you to reach your audience through SMS, email, and voice all on one platform. Our state-of-the-art fully customizable Enterprise Dashboard allows easy management of campaigns across multiple portfolios. Boost collections with less effort.

Late Payment SMS Strategies for Debt Collection CloudContactAI

The Fair Debt Collection Practices Act (FDCPA) is the federal law that defines what third party debt collectors can and cannot do when they're collecting a debt from a consumer. The law, passed in 1977, doesn't address many forms of modern communication. Text messaging, for example, wasn't introduced until 1992, 15 years after the FDCPA.

Debt Collection How AI and SMS are Driving Innovation

Use SMS to Lessen The Burden While Collecting Debt. There are enough reasons for you to use this channel for debt collection. Not only is this one of the widely used channels to engage but when it comes to open rate, SMS suppresses the previously dominant channel — email. Besides reminding people about the payment through emails, which are.

Debt Collection SMS Best Practices Nola Automation

2. Debt collection sms is cost-effective. The cost for sending out debt collection sms is far lower than any other traditional debt collection method. Sending out timely payment reminders, overdue warnings, etc., through mass texting campaigns are a quick and cheap debt collection method.

SMS & multichannel solutions for debt collection

10/13/2022. in Repaying Debt. As of Nov. 30, 2021, debt collectors have new options for how they may communicate with you about debts they're trying to collect. Now they can text you. Text messages, along with emailing and direct messages on social media, are allowed as part of an update to the Fair Debt Collection Practices Act (FDCPA).

Text messaging guide for firstparty debt collectors Get Paid Faster SimpleTexting

The benefits of debt collection text messages. A text message strategy can be part of an omnichannel approach, and it offers debt collectors a few distinct benefits: Get direct access to consumers who will likely see and read your messages. Allow consumers to respond and ask questions via a channel that may be easier or more comfortable for.

Debt Collection SMS Best Practices Nola Automation

Best practice: An effective SMS for debt collection is one that has a clearly defined call-to-action and complies with the law. Here's a collection of samples for using SMS for debt collection. Tips for using SMS for debt collection. Consider timing and delivery of your text message. Use our Analytics tool to understand the best time to send.

SMS Debt Collection Can Debt Collectors Text You? MMI

Text messages are cost-effective. Our plans start as low as $29 for 500 text messages-that's a lot cheaper than traditional debt collection methods. Text messages create a sense of urgency. Creating urgency helps get you paid faster. After 6 months, a debt is only 50% recoverable. After 12 months, this drops to 10%.

Use These Debt Collection Text Message Samples Today!

Useful SMS templates for debt collection. Feel free to use our debt collection text message samples either by copying them or by sending them directly from the Textmagic dashboard: 1. Soft automated reminder. Dear [First Name], we would like to remind you that the amount [Amount] was due for payment on [Date].

SMS for Debt Collection Collect Debt Faster CloudContactAI

There are two relevant Acts related to email and SMS: Fair Debt Collections Practice Act: Covers both email and SMS. This does not require consent to use any medium to contact a customer about a debt. Telephone Consumer Protection Act: Covers SMS only. This requires you to have consent to text a customer. Here, consent is normally captured by.

The Ultimate Guide to Using SMS for Debt Collection

SMS is a Trusted Tool for Debt Collection. But with the explosion of messaging apps, a huge opportunity is presented to collection teams and organisations. Although it may appear counter intuitive, messaging gives more control to customers. And consequently when you make a customer feel empowered it increases the quality of customer conversations.