How To Calculate Loan To Value Ratio Topic11BankingTutorialLearn Banking With Easy Tips

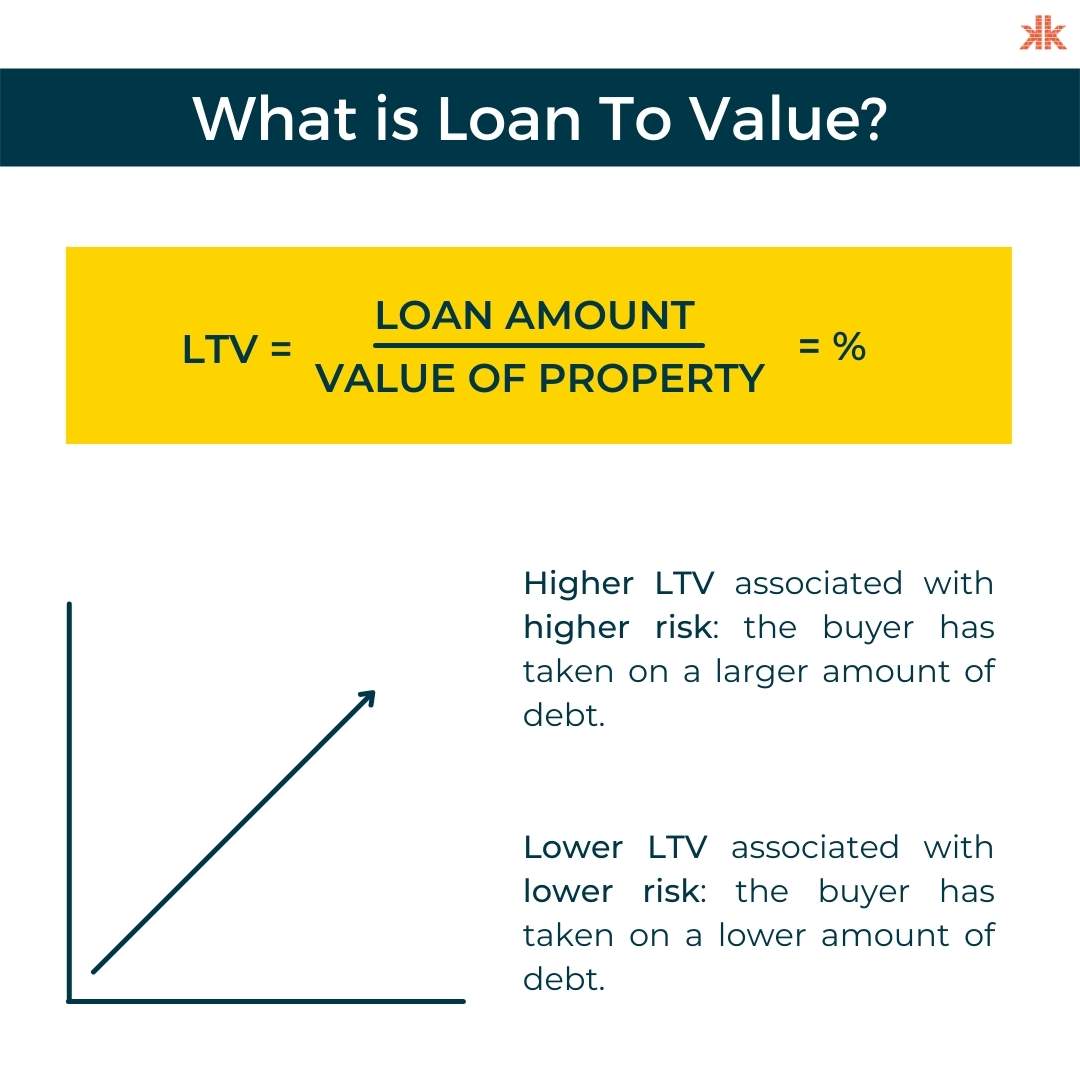

Rumus Loan To Value dan Cara Menghitungnya. Dalam rumus loan to value yang umum digunakan adalah menghitung persentase dari jumlah pinjaman terhadap nilai properti, lalu hasilnya dikalikan dengan 100 untuk mendapatkan nilai dalam bentuk persentase. Rumus loan to value = (Jumlah Pinjaman / Nilai Properti) x 100.

Rumus (Formula) Excel Present Value (PV) Menentukan Nilai Sekarang Kasus 2 YouTube

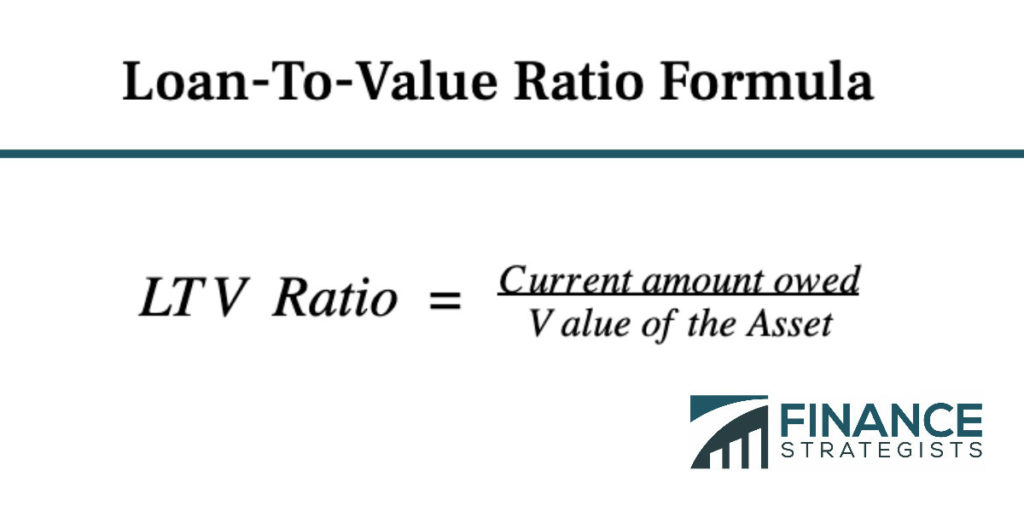

The Loan to Value Calculator uses the following formulas: LTV = Loan Amount / Property Value. Where, LTV is the loan to value ratio, LA is the original loan amount, PV is the property value (the lesser of sale price or appraised value). CLTV = All Loan Amounts / Property Value = ( LA 1 + LA 2 +. + LA n ) / Property Value.

What is loantovalue ratio? YouTube

Rasio Loan To Value Adalah: Rumus, Cara Hitung, dan Contohnya. Rasio loan to value, atau LTV, adalah faktor yang digunakan pemberi pinjaman untuk membantu menentukan risiko pinjaman. LTV adalah indikator seberapa banyak Anda meminjam relatif terhadap nilai aset. Semakin tinggi rasionya, semakin besar risiko yang diambil pemberi pinjaman dengan.

Loan to Value Ratio Example Explanation with Excel Template

Loan-to-value ratio compares the size of the mortgage you want to the cost of the home. If it's too big, you'll pay a higher interest rate.

Loan to Value (LTV) Infographic

The loan-to-value ratio is a simple formula that measures the amount of financing used to buy an asset relative to the value of that asset. It also shows how much equity a borrower has in the home.

At Last, The Secret To LoantoValue (LTV) Is Revealed BrikkApp Learn

Loan-To-Value Ratio - LTV Ratio: The loan-to-value ratio (LTV ratio) is a lending risk assessment ratio that financial institutions and others lenders examine before approving a mortgage.

/loan-to-value-ratio-315629_FINAL_v2-6fd1a550be4f4cd19dd4eea140143f44.png)

What Is a LoantoValue Ratio?

Divide that total amount of $270,000 by the property value of $350,000, and your combined loan-to-value (CLTV) ratio is 77%. Appraised home value: $350,000. Total amount Owed: $270,000. LTV formula: $270,000/$350,000 = 0.77 or 77% LTV. An LTV of 57% is great, and while a CLTV of 77% is still good, it may have different risk implications for.

How To Calculate Loan To Value Percentage Haiper

Formula. The loan to value ratio formula is calculated by dividing the mortgage amount by the appraised value of the home being purchased. The appraised value in the denominator of the equation is almost always equal to the selling price of the home, but most mortgage companies will require the borrower to hire a professional appraiser to value.

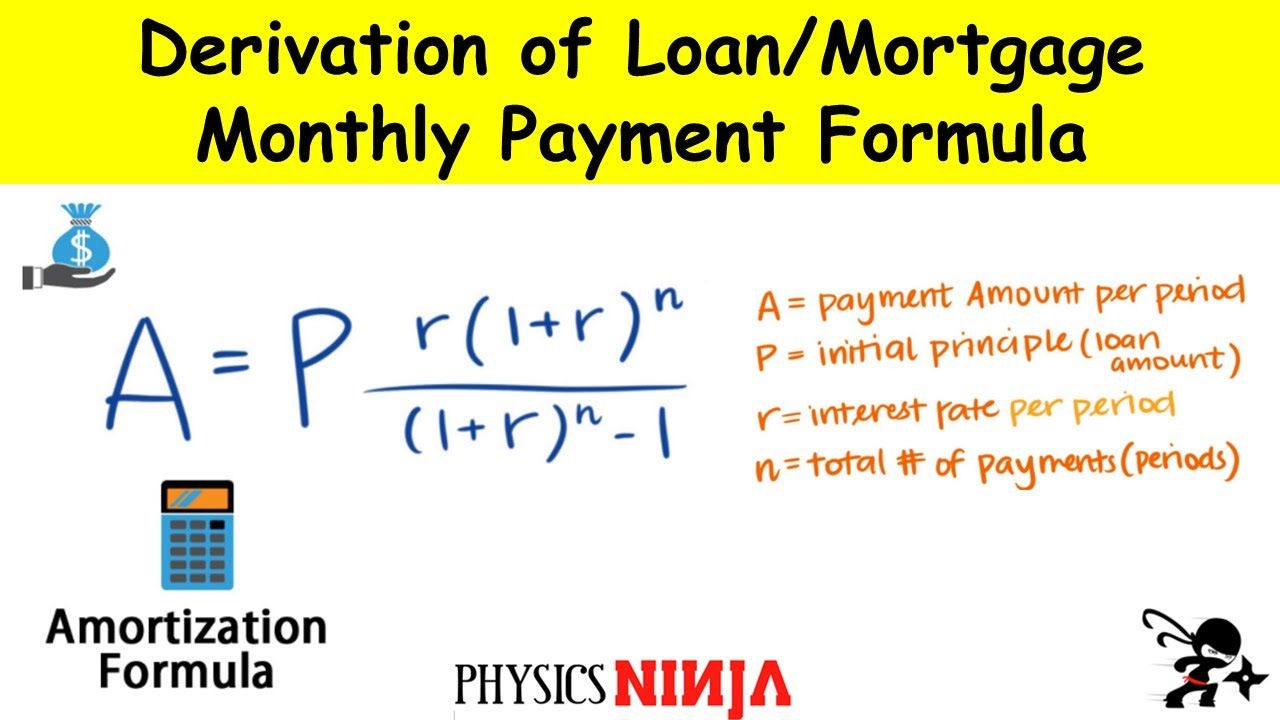

Derivation of Loan/Mortgage Monthly Payment Formula YouTube

Loan-to-value ratios are easy to calculate. Just divide the loan amount by the current appraised value of the property. For example, if a lender gives you a $180,000 loan on a home that's appraised at $200,000, you'll divide $180,000 over $200,000 and get an LTV of 90%. Written out, the formula looks like this:

Present Value (PV) of an Ordinary Annuity Formula with Examples Time Value of Money YouTube

Your loan-to-value ratio, or LTV, is usually expressed as a percent. To calculate your LTV ratio, divide the amount of your loan by the appraised value of the asset securing the loan. For example, say you want to purchase a home for $200,000, which is also its appraised value. If you have $40,000 for a down payment, you would need a $160,000.

Calculate payment for a loan Excel formula Exceljet

To calculate loan to value, divide your mortgage amount by the value of the property you own or want to buy, or use a simple loan-to-value calculator. For example: Say a house is valued at.

Understanding LoantoValue Ratio MCOCI

The loan-to-value ratio of your home loan affects your mortgage rate and mortgage insurance costs. Published Sun, May 28 2023 Jason Stauffer @/in/jason-stauffer-224b7398/

LoanToValue (LTV) Jeron Lee Division

Ringkasan Latar Belakang Pengaturan:. Bank Indonesia melakukan penyesuaian pengaturan batasan Rasio Loan to Value (LTV) untuk Kredit Properti (KP), batasan Rasio Financing to Value (FTV) untuk Pembiayaan Properti (PP), dan batasan Uang Muka untuk Kredit atau Pembiayaan Kendaraan Bermotor (KKB/PKB) melalui penerbitan Peraturan Bank Indonesia Nomor 23/2/PBI/2021 tentang Perubahan Ketiga atas.

:max_bytes(150000):strip_icc()/terms_l_loantovalue_FINAL-9676cca1d30f478a9a875a8f60f94ba8.jpg)

LoantoValue (LTV) Ratio What It Is, How to Calculate, Example

LTV (Loan-to-Value) The proportion of an asset's value that a lender is willing to debt finance. Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

LoanToValue (LTV) Ratio Meaning, Importance, Formula, & Interpretation

The loan-to-value ratio (LTV) is a percentage that measures the loan amount you need to borrow against the appraised value of the home you want to buy. For a refinance, your LTV is the sum of the outstanding balances for all liens against the appraised value of the property. Lenders frequently use the LTV ratio to assess any risks of lending money.

Present Value Anuitas Konsep, Rumus, dan Contoh YouTube

The loan-to-value ratio is the amount of the mortgage compared with the value of the property. It is expressed as a percentage. If you get an $80,000 mortgage to buy a $100,000 home, then the loan.