Gearing Ratio Business tutor2u

How to Calculate Gearing Ratio (Step-by-Step) The gearing ratio is a measure of a company's capital structure, which describes how a company's operations are financed with regard to the proportion of debt (i.e. the capital provided from creditors) vs. equity (i.e. the funding from shareholders).. Gearing ratios are useful for understanding the liquidity positions of companies and their.

:max_bytes(150000):strip_icc()/GearingRadio-48fddb932fbd46309660cec4741caafa.jpg)

Gearing Ratios Definition, Types of Ratios, and How To Calculate

Rumus untuk Menghitung Gearing Ratio. Setiap rumus rasio gearing dihitung secara berbeda, tetapi sebagian besar rumus mencakup total utang perusahaan yang diukur terhadap variabel seperti ekuitas dan aset. Rasio utang terhadap ekuitas. Mungkin metode yang paling umum untuk menghitung gearing ratio suatu bisnis adalah dengan menggunakan ukuran.

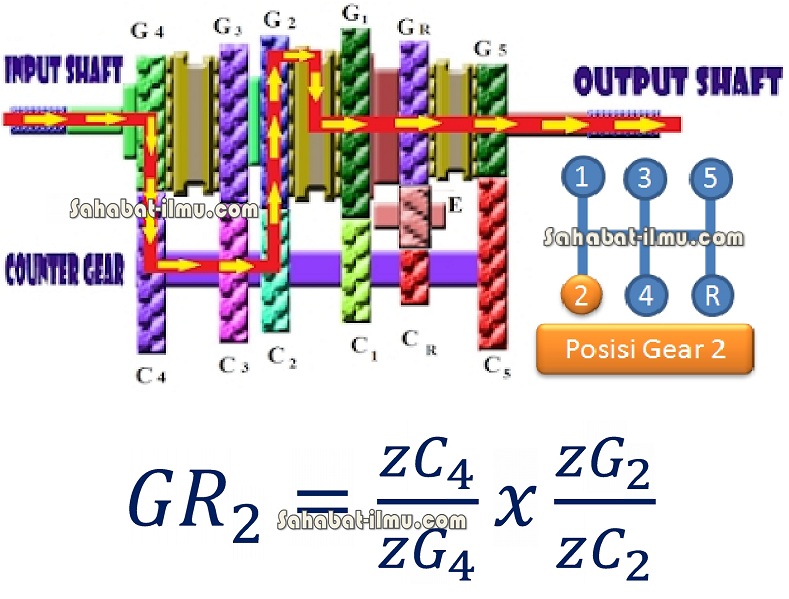

Rumus Menghitung Gear Ratio (Gigi Rasio) dan Contoh Cara Menghitung Gigi Rasio Gerai Teknologi

You are required to calculate the gearing ratio based on the below information: -. Solution: We will first calculate the company's total debt and then use the above equation. Calculation of gearing ratio can be done as follows: -. So this will be: -. Therefore, the ratio will be 0.65.

Hubungan Gear Ratio Terhadap Momen Dan Putaran

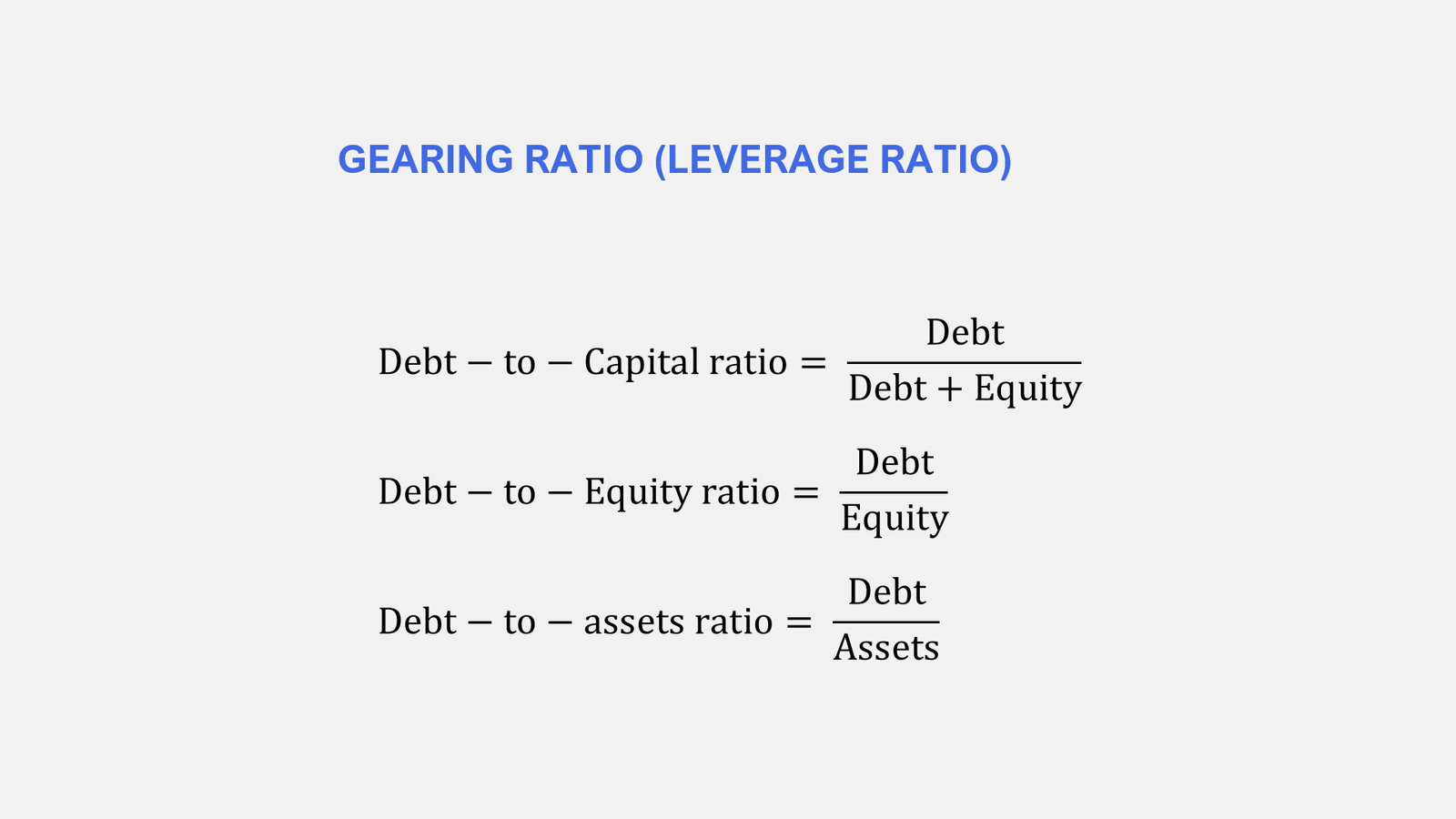

Rumus Gearing Ratio. Setiap rumus gearing ratio dihitung secara berbeda, tetapi sebagian besar rumus mencakup total utang perusahaan yang diukur terhadap variabel seperti ekuitas dan aset. Rasio utang terhadap ekuitas. Mungkin metode yang paling umum untuk menghitung rasio gearing suatu bisnis adalah dengan menggunakan ukuran hutang terhadap.

Cara Menghitung Perbandingan Final Gear Ratio Motor Rumus Dan Riset

4. Divide one teeth count by the other. Now that you know how many teeth are on each gear, you can find the gear ratio relatively simply. Divide the driven gear teeth by the drive gear teeth. Depending on your assignment, you may write your answer as a decimal, a fraction, or in ratio form (i.e., x : y ).

Gear Ratio Rumus Cara Menghitung Perbandingan Roda Gigi (Gear Ratio) Pada Transmisi Manual

The gearing ratio is a fundamental financial metric that provides insights into a company's financial structure and risk profile. It compares the proportion of owner's equity (or capital) to debt, revealing how a firm funds its operations. A higher gearing ratio signifies greater reliance on debt financing, which can have implications for a.

Hubungan Gear Ratio Terhadap Momen dan Putaran

The long-term debt gearing ratio is a financial metric that calculates the proportion of a company's long-term debts to its equity capital. This ratio is used to understand the financial leverage of a company, where 'leverage' refers to the amount of funds acquired through debt compared to shareholders' equity, or equity.

What is Gearing Ratio? Formula + Calculator

Financial gearing ratio is = (Short term debts + long term debts + Capital lease) / Equity. Example. Suppose a company, Amobi Incorporation wants to calculate its financial gearing, which has short-term debt of $800,000, long-term debt of $500,000, and equity of $1,000,000. How to calculate for the mentioned period?

Gearing Ratio Analysis Double Entry Bookkeeping

Gearing Ratio: A gearing ratio is a general classification describing a financial ratio that compares some form of owner's equity (or capital) to funds borrowed by the company. Gearing is a.

Gearing Ratio Pengertian, Manfaat, Cara Hitung, dan Tips Mengaturnya

Here is the most common formula for gearing ratio: Debt-to-Equity Ratio=Total Equity/Total Debt. But also other common formulas of gearing ratios include the following, as well: Times Interest Earned*= Total Interest/EBIT. Equity Ratio = Equity/Assets .

4 Easy Ways to Determine Gear Ratio (with Pictures)

The gearing ratio calculated by dividing total debt by total capital (which equals total debt plus shareholders equity) is also called debt to capital ratio. Debt-to-Capital Ratio =. D. D + E. Where D is the total debt i.e. the sum of interest-bearing long-term and short-term debt such as bonds, bank loans, etc.

Capital Gearing Ratio Formula Meaning How To Calculate With Examples ZOHAL

Rumus untuk menghitung gearing ratio adalah sebagai berikut: Debt to capital ratio = debt : debt + equity. Debt to equity ratio = debt : equity. Debt to assets ratio = debt : assets. Untuk modal utang, sumber pendanaannya bisa berasal dari pinjaman bank, obligasi korporasi, dan juga medium terms notes.

Gearing Meaning, How to Calculate, Pros and Cons — Penpoin.

Gearing ratios provide an insight into how a company funds its operations, relative to debt and equity. Using gearing ratios as part of your trading fundamental analysis strategy helps to provide crucial financial ratios that can be utilised to make smarter trading decisions. Continue reading to learn about key features of gearing ratios and how they can support your decision-making.

4 Easy Ways to Determine Gear Ratio (with Pictures)

Gearing refers to the level of a company's debt related to its equity capital, usually expressed in percentage form. It is a measure of a company's financial leverage and shows the extent to.

Rumus Menghitung Gear Ratio Brain

Rumus Dasar Perbandingan Rasio (Gear Ratio) 1. Rumus perbandingan 2 roda gigi. Rumus dasar untuk menghitung gear ratio adalah dengan menggunakan rumus roda gigi yang diputar (digerakkan) dibagi dengan roda gigi yang memutar (menggerakkan). Sehingga dapat disimulasikan dengan gambar adalah sebagai berikut:

Rumus Menghitung Gear Ratio (Gigi Rasio) dan Contoh Cara Menghitung Gigi Rasio Gerai Teknologi

A gearing ratio is a category of financial ratios that compare company debt relative to financial metrics such as total equity or assets. Investors, lenders, and analysts sometimes use these types of ratios to assess how a company structures itself and the amount of risk involved with its chosen capital structure.