Expected Return (ER) of a Portfolio Calculation Finance Strategists

Ans: You can calculate the expected return for a bond in Excel. For that, you can use the following formula. =RATE (nper, pmt, pv, fv)*nper. where "nper" is the number of periods, "pmt" is the periodic payment, "pv" is the present value, and "fv" is the future value. This will give you the expected return in percentage.

Expected Return (ER) of a Portfolio Calculation Finance Strategists

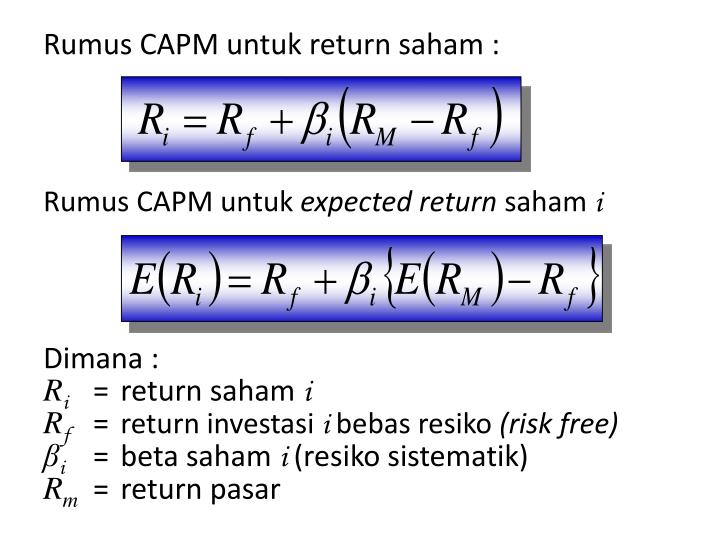

Return Yang Diharapkan (Expected Return) Return yang diharapkan akan diperoleh oleh investor di masa mendatang. Berbeda dengan return realisasi yang bersifat sudah terjadi (ex. Rumus untuk menghitung return yang diharapkan dari portofolio adalah sebagai berikut: dalam hal ini: E(Rp) = return yang diharapkan dari portofolio

Return on Equity (ROE) Formula, Examples and Guide to ROE

Simpulan. Well, itulah materi pembahasan tentang cara menghitung return saham di microsoft excel. Ada dua metode rumus return saham yang bisa digunakan, yakni rumus (1) R = (Pt - Pt-1) / Pt-1 dan (2) R = (Pt - Pt-1 + Dt) / Pt-1. Perhitungan ini bisa untuk periode harian, bulanan, dan tahunan.

:max_bytes(150000):strip_icc()/ExpectedReturn_Final_4196761-41e27ce95bd144a8a783ada8815b920a.png)

Expected Return Formula, How It Works, Limitations, Example

Expected return portofolio kemudian dihitung dengan memasukkan beta portofolio dan expected market return ke dalam rumus CAPM. 5. Pendekatan Simulasi Monte Carlo. Metode simulasi Monte Carlo dapat digunakan untuk mengestimasi expected return portofolio saham dengan mensimulasikan berbagai skenario pasar berdasarkan distribusi pengembalian.

Contoh Soal Expected Return Gudang Materi Online Riset

Rate of Return: A rate of return is the gain or loss on an investment over a specified time period, expressed as a percentage of the investment's cost. Gains on investments are defined as income.

Perhitungan Expected Rate of Return dan Risk Investasi via Excel YouTube

In column D, enter the expected return rates of each investment. In cell E2, enter the formula = (C2 / A2) to render the weight of the first investment. Enter this same formula in subsequent cells.

PPT CAPITAL ASSET PRICING MODEL (CAPM) PowerPoint Presentation ID3186182

Let's take an example to understand the calculation of the Expected Return formula in a better manner. Expected Return Formula - Example #1. Let's take an example of a portfolio of stocks and bonds where stocks have a 50% weight and bonds weight 50%. The expected return on stocks is 15%, and the expected return for bonds is 7%.

Calculating Expected Return

Konsep itu kemudian diturunkan ke dalam rumus berikut: Expected Return = Risk−Free Rate + Risk Premium. Keterangan: Expected Return: Tingkat return yang diharapkan. Risk-free rate: Tingkat imbal hasil instrumen investasi yang nyaris bebas risiko, seperti tingkat bunga deposito atau obligasi pemerintah. Komponen ini terdiri dari estimasi.

/dotdash_INV_final_Calculating_CAPM_in_Excel_Know_the_Formula_Jan_2021-01-547b1f61b3ae45d7a4908a551c7e7bbd.jpg)

Of Return Formula Bond Yield And Return Finra Org Aug 25, 2021 · the internal rate of return

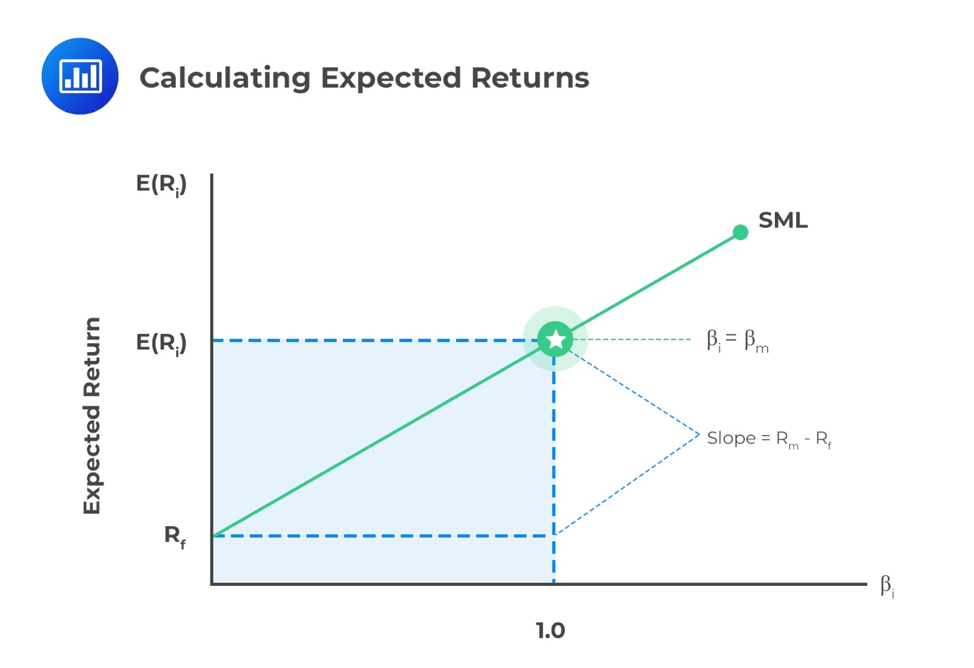

The capital market line graph can be plotted using the formula can be written as follows: ERp = Rf + SDp * (ERm - Rf) /SDm. Where, Expected Return of Portfolio. Risk-Free Rate. Risk-Free Rate A risk-free rate is the minimum rate of return expected on investment with zero risks by the investor.

3 Cara Menghitung Expected Return Portofolio Saham HSB Investasi

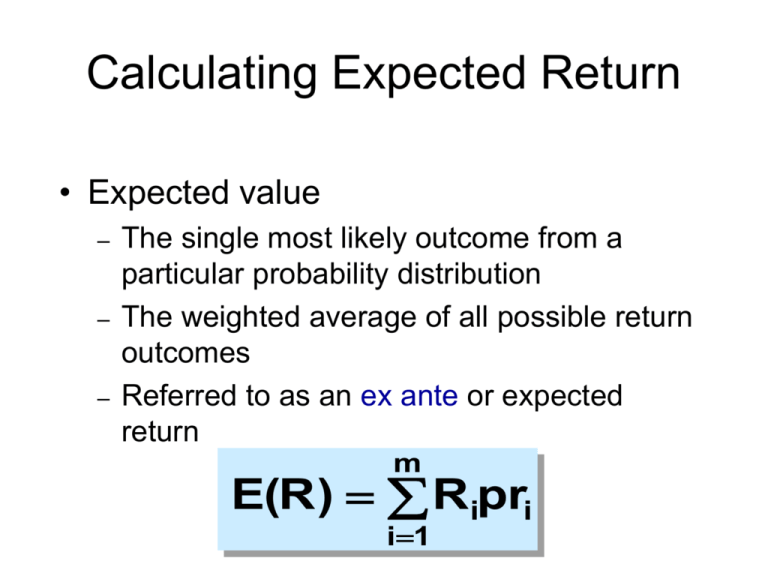

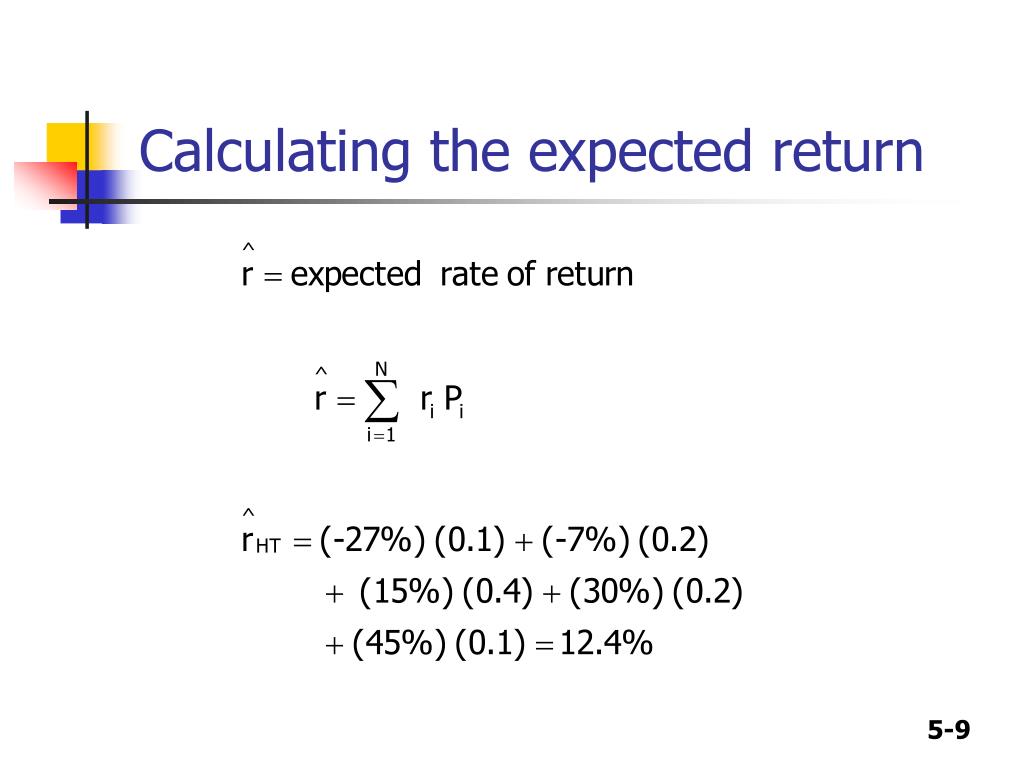

Untuk menghitungnya, kita bisa gunakan rumus dan langkah-langkah berikut ya teman-teman: Expected Return = (Return A x probabilitas A) + (Return B x probabilitas B). Untuk langkah-langkahnya dapat kita hitung sebagai berikut: Pertama, tentukan probabilitas setiap pengembalian yang mungkin terjadi. Untuk melakukan ini, lihat data historis.

PPT CHAPTER 8 Ri sk and Rates of Return PowerPoint Presentation, free download ID3146525

Cara menghitung return dengan dividen ini bisa dilakukan dengan rumus. Return=capital gain (loss) + yield . Capital gain (loss) merujuk pada return saham tanpa dividen. Sementara itu, yield adalah persentase dividen terhadap harga saham periode sebelumnya. Maka return saham total dapat dicari dengan rumus sebagai berikut. Return total = (Pt-Pt.

The Expected Return Model How You can Refine Investment Decisions, Prospect Stocks Clearly

The CAPM formula is used for calculating the expected returns of an asset. It is based on the idea of systematic risk (otherwise known as non-diversifiable risk) that investors need to be compensated for in the form of a risk premium. A risk premium is a rate of return greater than the risk-free rate. When investing, investors desire a higher.

Measuring Expected Returns

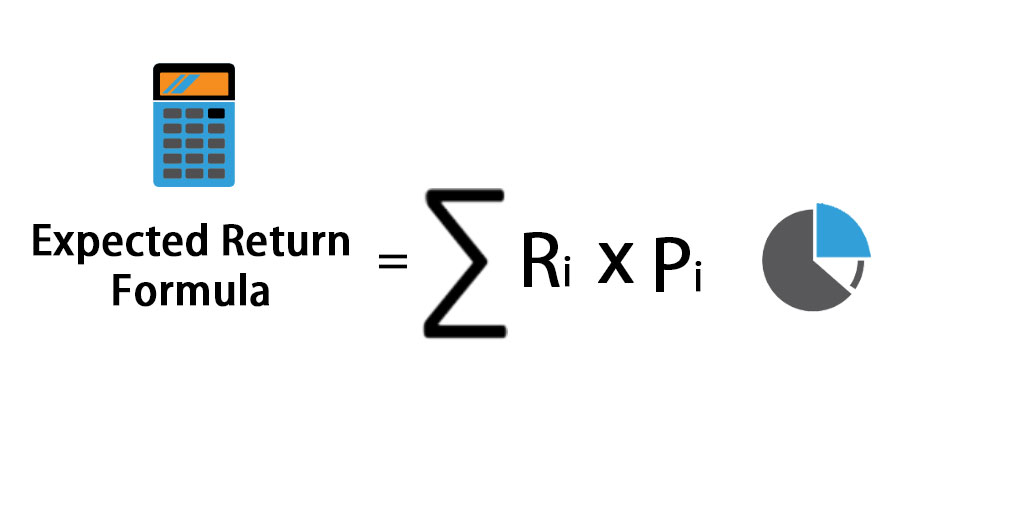

Expected return is the amount of profit or loss an investor anticipates on an investment that has various known or expected rates of return . It is calculated by multiplying potential outcomes by.

Calculating Returns using CAPM CFA Level 1 AnalystPrep

Note that although the simple average of the expected return of the portfolio's components is 15% (the average of 10%, 15%, and 20%), the portfolio's expected return of 14% is slightly below that simple average figure. This is due to the fact that half of the investor's capital is invested in the asset with the lowest expected return.

:max_bytes(150000):strip_icc()/expectedreturncorrected-e0e026cf96334027b60d468d7fc59866.jpg)

Expected Return Formula, How It Works, Limitations, Example

ER = Expected Return; R 1 sampai R n = Return yang mungkin diperoleh dari investasi; P 1 sampai P n = Probabilitas masing-masing return terjadi; Contoh Penggunaan Rumus Expected Return. Misalnya, kita ingin menghitung expected return dari investasi saham PT XYZ. Saat ini, harga saham PT XYZ di pasar modal adalah Rp 10.000,- per lembar saham.

Expected Return Formula Calculator (Excel template)

Sebelum kita melakukan investasi, hal penting yang harus kita perhatikan adalah menghitung expected return atau pengembalian harapan dari kinerja portofolio, dan keseluruhan untung atau rugi yang ditimbulkan.. Dengan menggunakan rumus di atas, berikut adalah perhitungannya: 10pv X 18.8% + 10pv X 27% + 5pv X -13.40% = 1.88pv + 2.7pv - 0,67pv