EBITDA vs. revenue Definition, calculation and implications gini

EBITDA to sales ratio: The EBITDA to sales ratio is a financial metric used to assess a company's profitability by comparing its revenue with earnings. More specifically, since EBITDA is derived.

Debt to EBITDA ratio formula and calculation Financial

A company's earnings before interest, taxes, depreciation, and amortization (commonly abbreviated EBITDA, pronounced / iː b ɪ t ˈ d ɑː /, / ə ˈ b ɪ t d ɑː /, or / ˈ ɛ b ɪ t d ɑː /) is a measure of a company's profitability of the operating business only, thus before any effects of indebtedness, state-mandated payments, and costs required to maintain its asset base.

Full EBITDA Guide What is It & How Investors Use It (Formula)

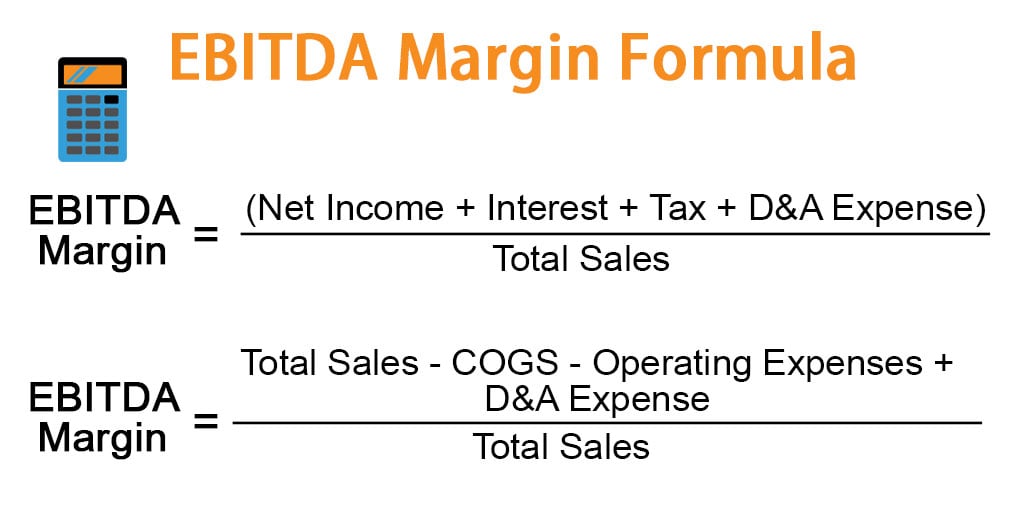

EBITDA margin is a measurement of a company's operating profitability as a percentage of its total revenue. It is equal to earnings before interest, tax, depreciation and amortization (EBITDA.

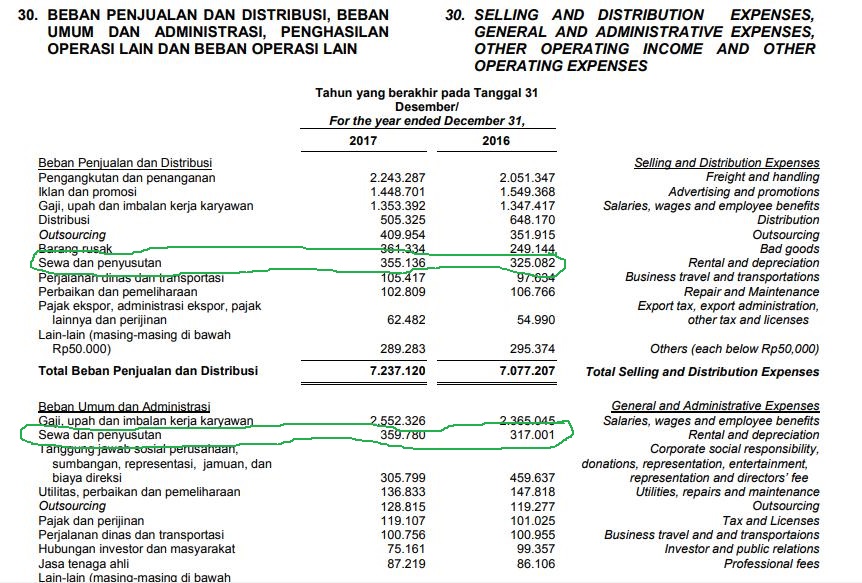

EBITDA 5 Komponen dan Contoh Cara Menghitungnya!

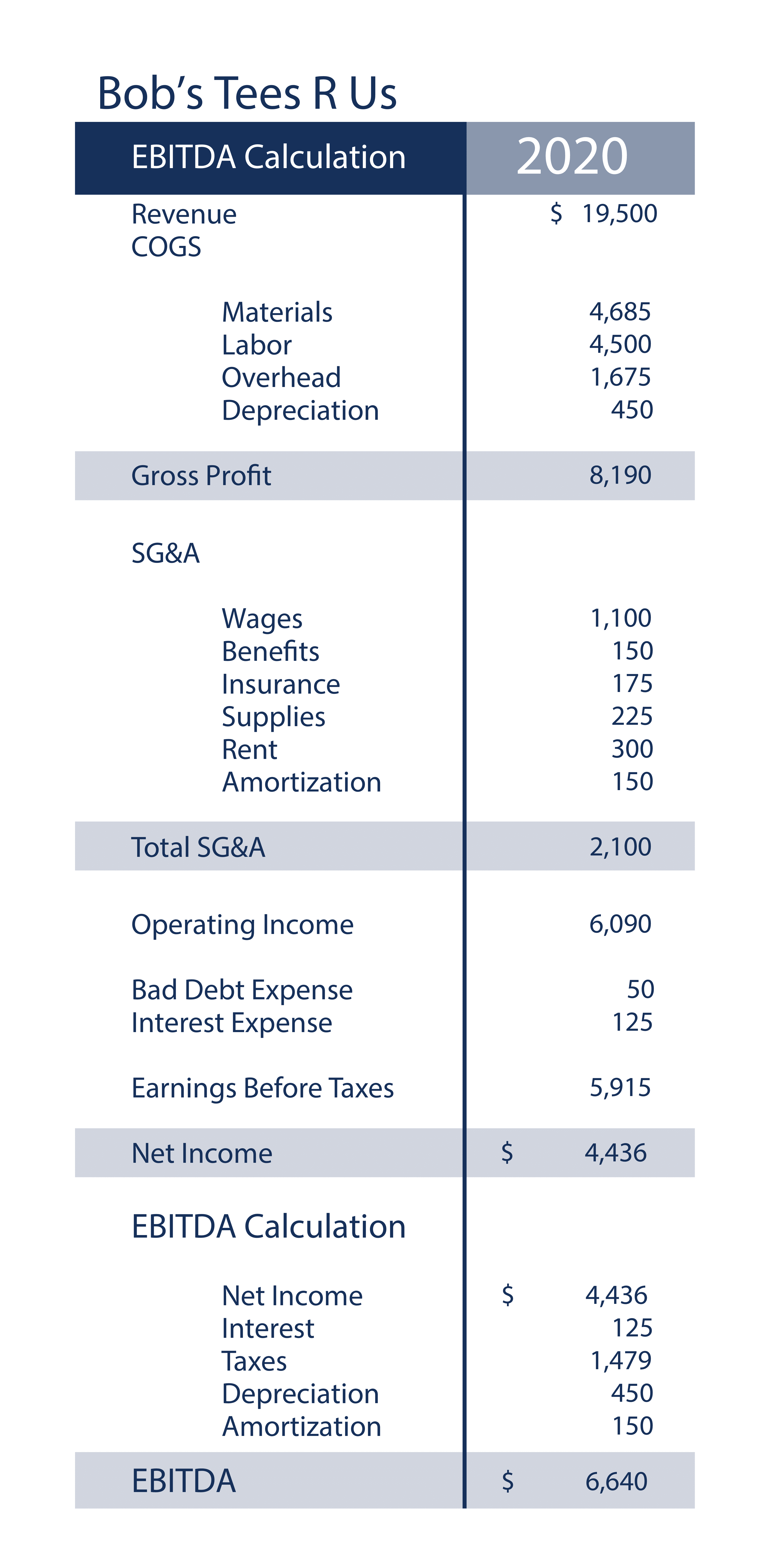

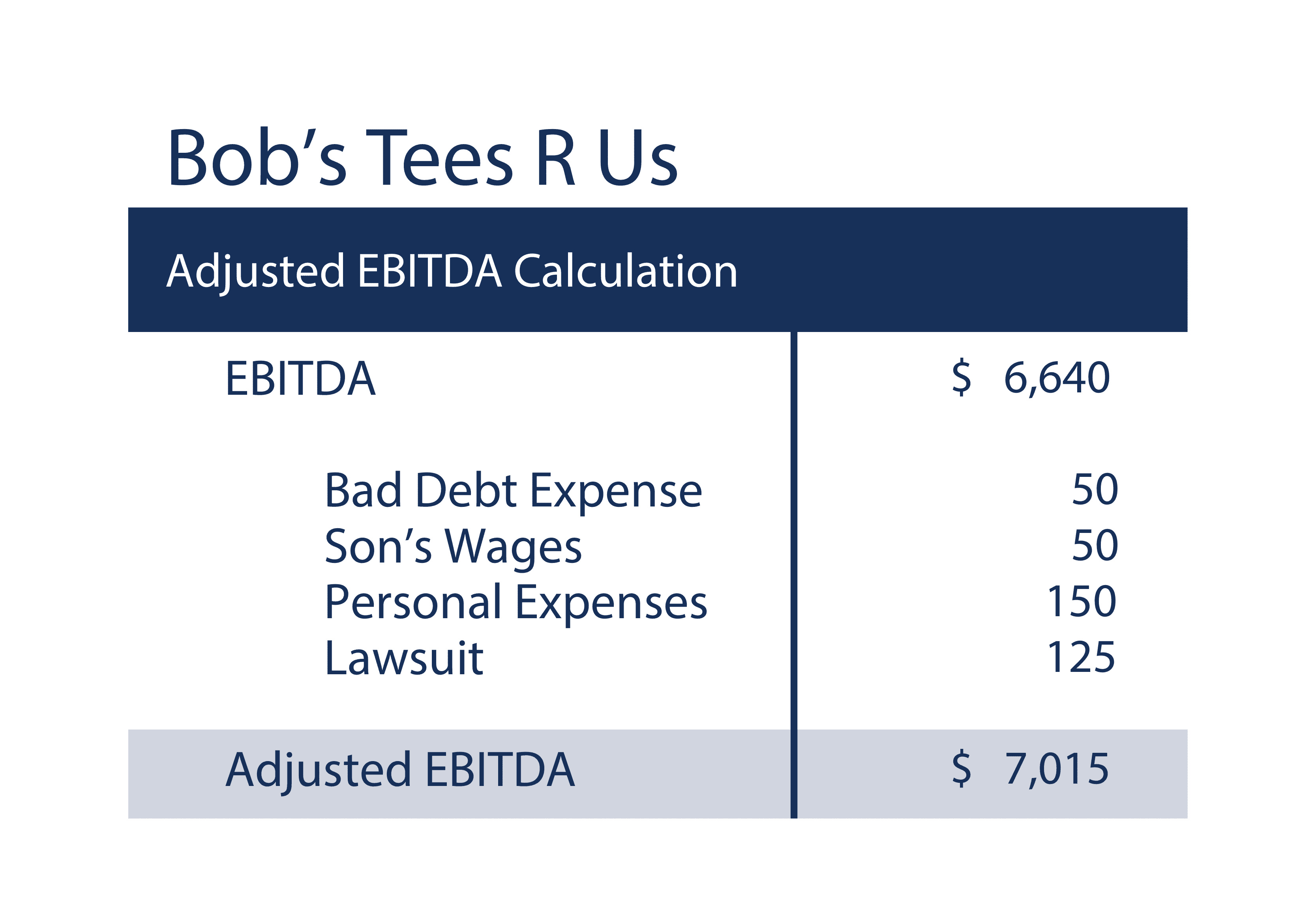

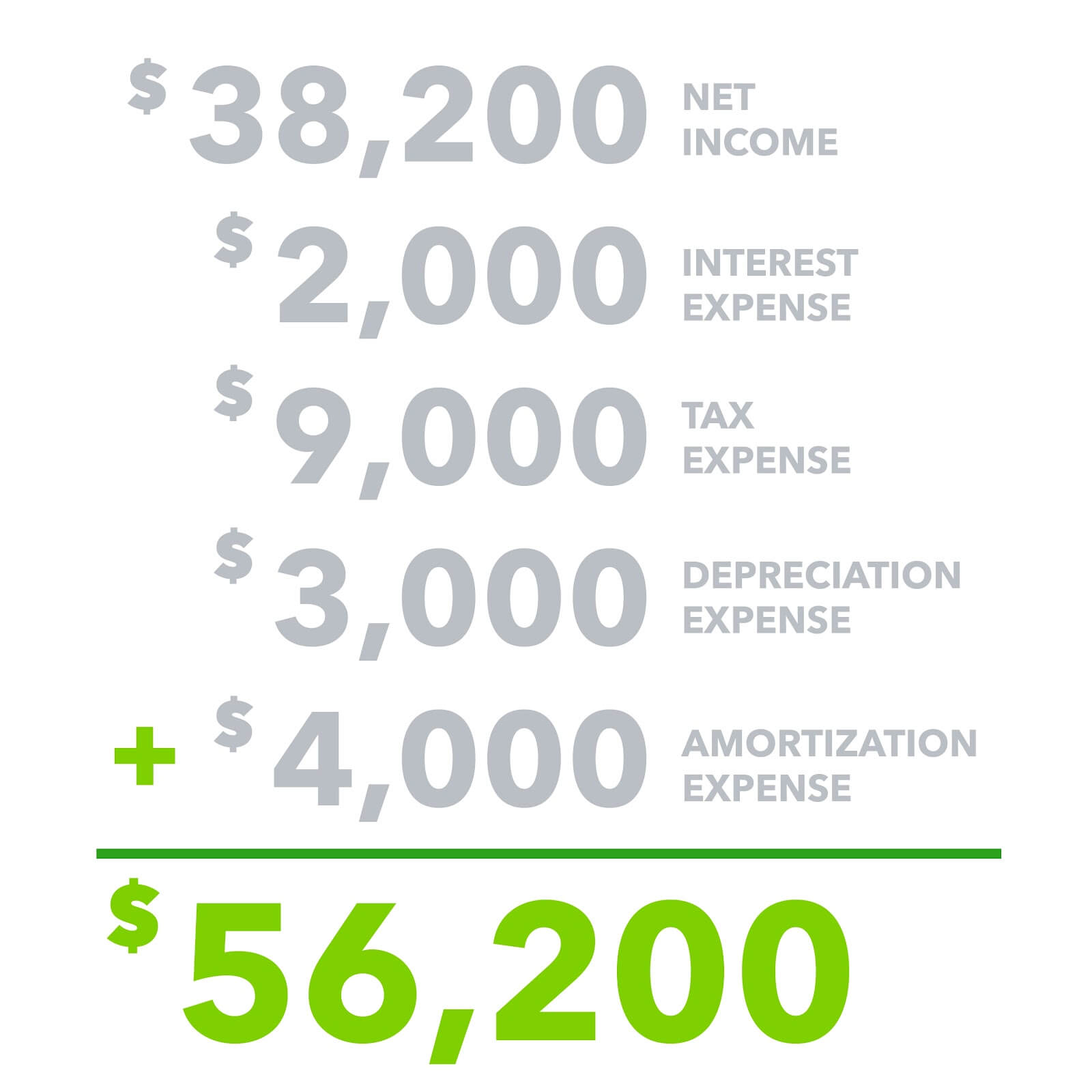

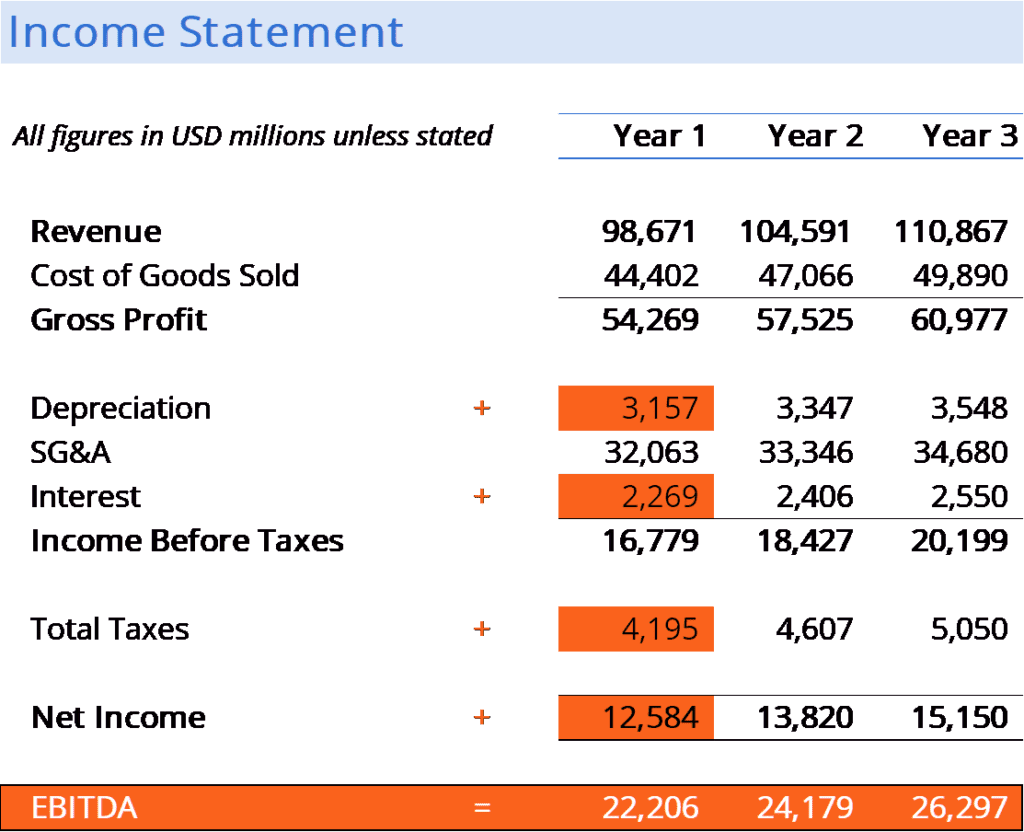

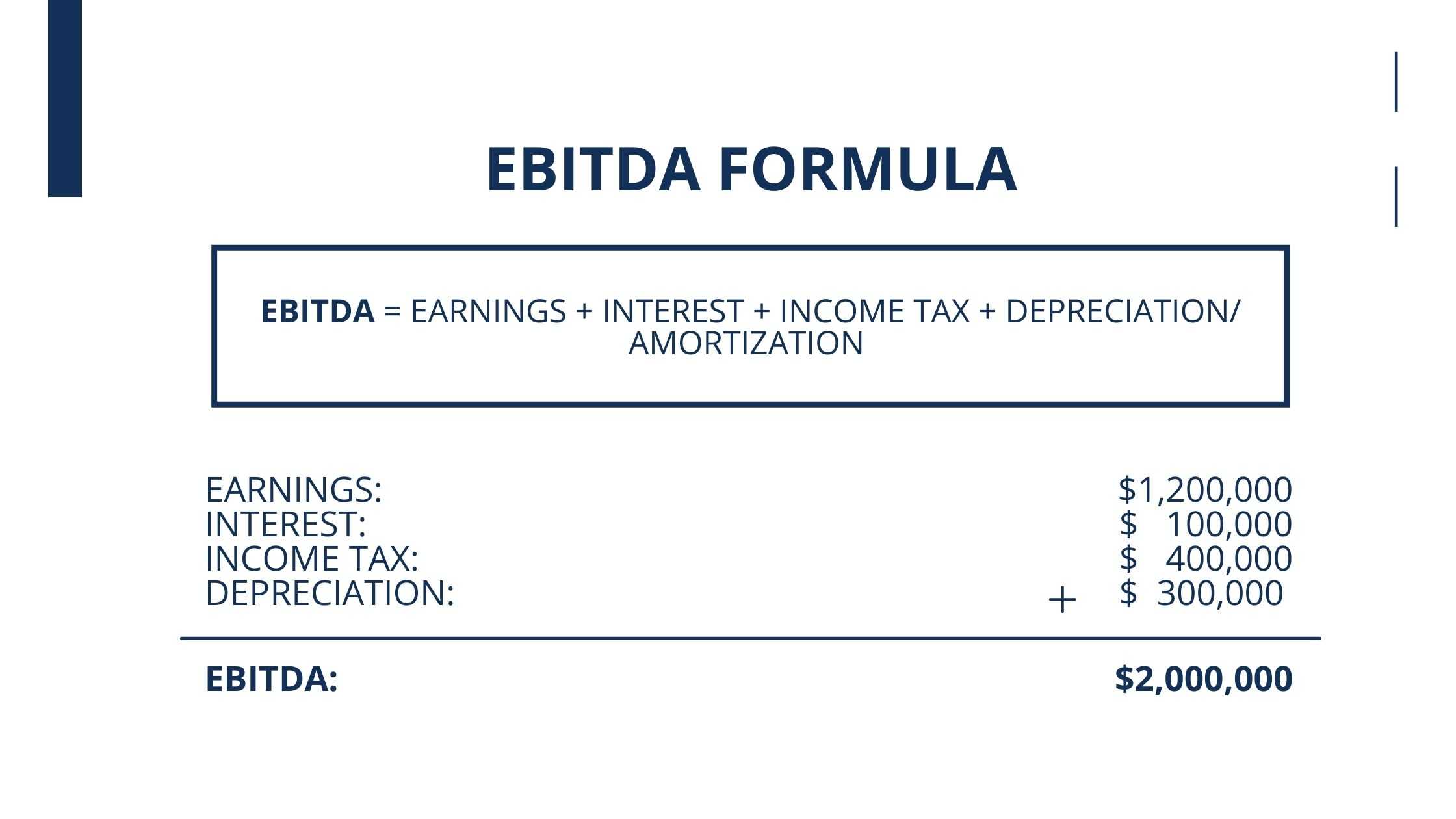

What is EBITDA? EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization and is a metric used to evaluate a company's operating performance.It can be seen as a loose proxy for cash flow from the entire company's operations.. The EBITDA metric is a variation of operating income (EBIT) that excludes certain non-cash expenses.

Full EBITDA Guide What is It & How Investors Use It (Formula)

How to Calculate EBITDA Margin. The EBITDA margin is a measure of operating profitability, calculated as the ratio between the EBITDA of a given company and the net revenue generated in the matching period.. While revenue is the starting line item on a company's income statement, EBITDA is a non-GAAP metric intended to represent a company's core profitability on a normalized basis.

EBITDA Adalah Rumus & Cara Mencari dalam Laporan Keuangan

atau. Saya Mau Bertanya Ke Sales Mekari Jurnal Sekarang! Nah, di atas telah dijelaskan apa yang dimaksud dengan EBITDA (Earning Before Interest, Taxes, Depreciation, and Amortization) serta rumus cara menghitung indikator untuk menentukan laporan keuangan ini. Mudah-mudahan informasi di atas bermanfaat.

EBITDA Margin Formula Example and Calculator with Excel Template

EBITDA = EBIT + Depreciation + Amortization. Earnings before interest and taxes (EBIT) is a measurement that is commonly employed in accounting and finance as an indicator of a company's profit. It includes all expenses except interest and any income tax expenses. As such, it is the difference between operating revenues and operating expenses.

EBITDA Definition, Formula, and How to Use It QuickBooks

EBITDA is earnings before interest, taxes, depreciation, and amortization. It measures a company's profitability from its core operations. EBITDAR is a variation of EBITDA that excludes rental.

:max_bytes(150000):strip_icc()/ebitda_definition_final_0831-c8a1b26d38db49829a69a86f3c294779.jpg)

EBITDA Margin What It Is, Formula, and How to Use It

Rumus EBITDA. Rumus EBITDA cukup sederhana, yaitu: EBITDA = Laba bersih + pajak + beban bunga + nilai depresiasi dan amortisasi. Apabila perusahaan yang Anda inginkan tidak mencantumkan variabel EBITDA dalam laporan keuangannya, Anda bisa menghitung variabel ini secara mandiri dengan mudah.

What is EBITDA Formula, Definition and Explanation

Where: EBITDA → EBITDA is a non-GAAP measure of a company's operating cash flow, which, in its simplest form, is calculated by adding depreciation and amortization (i.e. non-cash items) to operating income, or "EBIT".; Interest Expense → The periodic interest payments owed to the lender, which reflects the company's cost of debt, i.e. the riskiness of providing debt capital to the.

EBITDA Formula Calculator (Examples with Excel Template)

EBITDA - Earnings Before Interest, Taxes, Depreciation and Amortization: EBITDA stands for earnings before interest, taxes, depreciation and amortization. EBITDA is one indicator of a company's.

Rumus dan Cara Menghitung EBITDA

Rumus Menghitung EBITDA. Menghitung EBITDA di perusahaan Anda dapat dilakukan menggunakan salah satu dari dua rumus di bawah ini, keduanya menghasilkan hasil yang sama. EBITDA = Keuntungan Bersih + Bunga + Pajak + Depresiasi + Amortisasi. Atau. EBITDA = Pendapatan Operasional + Depresiasi + Amortisasi.

Apa itu EBITDA? Beserta Rumus dan Perhitungan IDMETAFORA ERP Developer

EBITDA is defined as earnings before interest, taxes, depreciation, and amortisation. On the other hand, EBIT does not add back depreciation expense and amortisation expense to the net income total. Businesses use assets to produce revenue, and depreciation expense is posted as tangible (physical) assets are used up.

EBITDA explained. What is EBITDA?

EBIT dan EBITDA: Pengertian, Cara Menghitung, dan Perbedaan. Ketika mendengar kata EBITDA atau EBIT, pasti banyak orang yang langsung membayangkan bahwa EBITDA atau EBIT adalah jenis perhitungan keuangan perusahaan. Hal ini tentu benar adanya, mengingat EBITDA dan EBIT adalah sama-sama merupakan indikator untuk menghitung pendapatan perusahaan.

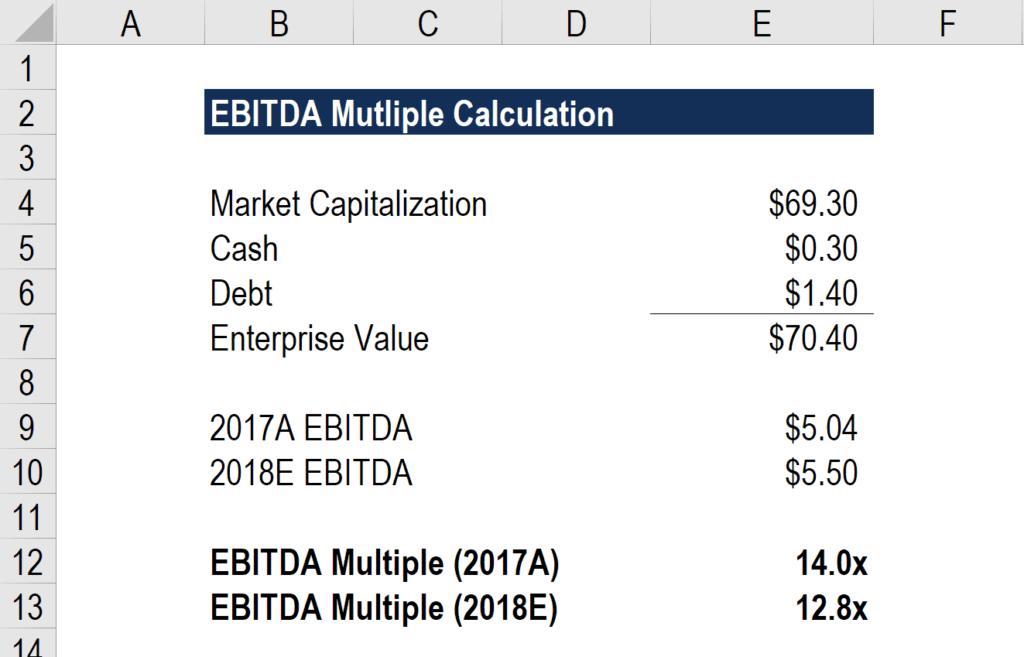

EBITDA Multiple Formula, Calculator, and Use in Valuation

EBITDA margin is a profitability ratio that measures how much in earnings a company is generating before interest, taxes, depreciation, and amortization, as a percentage of revenue. EBITDA Margin = EBITDA / Revenue. The earnings are calculated by taking sales revenue and deducting operating expenses, such as the cost of goods sold (COGS.

What is EBITDA Margin? Formula + Calculator

Calculation using Formula 1. Operating Profit given as $116 million and Depreciation and Amortization is $570 million. EBITDA = 116 + 570 = $686 million. Calculation using Formula 2. So, EBITDA = -116 +325 -126 +570 = $653 million. Now you will notice some differences between the values of formula#1 and #2.