Cara Menghitung Average Rate Of Return Dikte ID

Accounting Rate of Return (ARR) is the average net income an asset is expected to generate divided by its average capital cost, expressed as an annual percentage. The ARR is a formula used to make capital budgeting decisions. It is used in situations where companies are deciding on whether or not to invest in an asset (a project, an acquisition.

Rate of Return on Total Assets ROA YouTube

To calculate the rate of return, enter the values for Vb and Ve into the rate of return formula. With the correct values in place, your equation should look like this: R = [ ( $150 - $125 ) / $125 ] X 100. Solving out this formula using order of operations, your calculations should proceed as follows: R = [ $25 / $125 ] X 100.

Cara Menghitung Average Rate of Return (ARR) Magnate

The formula for calculating CAGR manually is: = ( end / start) ^ (1 / periods) - 1. In the example shown, the formula in H7 is: = (C11 / C6) ^ (1 / B11) - 1. where C11 is the ending value in year 5, C6 is the starting value or initial investment, and B11 is the total number of periods. The first part of the formula is a measure of total return.

:max_bytes(150000):strip_icc()/RoR-5c61fb1946e0fb0001f25474.jpg)

Rate of Return RoR Definition

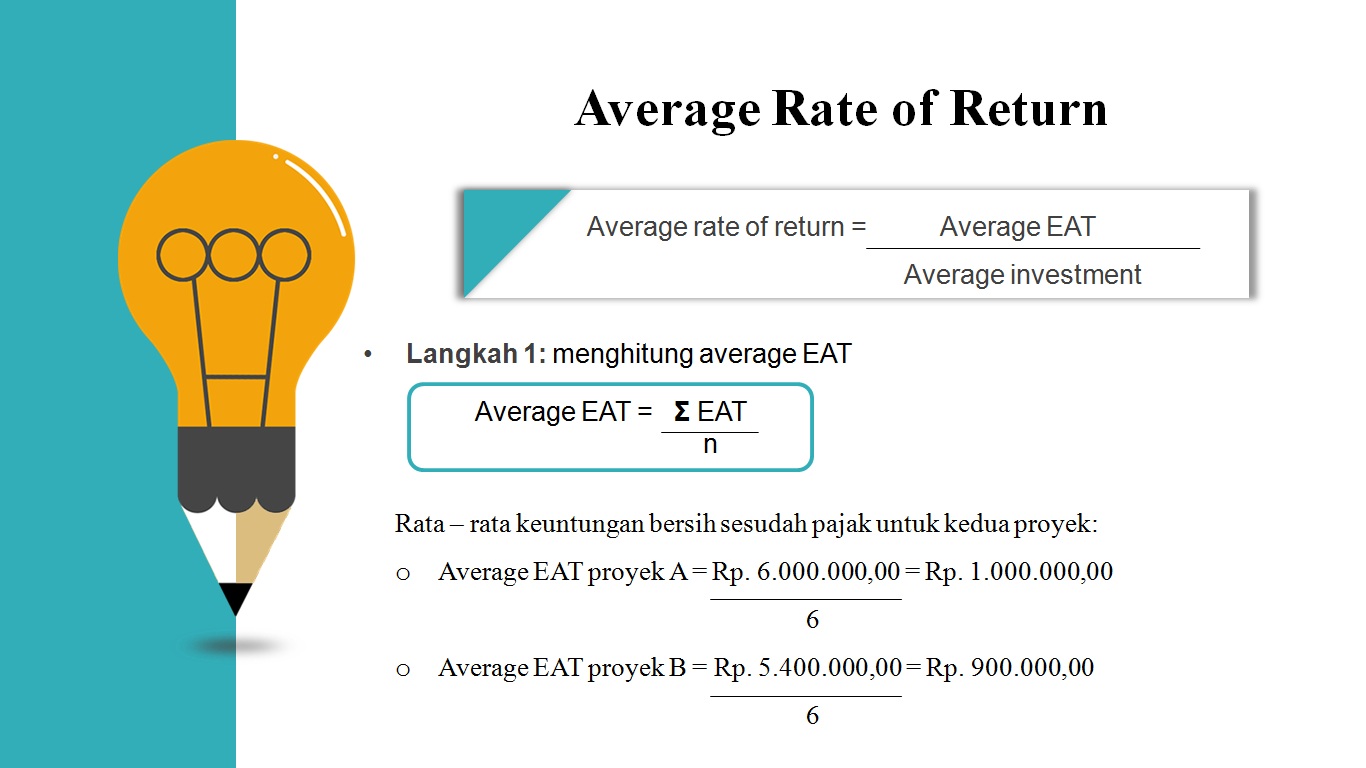

Average rate of return adalah perbandingan antara keuntungan yang dihasilkan oleh aset perusahaan dengan nilai investasi untuk membelinya.. Rumus Average Rate of Return. Secara sederhana, average rate of return (ARR) dapat dihitung dengan: ARR = (Rata-rata keuntungan per tahun : Investasi awal) x 100.

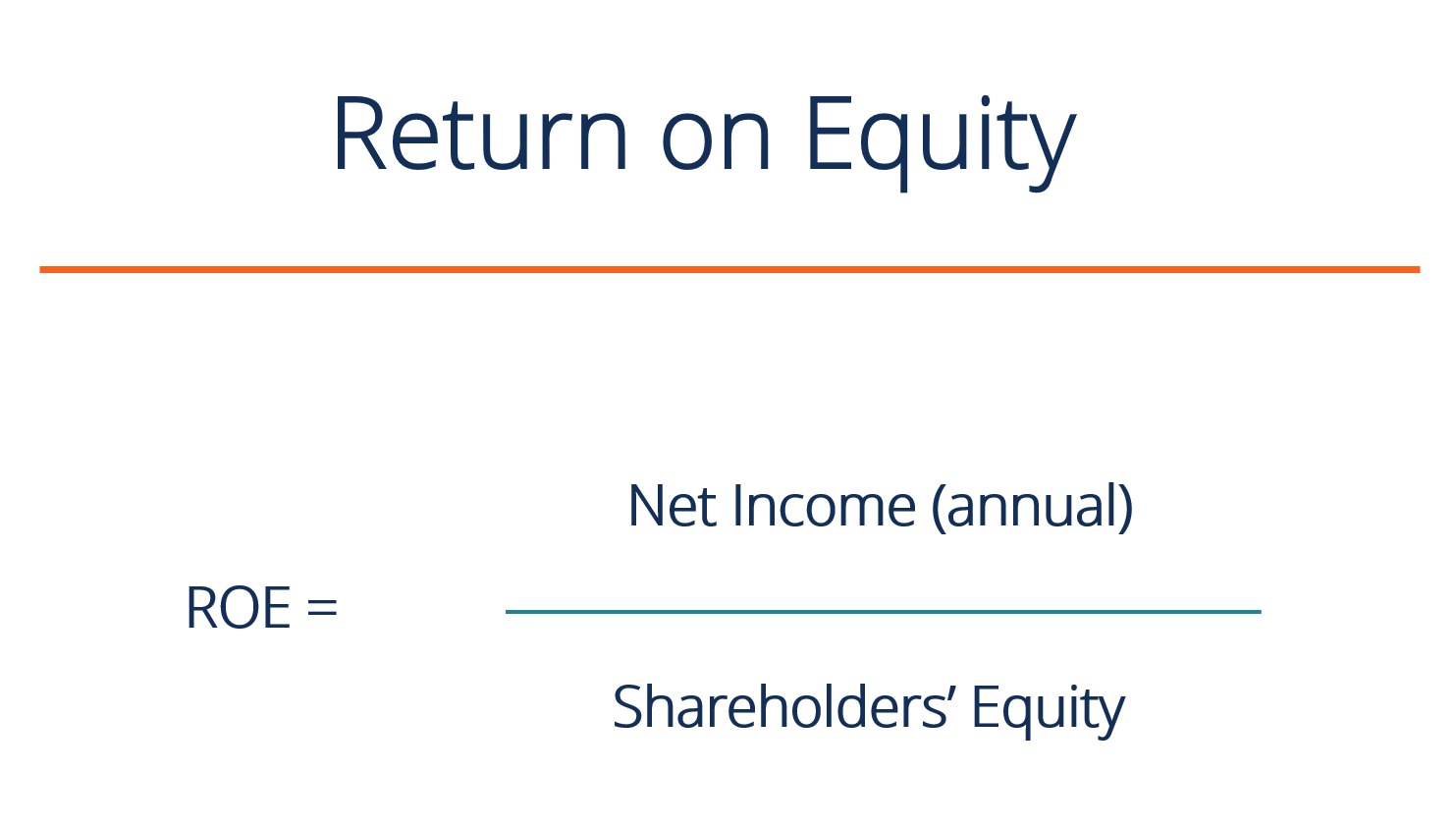

Return on Equity (ROE) Formula, Examples and Guide to ROE

The average return is defined as the mathematical average of a series of returns generated over a period of time. In regards to the calculator, the average return for the first calculation is the rate at which the beginning balance concludes as the ending balance, based on deposits and withdrawals that are made in-between over time.

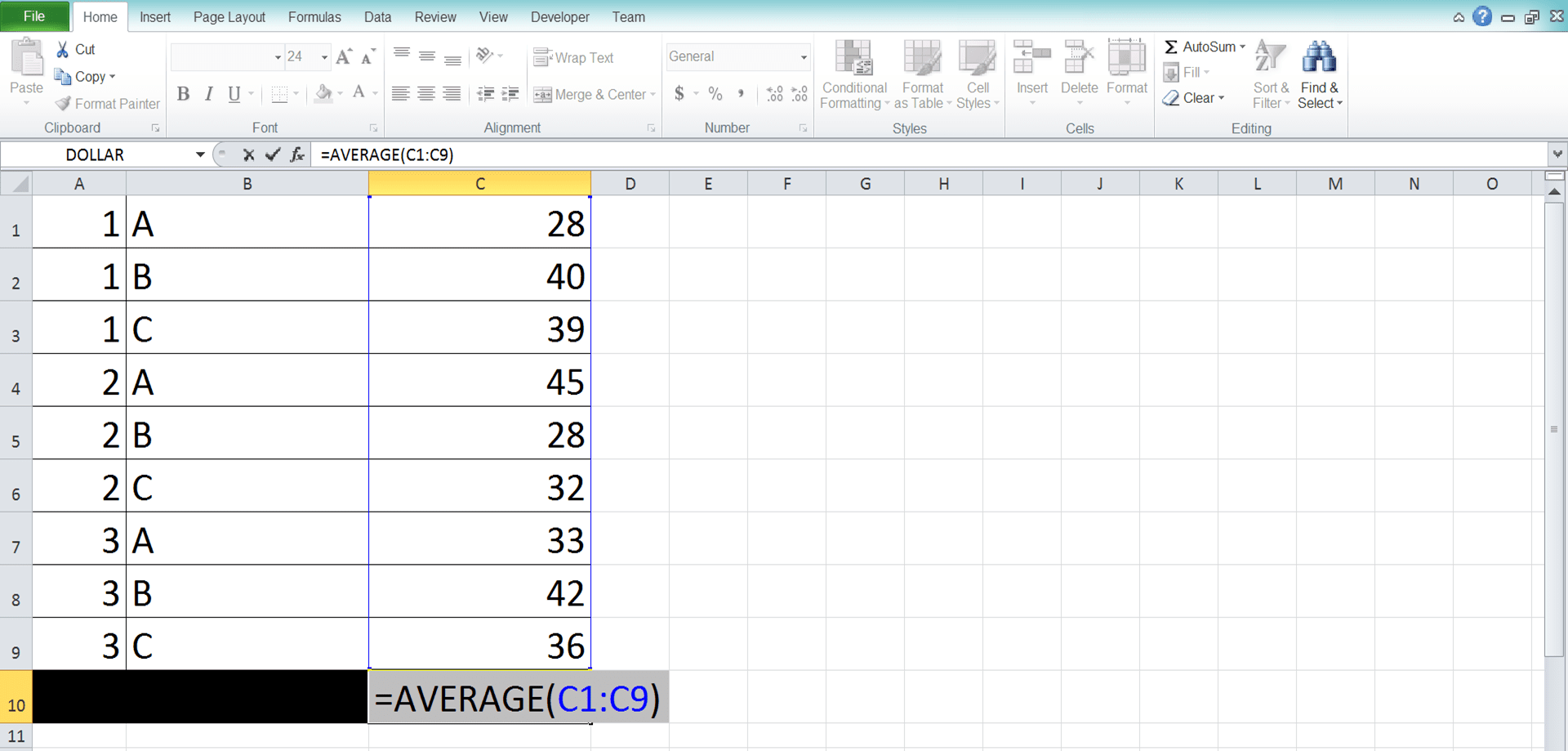

Rumus AVERAGE Excel Adalah; Fungsi, Contoh, dan Cara Menggunakannya

Average Expenses = 813333. Average Annual Profit. =900000-813333. Average Annual Profit = 86667. Therefore, the calculation of the accounting rate of return is as follows, = 86,667 /5,200,000. ARR will be -. Since the return on dollar investment is positive, the firm may consider investing in the same.

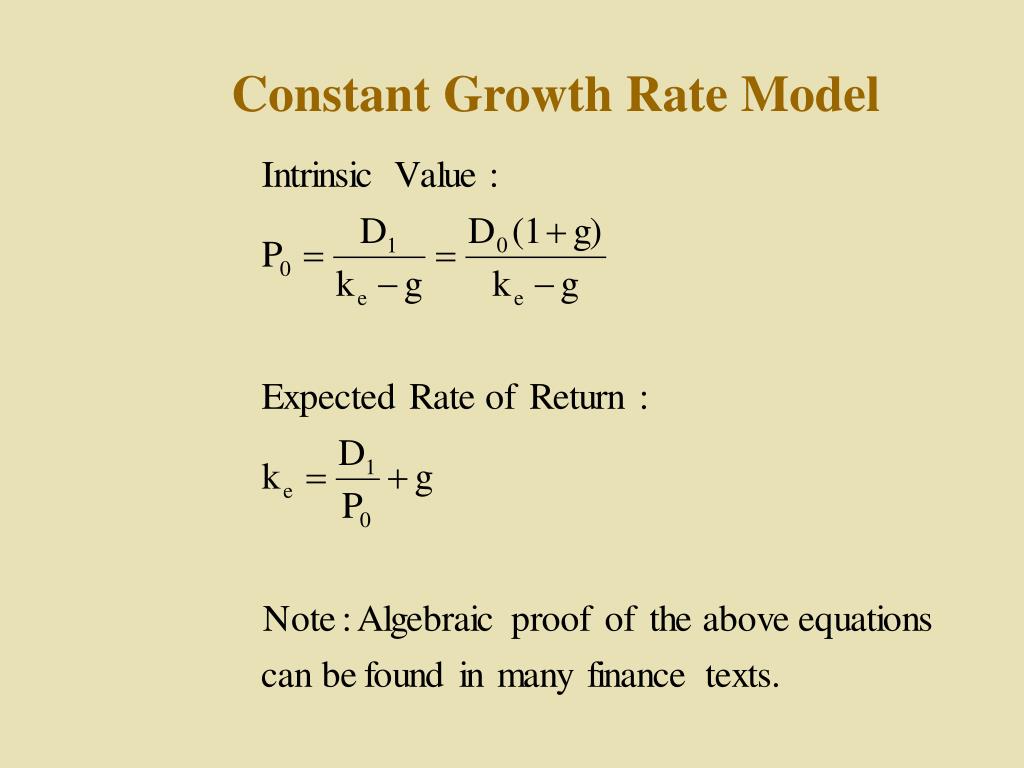

PPT Valuation and Rates of Return (Chapter 10) PowerPoint

Average Rate of Return Formula. Mathematically, it is represented as, Average Rate of Return formula = Average Annual Net Earnings After Taxes / Initial investment * 100%. or. Average Rate of Return formula = Average annual net earnings after taxes / Average investment over the life of the project * 100%. You are free to use this image on your.

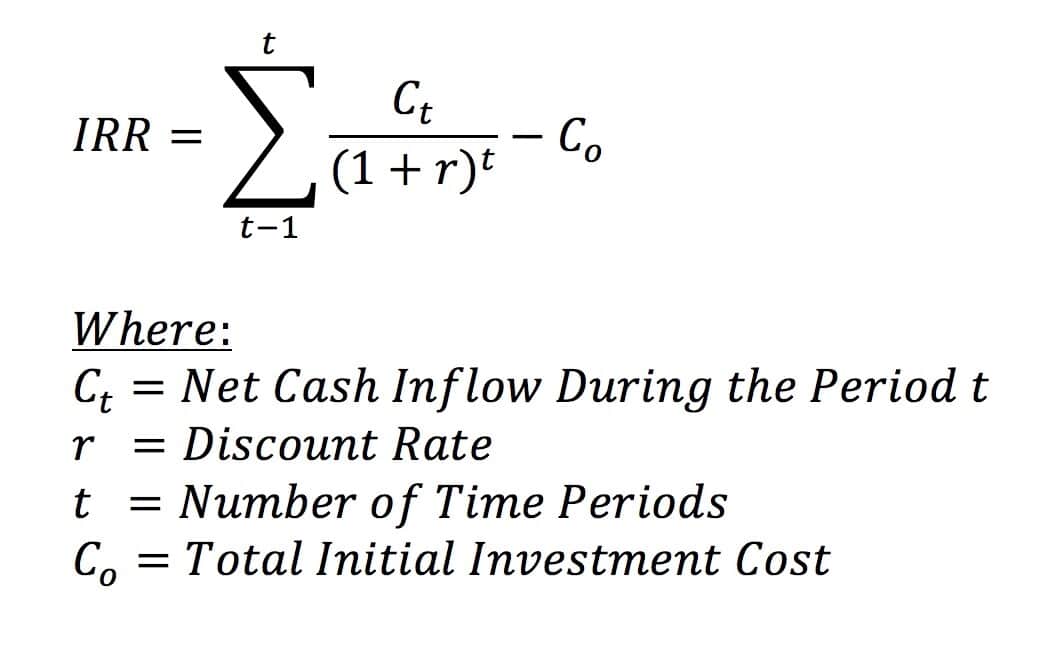

Cara Menghitung Internal Rate Of Return (IRR) dengan Rumus

Rumus average rate of return sendiri cukup sederhana. Untuk menghitungnya, kita perlu mengetahui dua hal, yaitu jumlah keuntungan atau kerugian dan jumlah modal yang diinvestasikan. Berikut adalah rumusnya:Average Rate of Return = (Keuntungan atau Kerugian / Modal) x 100%Contohnya, jika kita menginvestasikan 1 juta rupiah dan mendapatkan.

Contoh Soal Metode Average Rate Of Return Konsep – konsep dan

Rumus ARR. Dalam rumus average rate of return, kita mengambil rata-rata laba bersih tahunan dan membaginya dengan total biaya investasi.Kita, kemudian, melipatgandakannya dengan 100 untuk mendapatkan persentase. ARR = Average annual profit / Initial investment cost x 100%. Di mana rata -rata laba bersih tahunan dihitung melalui total laba selama periode investasi dibagi dengan jumlah tahun.

Rate of Return Analysis Ch7 part I YouTube

Average return is the simple mathematical average of a series of returns generated over a period of time. An average return is calculated the same way a simple average is calculated for any set of.

Rumus AVERAGE Excel 6 Contoh Menghitung RataRata Data M Jurnal

Plug all the numbers into the rate of return formula: = (($250 + $20 - $200) / $200) x 100 = 35%. Therefore, Adam realized a 35% return on his shares over the two-year period. Annualized Rate of Return. Note that the regular rate of return describes the gain or loss, expressed in a percentage, of an investment over an arbitrary time period.

/Accounting+Rate+of+Return+(ARR).jpg)

Rumus Average Rate Of Return

Rate of Return: A rate of return is the gain or loss on an investment over a specified time period, expressed as a percentage of the investment's cost. Gains on investments are defined as income.

Como Calcular Taxa Interna De Retorno EDULEARN

Source: Geometric Mean Return (wallstreetmojo.com) r = rate of return; n = number of periods; It is the average set of products technically defined as the 'n' th root products of the expected number of periods. The focus of the calculation is to present an 'apple to apple comparison' when looking at 2 similar kinds of investment options.

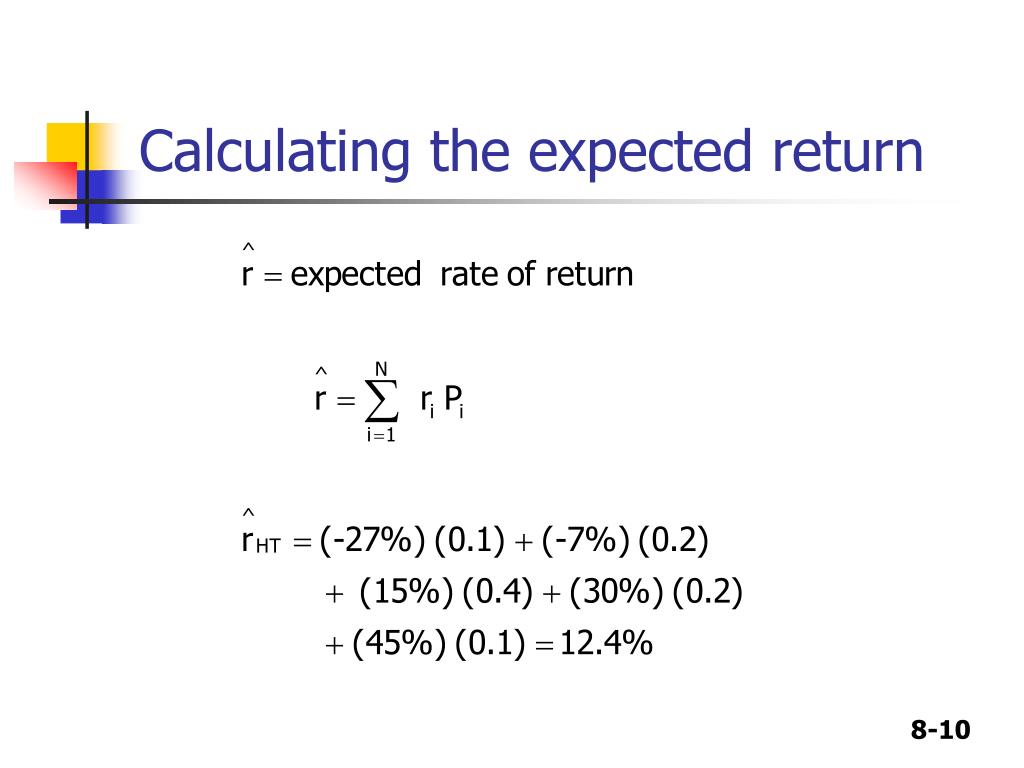

PPT CHAPTER 8 Risk and Rates of Return PowerPoint Presentation, free

The average return for six years is computed by summing up the annual returns and divided by 6, that is, the annual average return is calculated as below: Annual Average Return = (15% +17.50% + 3% + 10% + 5% + 8%) / 6 = 9.75%. Alternatively, consider hypothetical returns of Wal-Mart (NYSE: WMT) between 2012 and 2017. The returns on investments.

Accounting Rate of Return (ARR) with average investment YouTube

Year 4 = $116,909 (9%) Year 5 = $134,445 (15%) Once again, after doing the math, you will see that after five years, this investment also had an average rate of return of 7%. The key distinction.

Rumus AVERAGE Excel 6 Contoh Menghitung RataRata Data M Jurnal

Average Rate of Return = $1,600,000 / $4,500,000; Average Rate of Return = 35.56% Explanation. The average rate of return will give us a high-level view of the profitability of the project and can help us access if it is worth investing in the project or not.