How to Easily Calculate and Increase your Business Profit SBC

Traders report their business expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship). Commissions and other costs of acquiring or disposing of securities aren't deductible but must be used to figure gain or loss upon disposition of the securities. See Topic no. 703, Basis of assets. Gains and losses from selling.

Maximizing Your Profit Potential

Solo 401(k) profit-sharing plan. Consider a 25% deductible Solo 401(k) profit-sharing plan (PSP) contribution if you have sufficient trading gains. Increase payroll in December 2022 for a performance bonus. You don't have to pay into the retirement plan until the due date of the S-Corp tax return (including extensions by September 15, 2023).

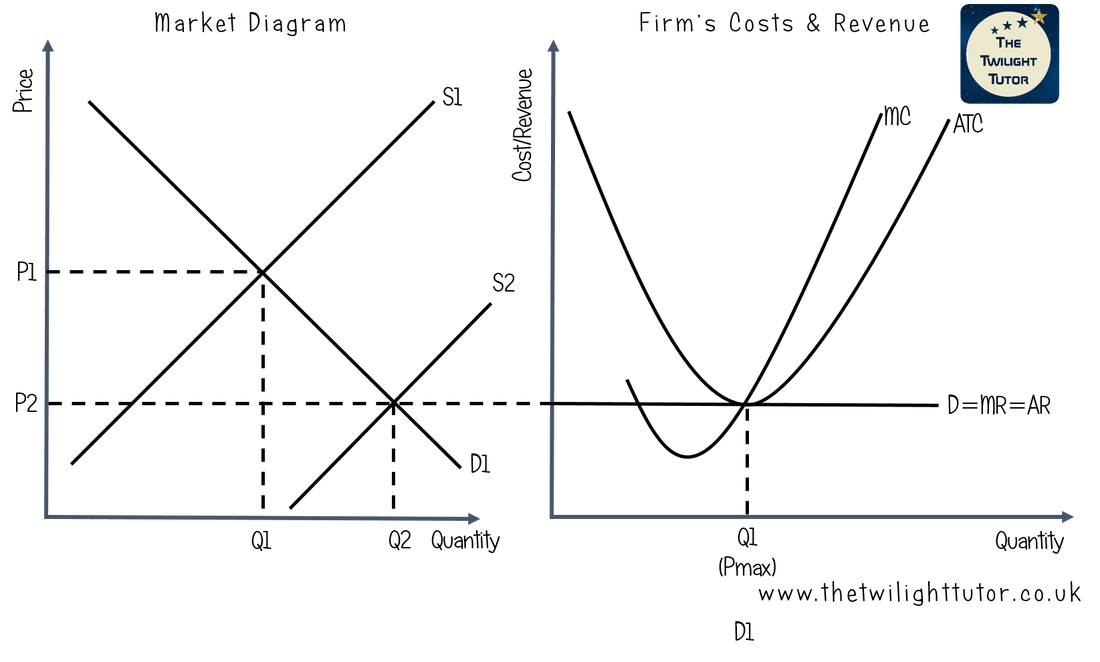

What is Supernormal Profit? The Twilight Tutor

Profit Voice is a text to speech (TTS) software that outputs audio mp3 files of speech from inputted text. It can also translate text to different languages.

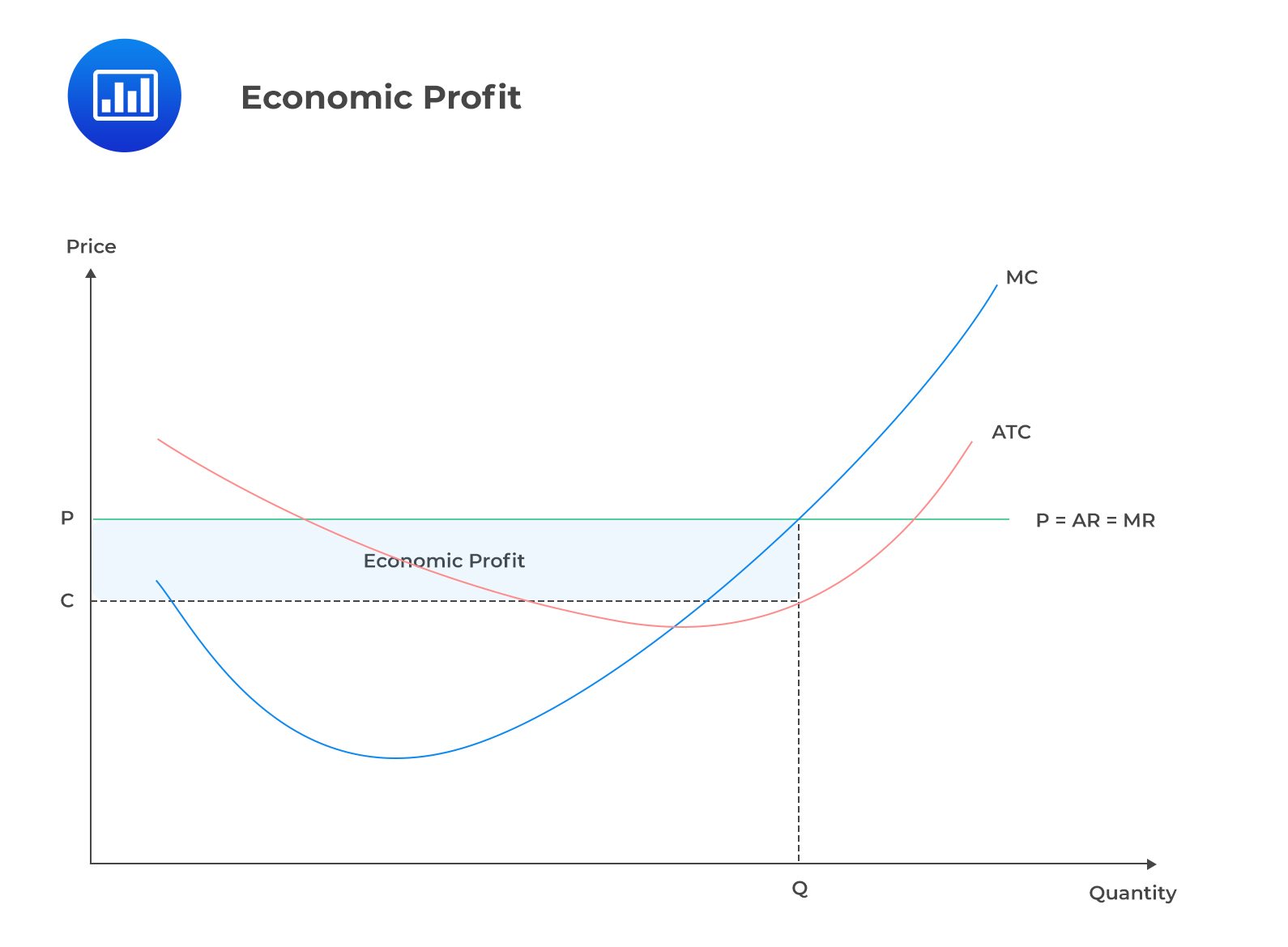

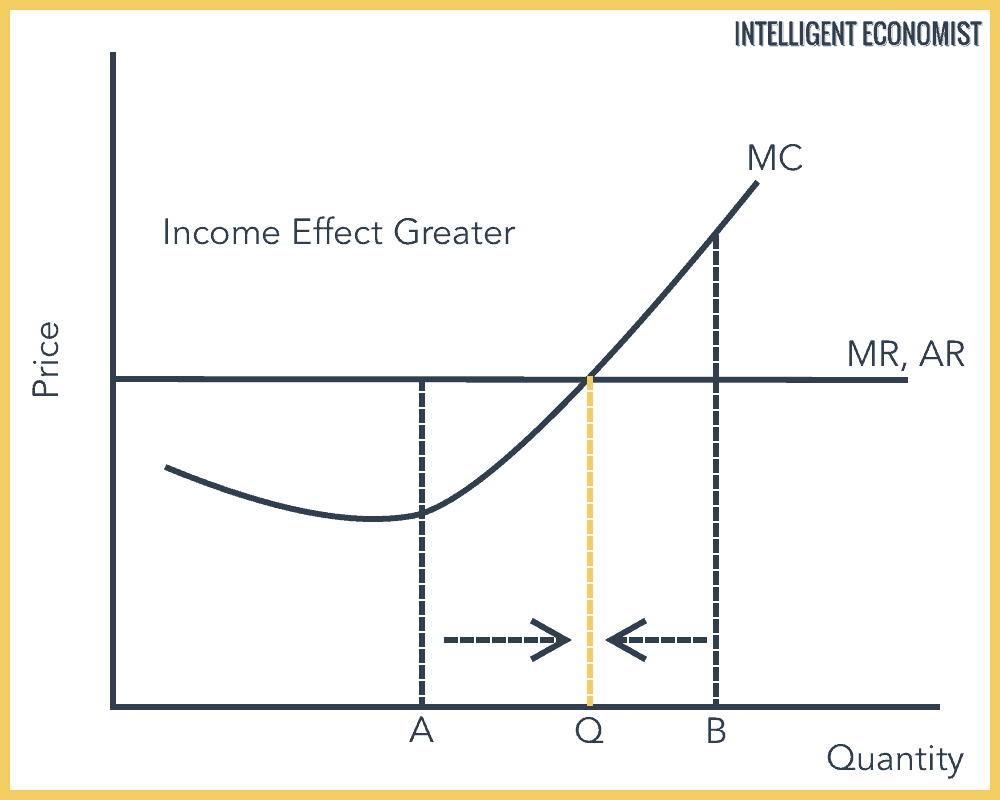

Price, Marginal Cost, Marginal Revenue, Economic Profit, and the Elasticity of Demand

Taking into account price changes, the sum of TTS were $1,079,357.50. I assumed that 30% of all TTS were refunded giving us $755,550.25. There were 12,981 unique names seen in chat. Since only season pass holders could type in chat that gives us 12,981*40 = $519,240.. Interested in what was the net profit. This whole project had to cost.

What is Profit and how do I calculate it?? INAccountancy

The IRS specifies three main characteristics for TTS qualification: Seek to profit from trades; Trade frequently; Trade at a great volume; Since TTS status essentially means the IRS is treating the activities of a day trader like a business, that trader has to actually operate like a business. This means working almost every market day for.

Perfect Competition Introduction to Microeconomics

Profit Voice is a low cost text to speech (TTS) web based software. Here's a demo of the voice in use.#shorts #profitvoice #tts

How to Read a Profit and Loss Statement SMI Financial Coaching

In December 2021, based on sufficient annual profits, a TTS S-Corp can pay maximum-required officer compensation of $154,000 to make the Solo 401(k) retirement plan contribution cap of $58,000.

IPhone With Trading Profits సాధ్యమా?How I made 130 Profits by Buying Options TTS YouTube

Prices are subject to change. The best route is from Doobin to Hilltop. The highest-income route is from Anastazja's Point to Hordlo and vice versa. Private servers lower sell prices by 40%. TTS Profit Map.

Profit and Loss Report [English] YouTube

View Financial Supplement (Excel) New York - Citigroup Inc. today reported net income for the fourth quarter 2022 of $2.5 billion, or $1.16 per diluted share, on revenues of $18.0 billion. This compares to net income of $3.2 billion, or $1.46 per diluted share, on revenues of $17.0 billion for the fourth quarter 2021.

Increase Profit Means Upwards Raise And Revenue Free Stock Photo by Stuart Miles on

View Financial Supplement (Excel) New York, April 14, 2023 - Citigroup Inc. today reported net income for the first quarter 2023 of $4.6 billion, or $2.19 per diluted share, on revenues of $21.4 billion. This compares to net income of $4.3 billion, or $2.02 per diluted share, on revenues of $19.2 billion for the first quarter 2022.

PROFIT SCREENSHOTS Intraday Star by Mittal Research Stock Trading Academy in Patiala

This person owns a single-member LLC (SMLLC) taxed as an S-Corp, eligible for TTS business expense deductions. In December 2021, based on sufficient annual profits, a TTS S-Corp can pay maximum-required officer compensation of $154,000 to make the Solo 401(k) retirement plan contribution cap of $58,000 ($64,500 for age 50 or older; 2021 limits).

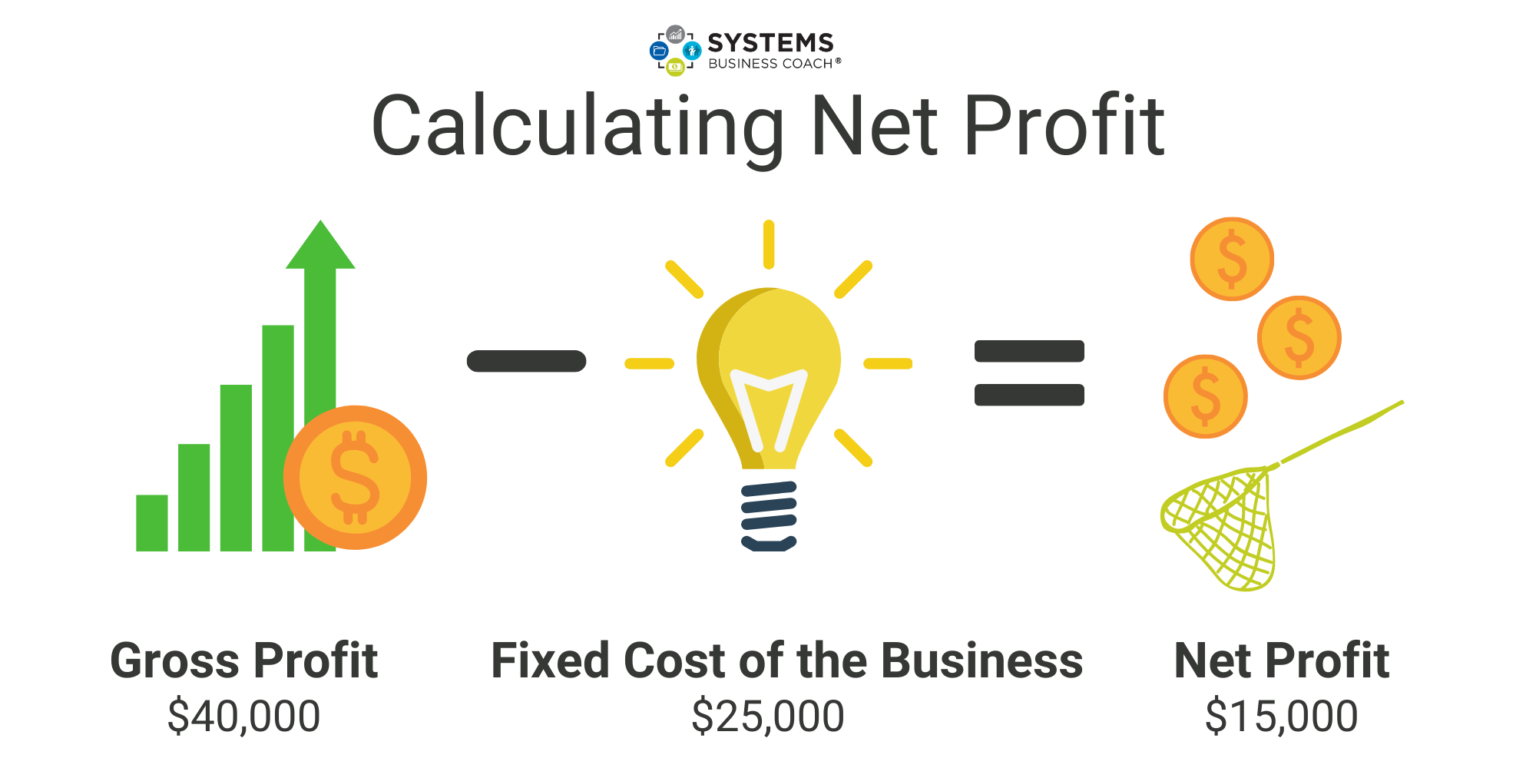

Differences Between Gross and Net Profit (and Why Neither Matter Unless You Get Paid!)

The maximum PSP amount is $37,500 on wages of $150,000 ($37,500 divided by 25% equals $150,000). The total limit for a Solo 401 (k) is $63,500 ($19,500 ED, $6,500 catch-up ED, and $37,500 PSP). LLC taxed as a partnership. A TTS trader can organize a spousal-member LLC and file as a partnership.

🏷️ Explain profit maximization. Profit Maximization. 20221023

ProfitVoice Review: Profit Voice Text To Speech Software Toolhttps://bit.ly/3wIuaNQ - Get ProftVoice HereHello and welcome to my Profit Voice review. In this.

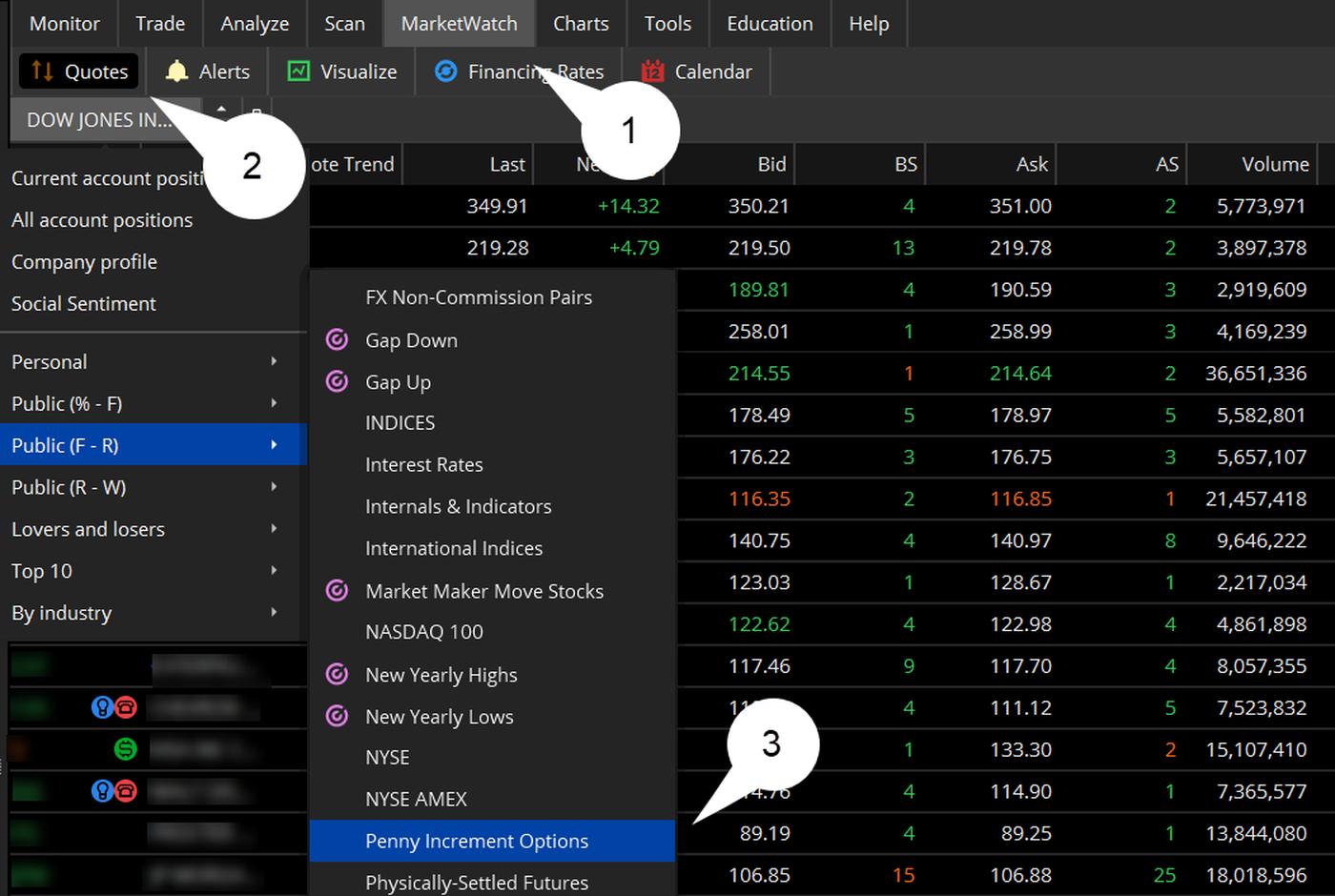

Stock Trading Strategy Frequent Trading Profit Loss Diagram Thinkorswim

TTS business expenses. If you qualified for TTS in 2023, you could claim business expenses on Schedule C. No IRS election was required. Schedule C is part of an individual tax return (Form 1040).

Profit Maximisation Economics tutor2u

Text to speech (TTS) is a technology that converts text into spoken audio. It can read aloud PDFs, websites, and books using natural AI voices. Text-to-speech (TTS) technology can be helpful for anyone who needs to access written content in an auditory format, and it can provide a more inclusive and accessible way of communication for many people.

Profit Trader indicadores e colocação de média móvel YouTube

Excess business losses and net operating losses. The net Section 475 losses and TTS business expenses are subject to the excess business loss (EBL) limitation for the tax year 2022. You can.