:max_bytes(150000):strip_icc()/Cost-of-Goods-Sold-COGS-60d335925dd14754a278392cae907b92.png)

Cost of Goods Sold (COGS) Explained With Methods to Calculate It (2022)

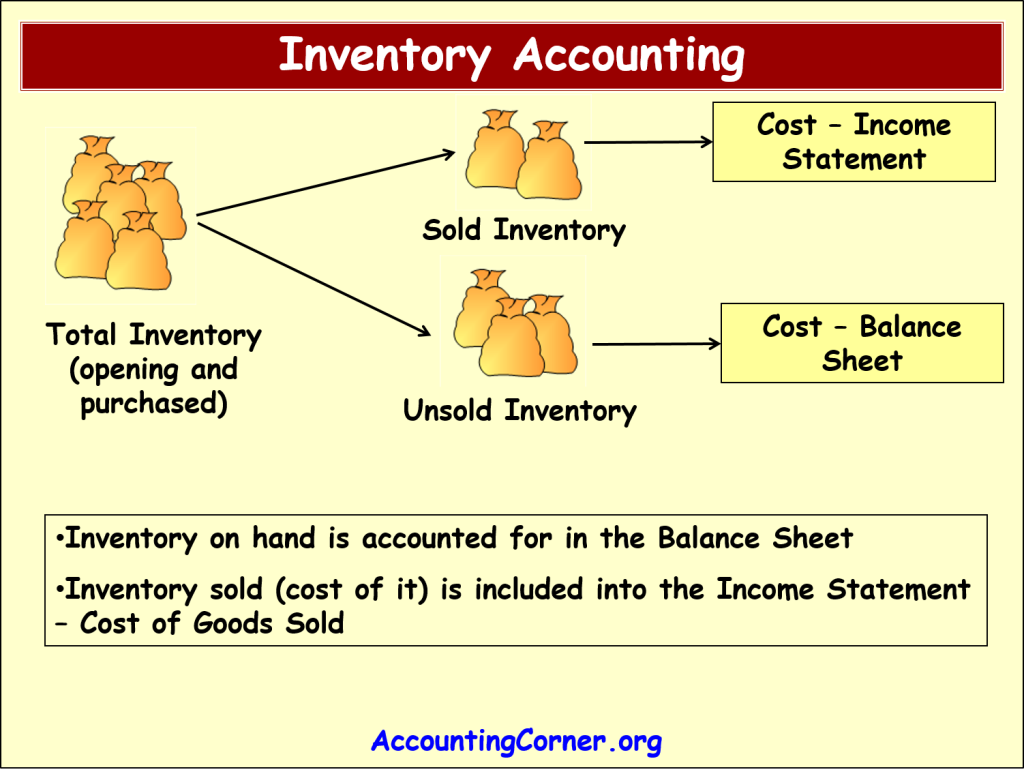

Cost of Goods Sold - COGS: Cost of goods sold (COGS) is the direct costs attributable to the production of the goods sold in a company. This amount includes the cost of the materials used in.

Cost of Goods Sold (COGS) Pengertian, Rumus Cara Menghitung

2nd Step : To Apply Formula. Now, we just put the value of cost of goods sold and sales in following formula. Cost of goods sold / sales. If we want to know its %, we can multiply this formula with 100. Important Note : Both gross margin and markup can be calculated from cost of goods sold ratio. Gross profit or gross margin ratio is the.

What Is the Cost of Goods Sold (Cost of Sales)? Everything About It 万博体育app下载入口万博全站官网app入口

The cost of goods sold (COGS) is not only used for calculating the taxable income and net income. It is also used in calculating the gross profit margin for your business. The cost of goods sold (COGS) ratio provides insight into the health of a business. Every industry has some ideal standards for the cost of goods sold (COGS).

How to Calculate Cost of Goods Sold? COGS Formula

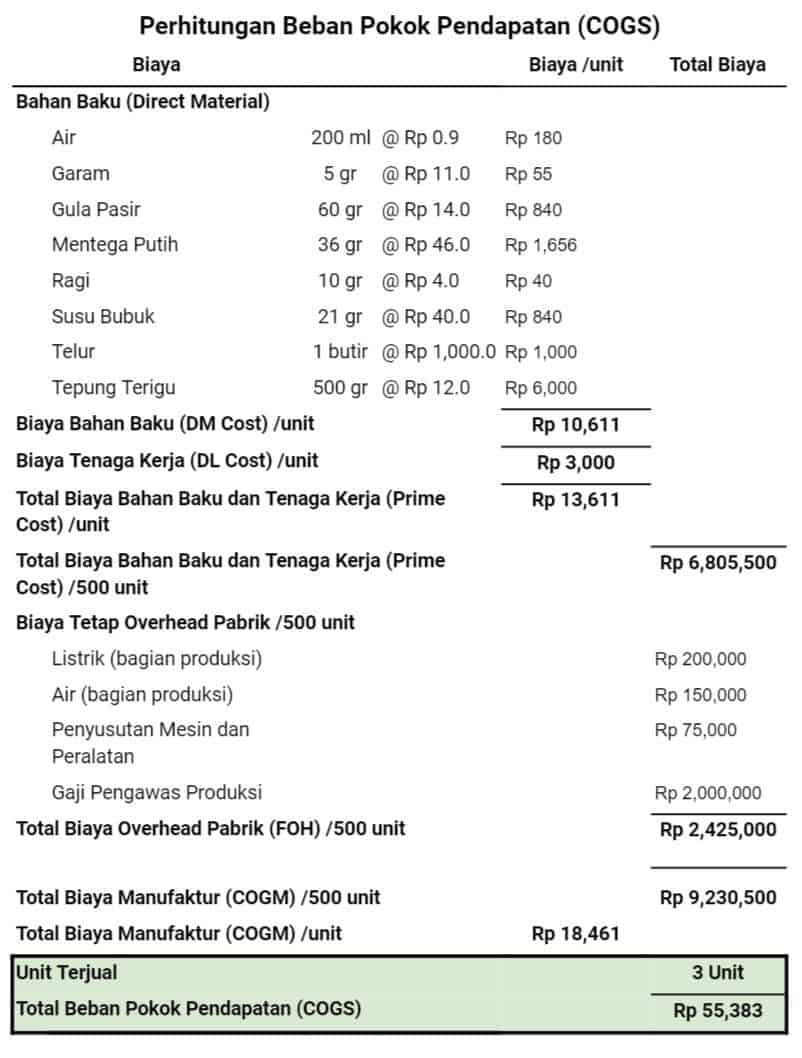

Cost of Goods Sold (COGS) atau Harga Pokok Penjualan (HPP) adalah peghitungan "biaya langsung" yang timbul dalam produksi barang atau jasa apa pun. Ini termasuk biaya material, biaya tenaga kerja langsung, dan biaya overhead pabrik langsung, dan berbanding lurus dengan pendapatan. Ketika pendapatan meningkat, lebih banyak sumber daya.

What is the cost of goods sold formula? Here's our detailed guide!

The cost of goods sold is used by analysts and investors to help determine how efficiently a company is managing its production costs. Note. COGs can play a key role in minimizing tax bills. Businesses can use COGS on the Schedule C form. By documenting expenses during the production process, a business will be able to file for deductions that.

Cost of Goods Sold [Basics Explained & Made Easy]

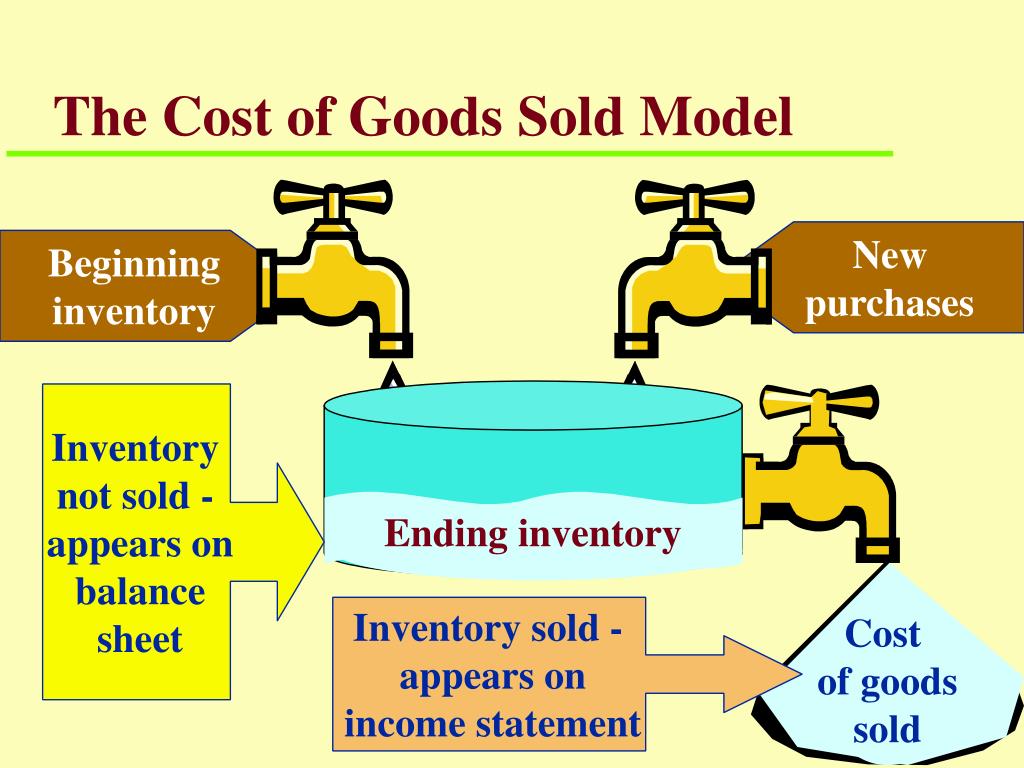

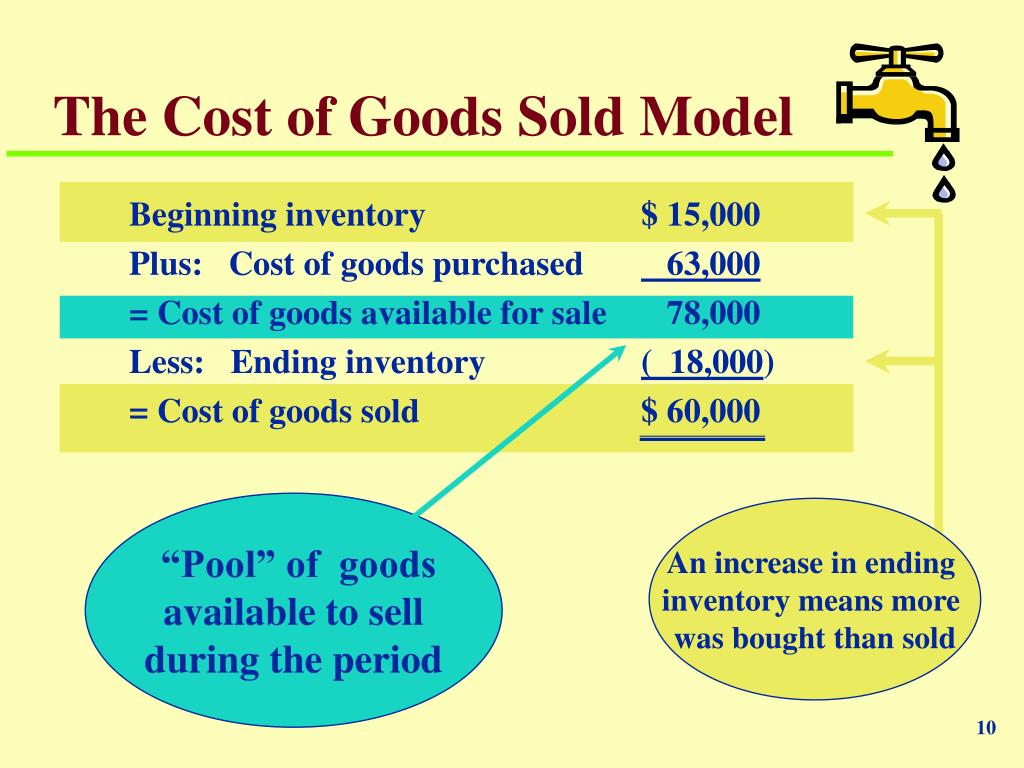

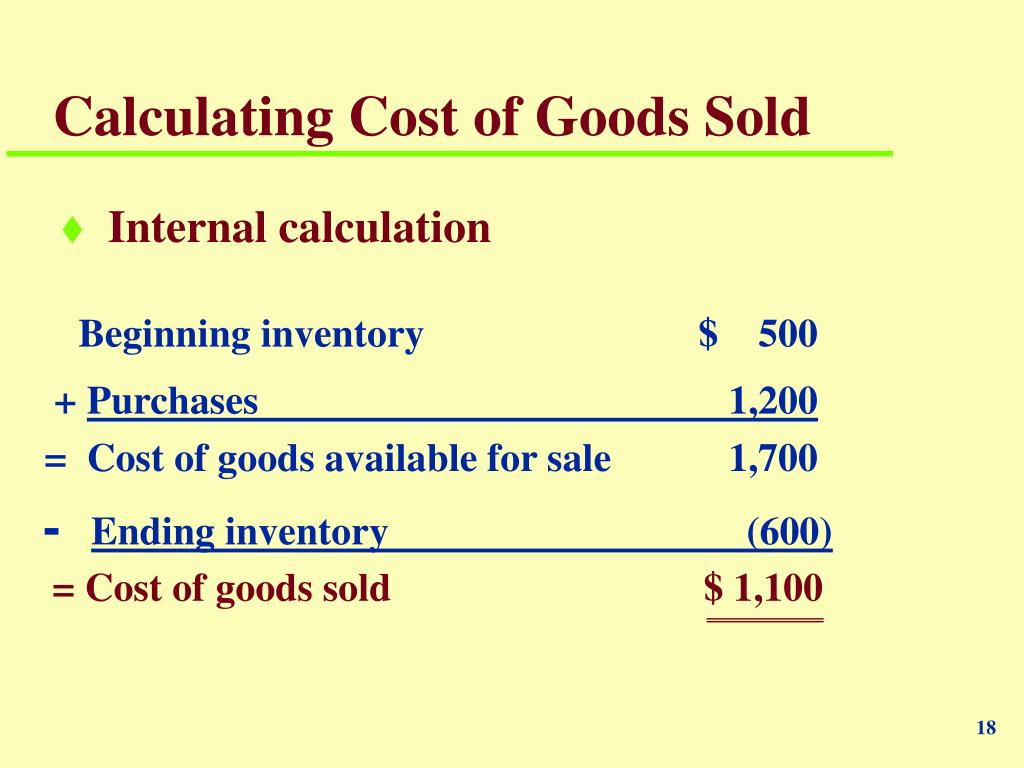

To calculate her cost of goods sold for the month, her formula would be: 8,300 + 4,000 - 5,600 = $6,700. 🤓 Nerdy Tip. If the COGS formula is confusing, think of it this way. When you add your.

Calculate Cost of Goods Sold StepbyStep Guide MintLife Blog

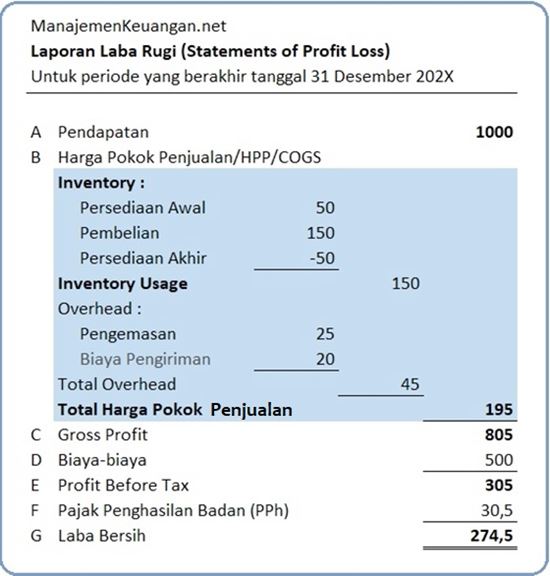

2.1 Cost of Goods Sold (COGS) 2.2 Cost of Goods Manufactured (COGM) 3 Komponen COGS. 3.1 1. Persediaan atau Inventory; 3.2 2. Overhead; 3.3 3. Transaksi Inventory Cost; 4 Rumus Perhitungan COGS. 4.1 Tahap 1: Menghitung Bahan Baku Yang Digunakan; 4.2 Tahap 2: Menghitung Biaya Produksi; 4.3 Tahap 3: Menghitung Harga Pokok Produksi; 4.4 Tahap 4.

Cost of Goods Sold Formula & Explanation Accounting Corner

Cost of Goods Sold atau COGS adalah harga pokok penjualan yang ada pada setiap aktivitas produksi dalam perusahaan. Pengertian COGS secara lengkap yaitu seluruh biaya yang dibutuhkan perusahaan untuk menghasilkan sebuah produk atau jasa, meliputi proses pembuatannya hingga siap dipasarkan. COGS adalah perhitungan yang mencakup biaya bahan baku.

PPT Chapter 7 PowerPoint Presentation, free download ID6421395

Cost of goods sold was calculated to be $8,283, which should be recorded as an expense. The credit entry to balance the adjustment is for $13,005, which is the total amount that was recorded as purchases for the period. This entry distributes the balance in the purchases account between the inventory that was sold (cost of goods sold) and the.

PPT Chapter 7 PowerPoint Presentation, free download ID6421395

Cost of Goods Sold (COGS) → COGS are "direct costs" that tend to consist of variable costs, as the value is dependent on the production volume. Operating Expenses (Opex) → In contrast, Opex comprises "indirect costs", such as overhead costs, utilities, rent, and marketing expenses. Opex tends to consist of fixed costs, which means.

Apa itu Harga Pokok Penjualan (Cost of Goods Sold COGS)?

Contoh Perhitungan Cost Of Goods Sold (COGS) Pabrik Mulya Abadi merupakan perusahaan manufaktur yang mengolah tepung tapioca menjadi kerupuk.. Ini artinya biaya produksi kerupuk persatuannya adalah Rp 33.217.500 / 250.000 = Rp.132.87,-Berdasarkan harga jual yang ditetapkan, yaitu 600 per buah dan dengan biaya produksi sebesar Rp.132.87,- pcs.

Calculating Cost of Goods Sold for Glew

Cost of Revenue: The cost of revenue is the total cost of manufacturing and delivering a product or service. Cost of revenue information is found in a company's income statement , and is designed.

Cost of Goods Sold (COGS) Pengertian, Penting, dan Cara Hitung COGS

Menghitung Cost of Goods Sold (COGS) Perusahaan Manufaktur. Ketika sudah diketahui bahwa biaya pokok produksi adalah Rp159.833.000 per unit, maka kita akan mengecek berapa unit mobil yang sudah selesai.. Artinya sisanya sebanyak 140 unit sudah terjual. Berapakah HPP untuk 140 mobil tersebut?

What Is the Cost of Goods Sold (Cost of Sales)? Everything About It

Cost of goods sold is an important figure for investors to consider because it has a direct impact on profits. Cost of goods sold is deducted from revenue to determine a company's gross profit. Gross profit, in turn, is a measure of how efficient a company is at managing its operations. Thus, if the cost of goods sold is too high, profits.

How To Calculate Cost Of Goods Sold Haiper

Berikut adalah beberapa rumus yang bisa kamu gunakan: Laba bersih sebelum pajak = laba kotor - akumulasi biaya. Laba kotor = penjualan bersih - harga pokok penjualan. Cost of Sales = persediaan awal barang + pembelian bersih - persediaan akhir. Pembelian bersih = pembelian - biaya angkut pembelian - retur pembelian - potongan pembelian.

Partnership MeaningTypesFeaturesAdvantagesDisadvantages Accounting Notes, Accounting

Total biaya overhead : (a)+ (b) = 25+20 = 45. Total Harga Pokok Penjualan (HPP/COGS) adalah: = Inventory usage + Total overhead. = 150 + 45 = 195. Jadi, perubahan komponen dan unsur cost of goods sold bisa sebagai penyebab harga pokok penjualan naik, maka perhatikan secara cermat elemen-elemen tersebut.