Maximize Call Center Agent Bandwidth Without Adding Headcount

General tax assistance. Make an appointment with a local IRS office: 844-545-5640. Learn more about how to find an IRS tax office near you. Find a free tax clinic near you: 800-906-9887; 888-227.

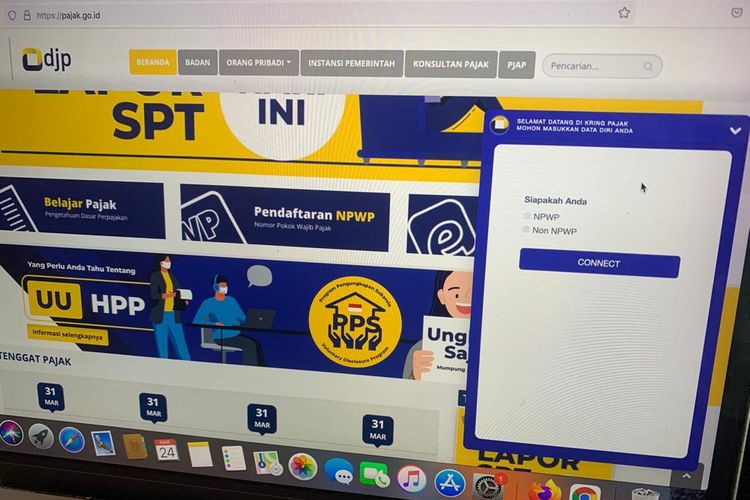

Bingung Lapor SPT atau Lupa EFIN? Coba Hubungi Call Center Pajak Ini

The Internal Revenue Service (IRS) works with ID.me, a technology provider, to provide authentication and identity verification for taxpayers and tax professionals accessing IRS applications.. Proving your identity involves uploading government documents, taking a video selfie, and filling out personal information. These identity verification services are crucial for the IRS to ensure millions.

Your Complete Guide to Call Center Outsourcing Services

Your EFIN Status page gives you the number of returns the IRS received, which you can match to your records. The statistics are updated weekly. Please contact the IRS e-help Desk at 866-255-0654 if you see a significantly higher volume than you transmitted.. The firm must call the e-help Desk at 1-866-255-0654 to request a new EFIN..

Maximize Your Efficiency with Blended Call Centers TCN

The alternative, a home-based call center, is more cost effective. But, unless you're starting with call center veterans, getting staff members up to speed is more complex. Average costs for a small call center office hover around $2,500 per month, according to one analysis. The basic rent rate may include utilities (electricity, water, etc.

Efficiently Managing Escalated Calls in Call Centers

JAKARTA, DDTCNews - Jelang deadline pelaporan SPT tahunan, Ditjen Pajak (DJP) menambah platform layanan contact center melalui Whatsapp.. Melalui akun Twitter resminya, contact center DJP Kring Pajak mengatakan penambahan platform layanan ini dilakukan untuk memfasilitasi wajib pajak dalam urusan pelaporan SPT tahunan.Terlebih adanya pandemi Covid-19 membuat pelayanan tatap muka dihentikan.

Call Center Best Practices The Pros and Cons of Recording Phone Calls

Direktorat Jenderal Pajak is the official website of the tax authority in Indonesia. You can find information about tax regulations, services, forms, and news. You can also register for NPWP, pay your taxes, and report your tax returns online. Visit pajak.go.id to fulfill your tax obligations easily and conveniently.

Boost Call Center Efficiency with Web Dialer JustCall Blog

Information for tax professionals. Access online tools for tax professionals, register for or renew your Preparer Tax Identification Number (PTIN), apply for an Electronic Filing Identification Number (EFIN), and more.

.jpg?width=2667&name=_MG_3412 (1).jpg)

Inbound Call Center Philippines, Outsource Telemarketing Service

How to obtain an EFIN from the IRS. An EFIN is required for preparers to submit e-file returns to the IRS. The application process can take up to 45 days, so preparers are encouraged to begin the registration well in advance of tax season. Your tax program won't let the return to be e-filed if there is no EFIN entered in your software or if the.

The eFIN Monthly Recap. Even as eFIN starts its new journey… by eFIN Project Medium

Wajib pajak bisa mendapatkan kembali kode EFIN dengan menghubungi call center Kring Pajak di nomor 1500200. Nantinya, Anda akan diminta untuk mengonfirmasi data diri dan menyebutkan nomor NPWP. Jika data diri sudah sesuai dengan data yang tesimpan di DJP, maka petugas akan memberikan kode EFIN Anda. Itulah cara mendapatkan kode EFIN secara.

Inbound Call Centers Base Outsourcing

For more information or to speak with an Intuit tax consultant, please call (844) 824-7164. What is an Electronic Filing Identification Number (EFIN)? An EFIN is a number issued by the IRS to individuals or firms that have been approved as Authorized IRS e-File providers.

Call Center Automation 7 Ways It Impacts Customer Care & Beyond

Contact the e-help desk at 866-255-0654 (6:30 a.m. to 6 p.m. CT) to find out additional information or visit Information for IRS e-file Providers on IRS.gov if you have questions or concerns in regards to your EFIN. A few examples may be: Report a possible compromised EFIN. You haven't used your EFIN in the last 2 years.

Call Center, herramienta clave para potenciar el canal directo de venta.

1. Kring Pajak. Kring Pajak merupakan layanan Call Center pajak dari DJP untuk menangani persoalan perpajakan, yang bisa diakses dengan menghubungi lewat telepon di nomor "1500200" atau "0211500200" (tanpa tanda kutip) bila menggunakan ponsel. Waktu layanan konsultasi atau pengaduan pajak lewat Kring Pajak 1500200 tidaklah 24 jam.

Best Call Center Software Providers 2023 Tech.co

Nomor Pokok Wajib Pajak (NPWP) yang dimasukkan hanya angka, tanpa tanda titik (.) dan strip (-).; Dapatkan EFIN (Electronic Filing Identification Number) di Kantor Pelayanan Pajak (KPP) terdekat bagi Wajib Pajak Orang Pribadi atau di KPP terdaftar bagi Wajib Pajak Badan.Untuk melakukan registrasi akun masukkan NPWP, EFIN, dan Kode Keamanan dengan benar, kemudian klik tombol Submit untuk ke.

How to Build an Efficient Framework for QA in Call Centers?

Go to IRS.gov, keyword 'Pub 3112'. Report suspected tax fraud activity by completing Form 3949-A, Information Referral at IRS.gov, keyword 'Form 3949-A', or by calling the Tax Fraud Hotline at 800-829-0433. Centralized toll-free number for the EPSS e-help Desk - assistors are ready to respond to questions and issues concerning e-products.

Call Center Arena Simulation Software

Tenang saja, khusus untuk Wajib Pajak Orang Pribadi, Anda masih bisa mendapatkan kembali EFIN Anda dengan menghubungi call center Kring Pajak di nomor 1500200. Anda akan diminta untuk mengonfirmasi data diri dan menyebutkan nomor NPWP. Jika data diri yang disebutkan sesuai dengan data yang tersimpan di DJP, maka petugas pajak akan memberikan.

What Are the Benefits of Hiring Inbound Call Center Services for Your Small Business?

Aktivasi EFIN Anda Setelah Anda mendapatkan e-FIN (berupa nomor 10 digit). Hubungi Call Center Kring Pajak di nomor 1500200. Cari lagi berkas-berkas perpajakan Anda, mungkin lembar e-FIN Anda terselip. Periksa lagi inbox email Anda, dengan mencari kata kunci "e-FIN".