How to Create A Business Pitchbook for Presenting Real Value

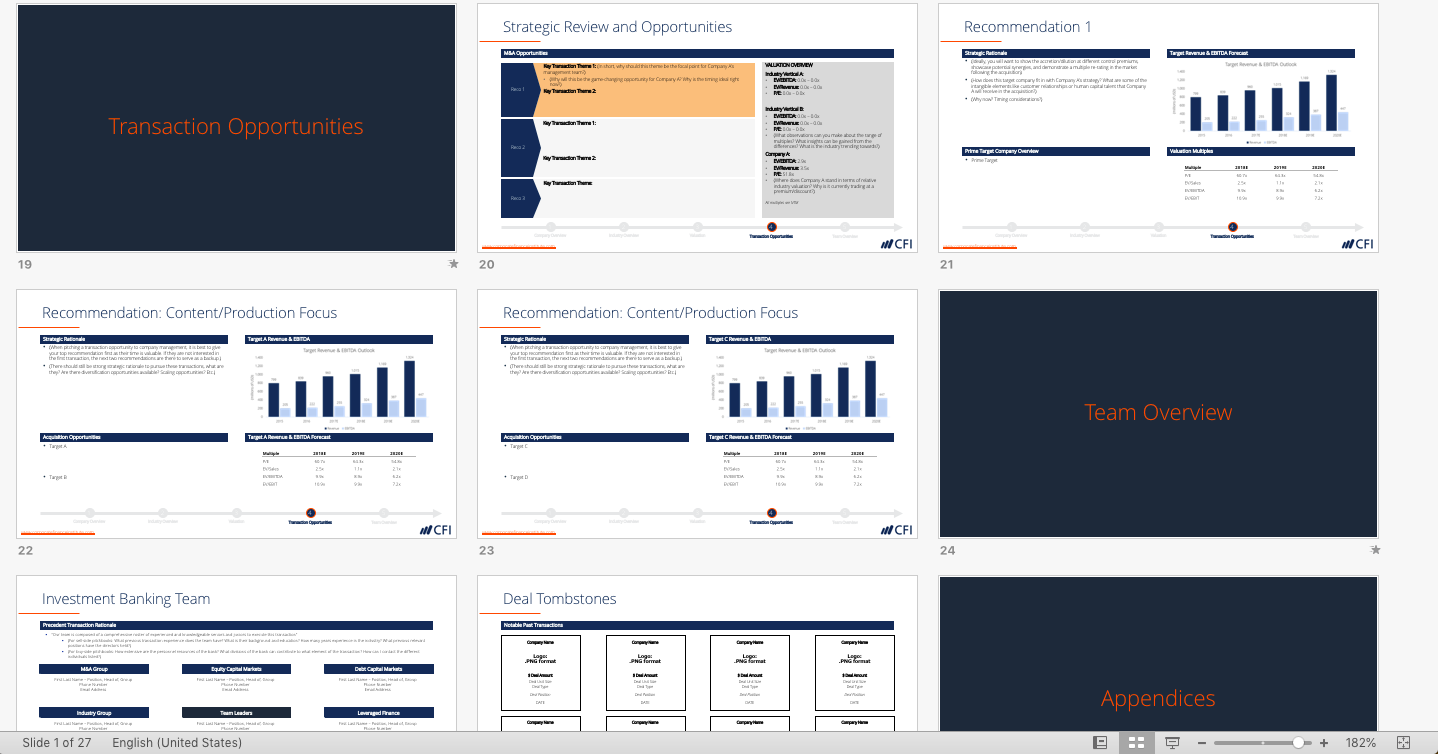

There are two primary kinds of pitchbooks. The main investment presentation's features are the key attributes of the business, and the second one is deal-specific. The second pitchbook is used when making a presentation about a particular deal. It is used for initial public offerings and the selling of investment products.

Pitch Book Template Download investment pitch book example ppt YouTube

1. Pitch Deck Example for Startup Tailored for entrepreneurs aiming to make a lasting impression, this startup pitch deck example exemplifies critical components essential for success. From compelling visuals to strategic content flow, it serves as a guiding example for those seeking inspiration in crafting impactful presentations.

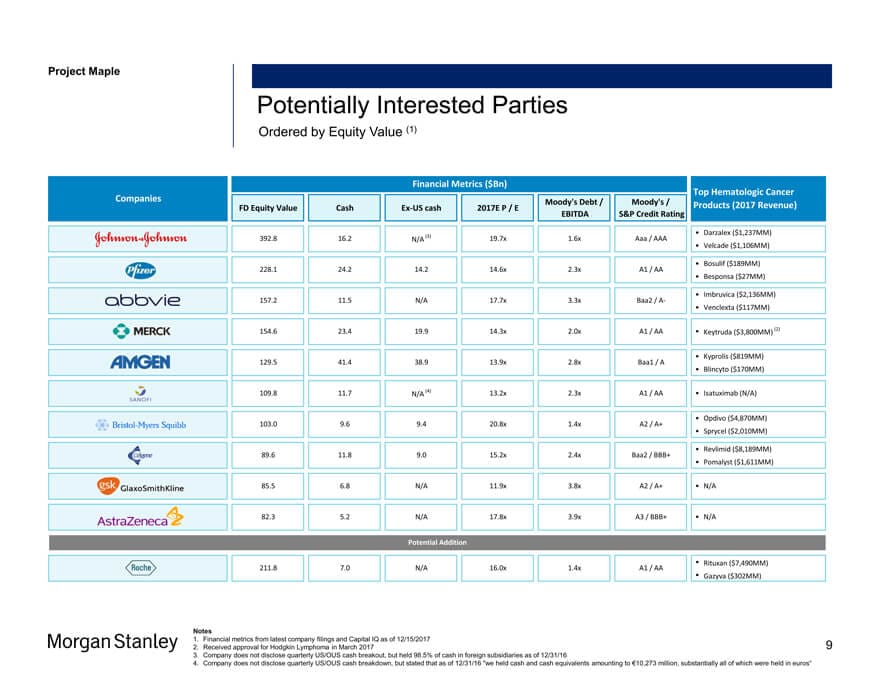

Investment Banking Pitch Books Structure, Samples & Templates

For example, the pitch book could be used in a "bake-off" among various competing firms for the same client to provide M&A advisory services to a client interested in acquiring a competitor, or a private company seeking to raise capital in the public markets via an initial public offering ( IPO ).

Investment Banking Pitch Books Structure, Samples & Templates

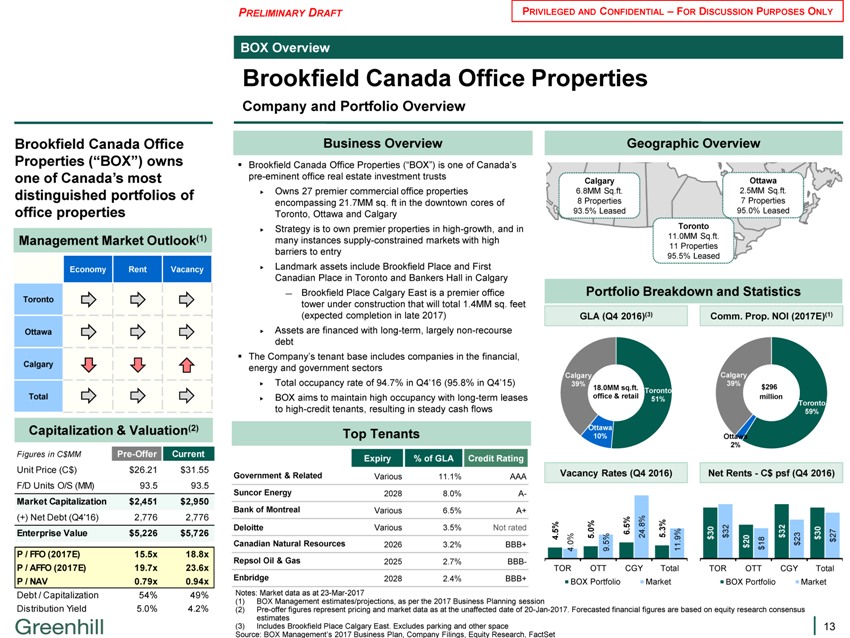

1. Market overviews / Bank introductions - (main pitch book): This type of investment banking pitch book would include all details that one needs to have about the investment firm. This would include its background details, its vision & mission statements, history, and details about management.

How do I create a great book proposal? MacGregor and Luedeke Literary

A pitch book (or pitch deck) is a document used by investment banks to help pitch potential transactions to current and potential clients. It is among the most important tools used by investment bankers to help sell their services.

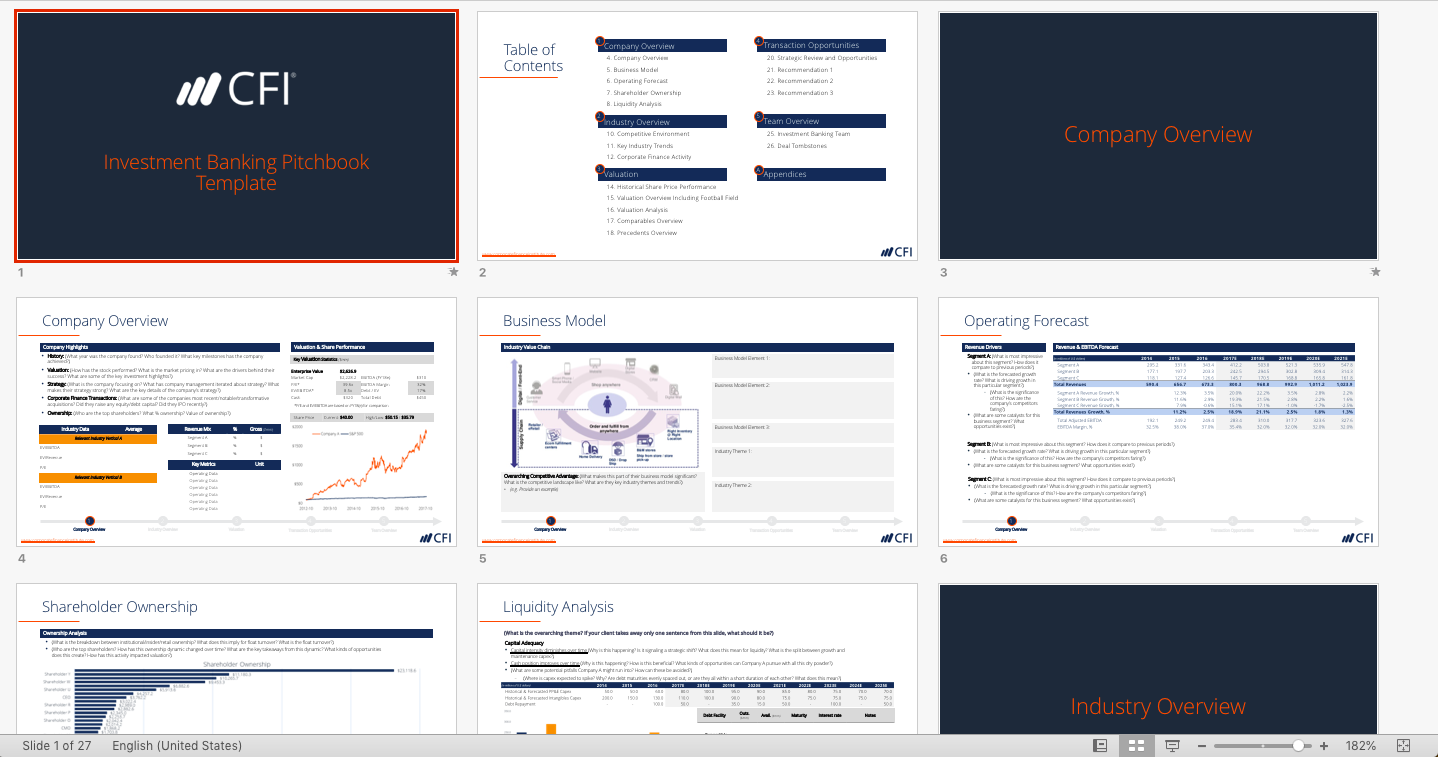

IB (Investment Banking) Pitchbook Template Eloquens

na Investment banking pitchbook: Types, examples, and tips Jan 16, 2023 A pitchbook is an essential sales tool in the investment banking process. It helps bankers pitch their services to current and potential clients. The guide below aims to explain how a pitchbook works and how to create it. What is a pitchbook?

Investment Banking Pitch Books Structure, Samples & Templates

1. Introduce the firm You can start by introducing the firm you work for to potential clients. They may know some information about the bank, but it's beneficial to remind them about the firm and its history. You might include information about the bank's founders and how they started the business.

Picture Book Query Pitch examples of published picture books

Key Takeaways Investment banking pitch books are structured PowerPoint presentations designed to attract new business. They articulate why the bank is the best choice for transaction processes and why clients should opt for its services.

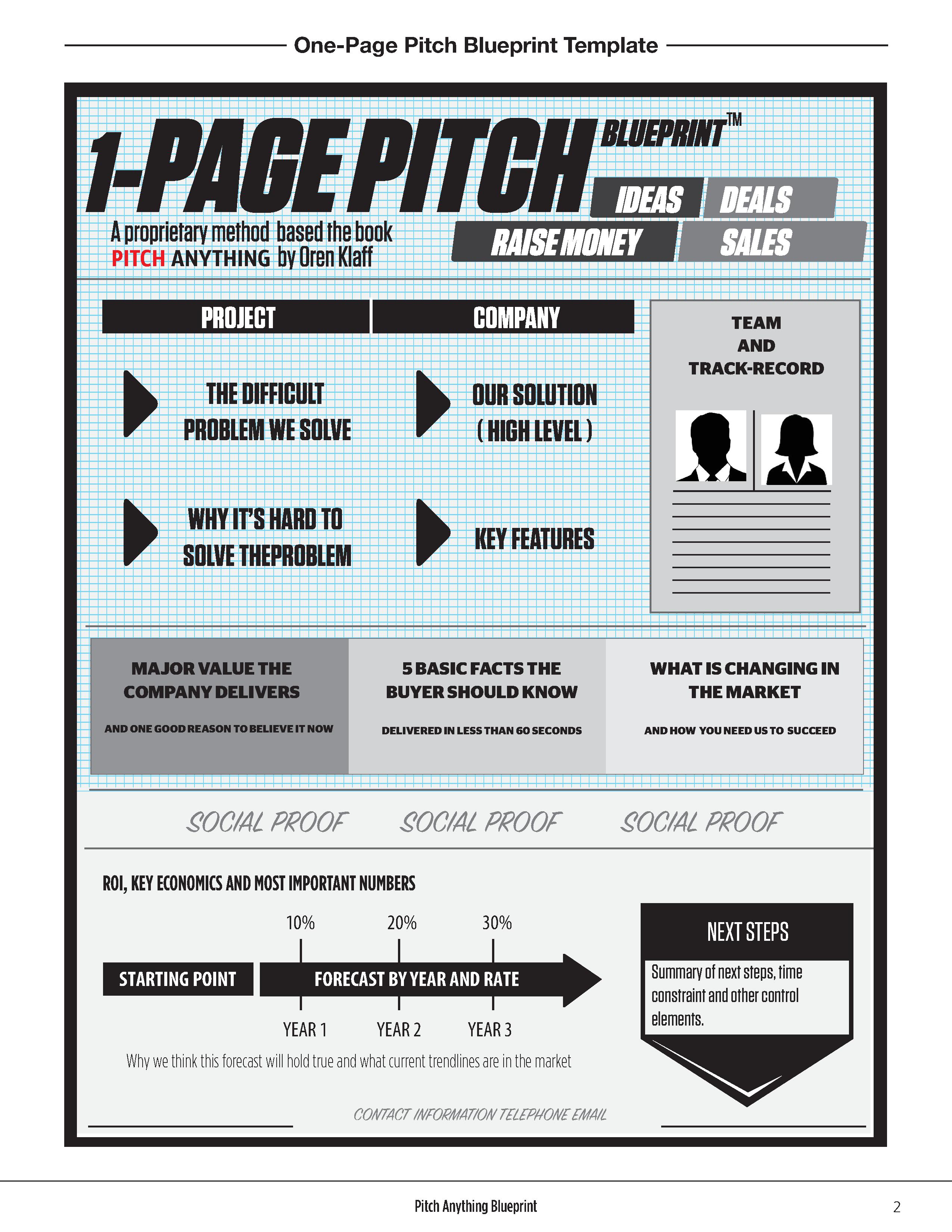

One Page Pitch Deck Template

Create a media list. Identify the best contact person for each magazine/journal. Identify the most powerful elements of your article. Prepare a script for your elevator pitch. Practice and refine your elevator pitch. Research each magazine on your list (read their content). Brainstorm article ideas for each magazine on your list.

Investment Banking Pitch Books Structure, Samples & Templates

Written by CFI Team What is a Pitchbook? A pitchbook is a sales book used by investment banks to sell products and services, as well as to pitch potential clients. The purpose of a pitchbook is to secure a deal with the potential clients.

Pitch Book Template Example for Investment Banking Pitch Book (NEW)

Key Learning Points Investment banks create pitch books to market their business to clients. The goal is to be chosen by the client to handle a transaction such as buying or selling a company or raising capital. A pitch book for an M&A transaction includes the target's vision, mission, company overview, and business model.

Pitch Book Sample Mergers And Acquisitions Stocks

The Industry Overview section of the Pitchbook template includes: Competitive Environment Key Industry Trends Corporate Finance Activity III. Valuation The Valuation section of the Investment Banking deck includes: Historical Share Price Performance Valuation Summary (including Football Field) Comparables Overview Precedents Overview IV.

Pitch Book Template Example for Investment Banking Pitch Book (NEW)

60 Examples of Hooks for Books This post collects 60 examples of hooks for books. Also called elevator pitches, these book hooks show real-life examples in a variety of writing genres for fiction and nonfiction books. Robert Lee Brewer Aug 17, 2022

IB (Investment Banking) Pitchbook Template Eloquens

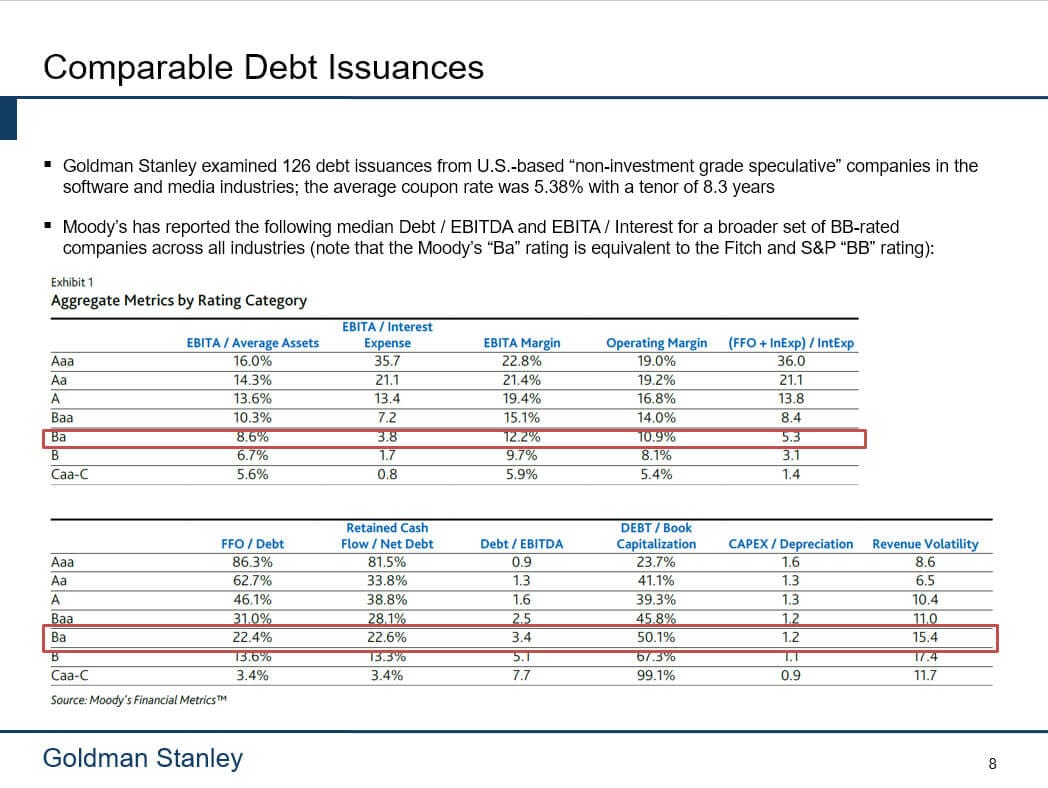

Icahn/Southeastern letter assumes 1H FY14 cash flows and debt pay down of ~$0.9bn and ~$2.4bn versus company expectation of ~$0.3bn and ~$2.2bn, respectively. Assumes $6.4bn of minimum cash.

Investment Banking Pitch Books Structure, Samples & Templates

PitchBook Simple Example. Uses of Pitch Books. #1 - They are Marketing devices. #2 - Should have Investment Actions well specified. #-3 Contributors. Step by Step Guide to Creating an Investment Banking PitchBook. #1 - Capabilities and Qualifications of the Investment Bank. #2 - Market Updates. #3- Transaction Section.

Investment Banking Pitch Books Structure, Samples & Templates

Pitchbook: A pitchbook is a sales book created by an investment bank or firm that details the main attributes of the firm, and it is used by the firm's sales force to help sell products and.