Financial Planning Fact Finder Template The Human Tower

Data gathering for a comprehensive financial plan. The problem The fact finder conundrum. Every client is unique. Some are more tech savvy than others. Some don't even know where their financial documents are.. Create a specific template for a specific client, or split your data gathering process into several small steps over time. The.

Estate Planning Worksheet Pdf

Comprehensive Fact Finder for 1 Prepared by: Financial Brokerage, Inc. Gary Peterson, CLU, ChFC 2837 s 156 cir Omaha, NE 68130 Office: (402) 697-9998 Office: (800) 397-9999 [email protected]. Insurer or Service Type Plan Insured Benefits (Rm & Bd., Overall Max) Premium Amount and Mode Date of Issue Type Policy (Hosp., Major Med) Premium Payor

Financial Plan Template Word Unique 12 Financial Planning Fact Finder Template Iyuye Financial

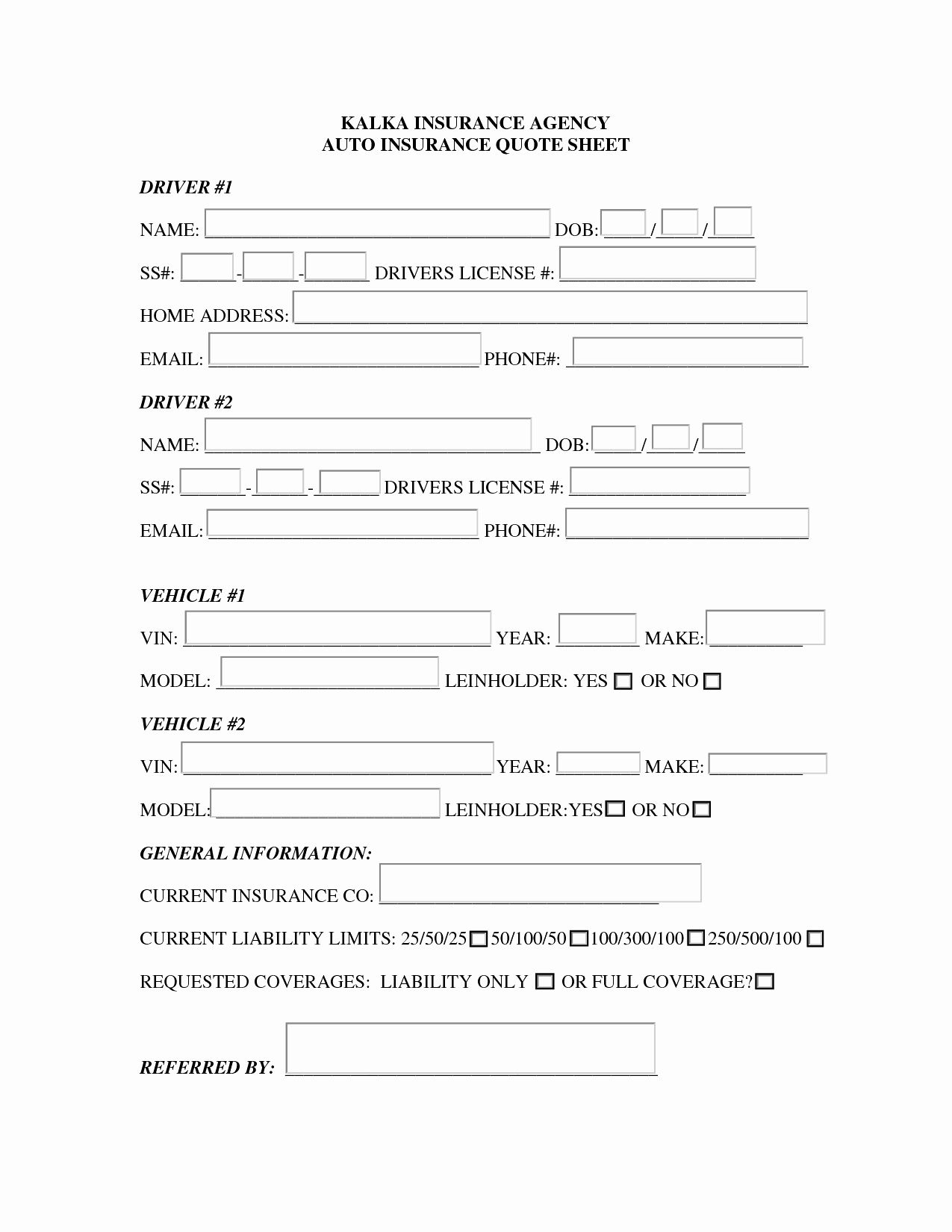

Prices and ordering information are at the bottom. AKA: Fact Finders, Client Discovery Tools, Data Collection Sheets, Risk Tolerance Questionnaires, Client Profile Tools, and Financial Discovery Tools. These financial plan tools are for financial advisors that want to do a much better job than fumbling around with a yellow pad during client.

6 Financial Planning Fact Finder Template FabTemplatez

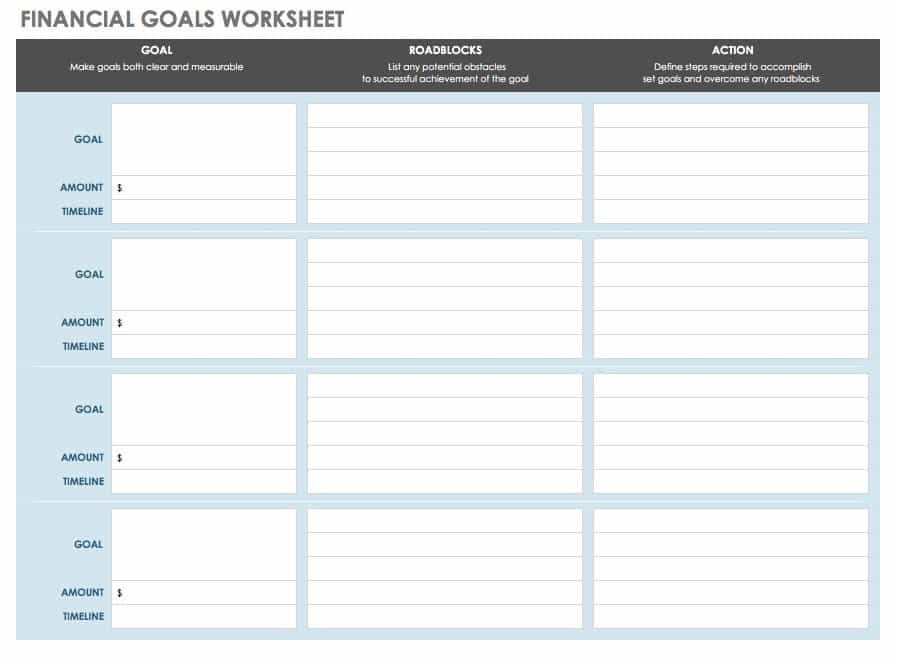

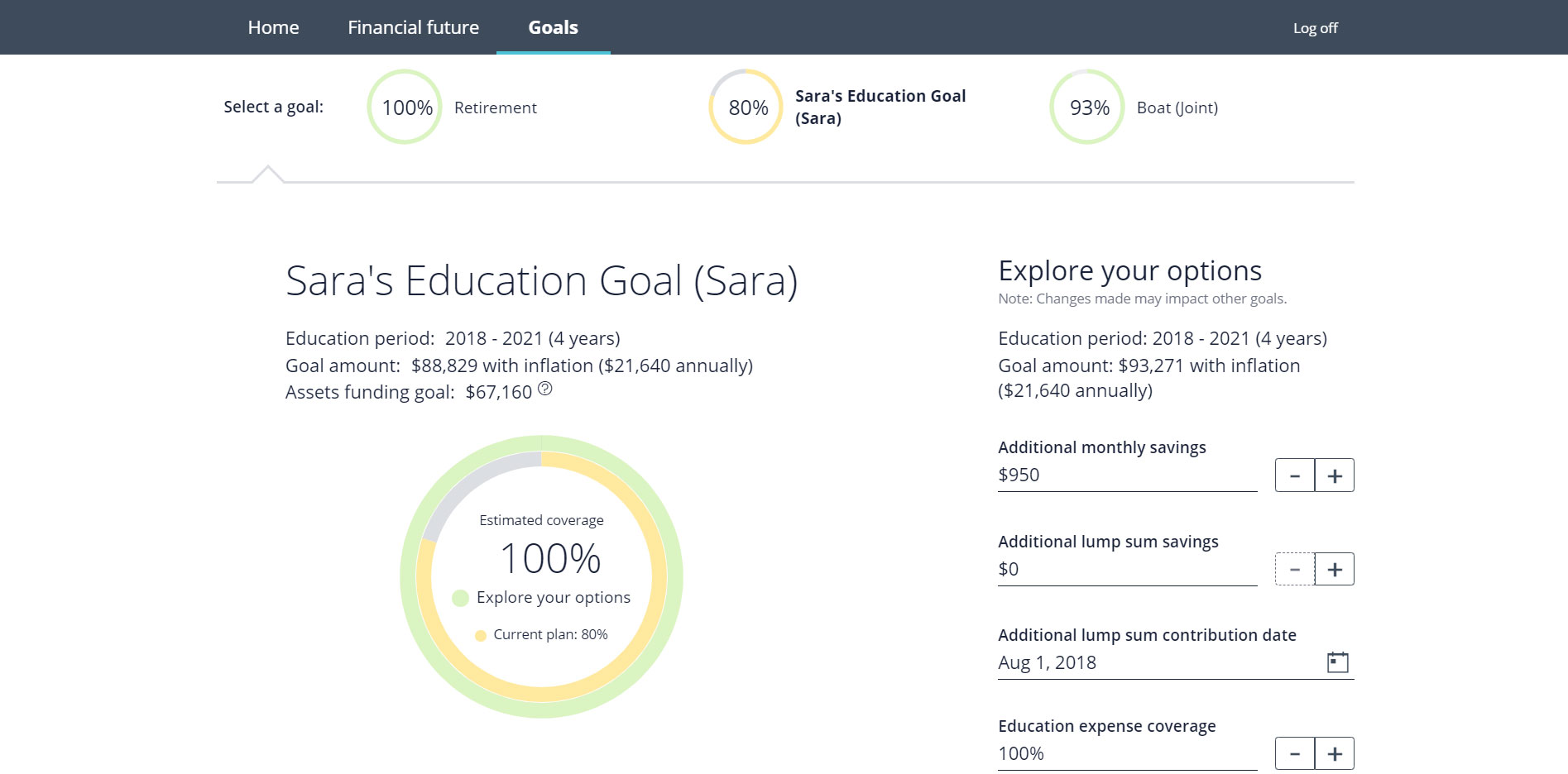

Fact Finder annual planning tools help financial professionals to guide client discussions pertaining to their current financial picture and assist in planning and achieving goals. [email protected]; 888-998-6521; Toggle. setting the expectations from the beginning. These tools are great resources for financial advisors to conduct discovery.

Printable Client Information Sheet

Cloned 1,267. A Financial Planning Client Fact Find is a questionnaire used by financial planners or accountants to collect information about their client's current financial situation. Whether you're a financial planner or accountant, use our free Financial Planning Client Fact Find template to collect contact information and other details.

Free Financial Planning Templates (2022)

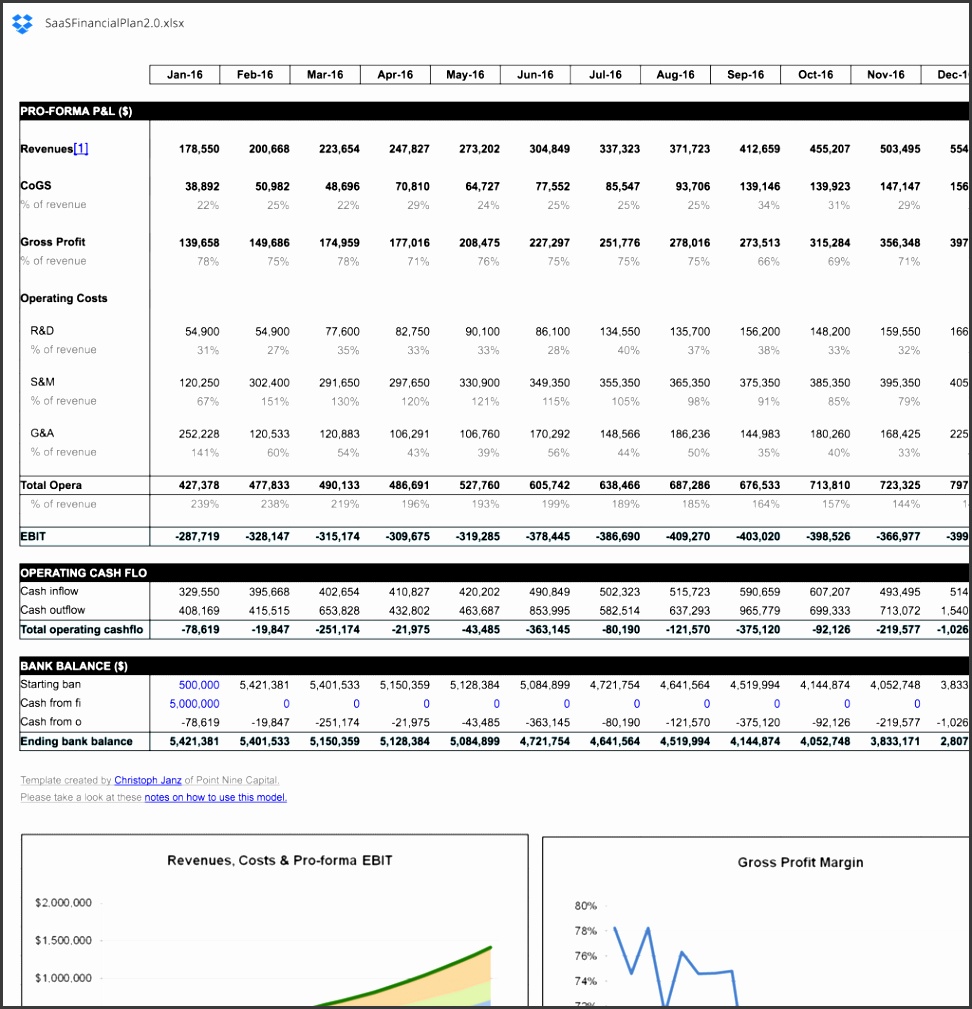

Implementing the financial plan is a crucial step towards achieving the client's financial goals. This task involves taking action on the strategies and recommendations outlined in the plan. It may include opening investment accounts, reallocating assets, initiating tax-saving strategies, or setting up retirement plans.

8 Business Plan Financial Template SampleTemplatess SampleTemplatess

Every month, the CFP Board Report brings together CFP Board news, activities, policies and upcoming events to help CFP® professionals stay up to date.. Subscribe to CFP Board's Newsletter. The Let's Make a Plan newsletter provides consumer alerts, financial planning tools and resources, many of which offer topical information for discussing with your clients.

Financial Planning Fact Finder Template 20202022 Fill and Sign Printable Template Online US

Add the Financial planning fact finder template for editing. Click the New Document option above, then drag and drop the document to the upload area, import it from the cloud, or via a link. Adjust your template. Make any changes required: add text and images to your Financial planning fact finder template, highlight details that matter, remove.

Digital financial planning fact finder NaviPlan by InvestCloud

Quick steps to complete and e-sign Financial planning fact finder pdf online: Use Get Form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully type in required information. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

Fact Finder

This one-page template allows you to create a personal financial plan that is concise yet comprehensive. Determine your current financial situation, create an action plan for reaching goals, and use the plan to track implementation and progress. If needed, you can include numbers for life insurance or estate planning.

Financial Fact Finder Help Center / Financial Planning Fact Finder Template Fill Online

Fact-Finder Client Questionnaire Part 1: Establishing the Relationship This is the introductory section of the fact-finder, and is meant to help you determine exactly. Which financial planning services do you want me to provide? Are there aspects of your finances that you would prefer to deal with yourself? For example, a client could ask an.

Sample Screenshots, Financial and Retirement Plans

7. Forget the idea there is a 'right way' of doing a financial planning fact find. If we get the idea in our mind that there is a 'right way' to do a financial planning fact find then our mind will be occupied with evaluating how we think we are doing. So, forget this idea and allow the process to be natural, flowing, and intuitive. 8.

Fact Finder

FINANCIAL PLANNING QUESTIONNAIRE. The following documents will be needed for study and analysis as we work together to create a financial strategy for you. It is understood that this material will be treated confidentially and returned when the plan is completed, or earlier if requested. The following documents will be needed for study and.

50 Professional Financial Plan Templates [Personal & Business] ᐅ

Use our Financial Fact Finder as-is, or customize it to your firm's needs. Your clients will gladly do all the data input work, since they want to provide you with as much quality data as possible. After all, it's their financial future that your helping them plan for! . Also, did you know that PreciseFP templates can be pre-filled with data.

3 Financial Planning Questionnaire Template FabTemplatez

Financial Planning is the exercise of: a. gathering all the details of your financial position; b. understanding your financial goals; c. analysing all the issues and options which will form the basis of any recommendations; d. providing advice and recommendations, whilst also making all the required disclosures; e.

6 Financial Planning Fact Finder Template FabTemplatez

This fact finder is a 27 page questionnaire that is a comprehensive overview of your financial position and your priorities. In order for us to get the best possible picture of your financial situation, our advisors recommend reviewing and filling out this document prior to your first meeting.