Top Chart Patterns Every Crypto Trader Should Know

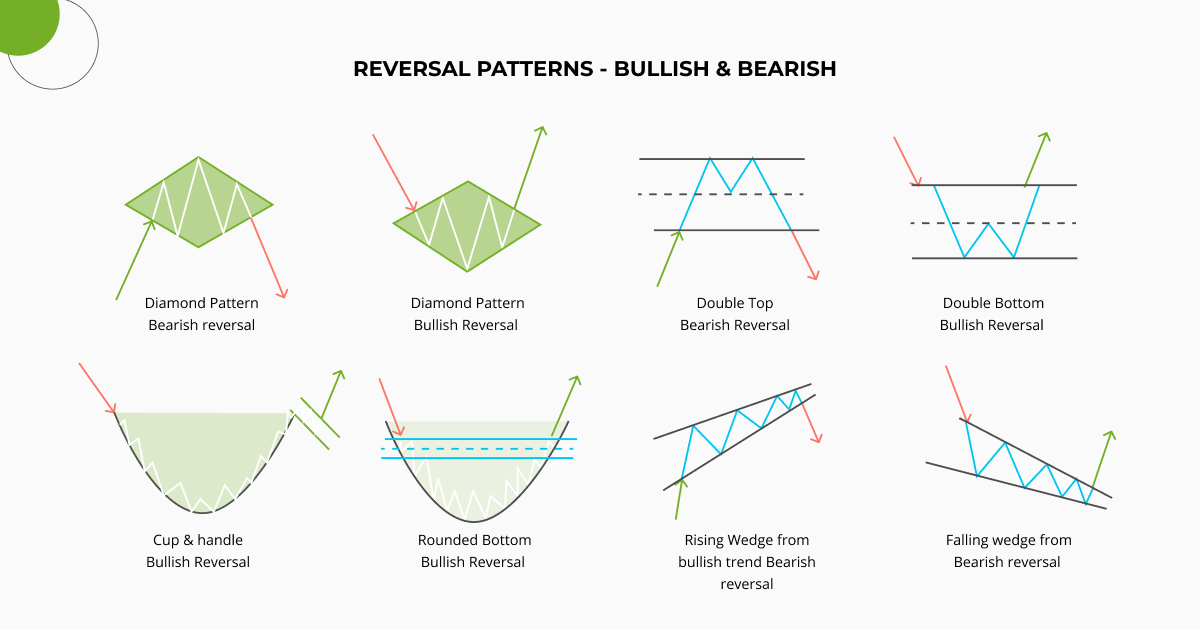

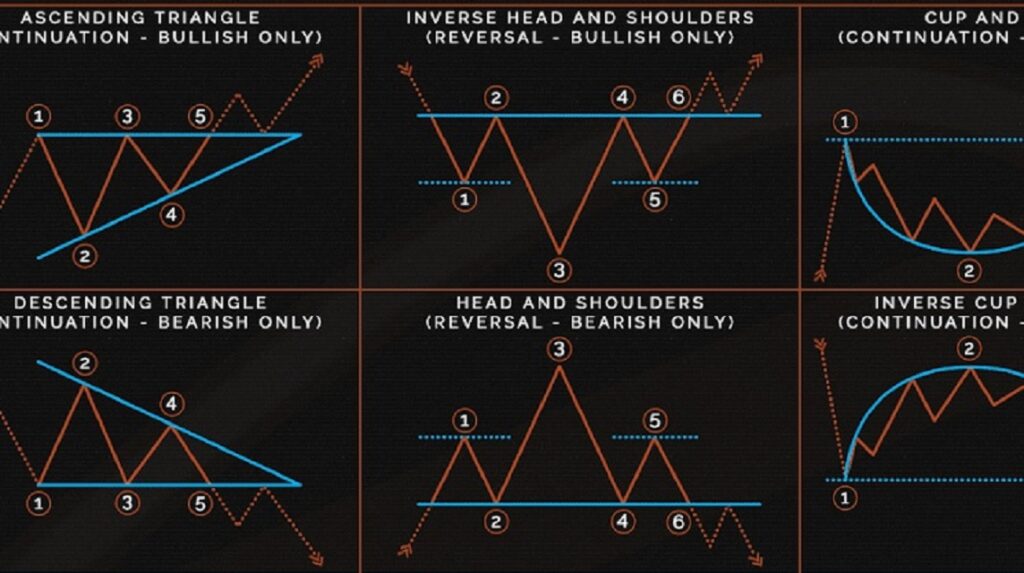

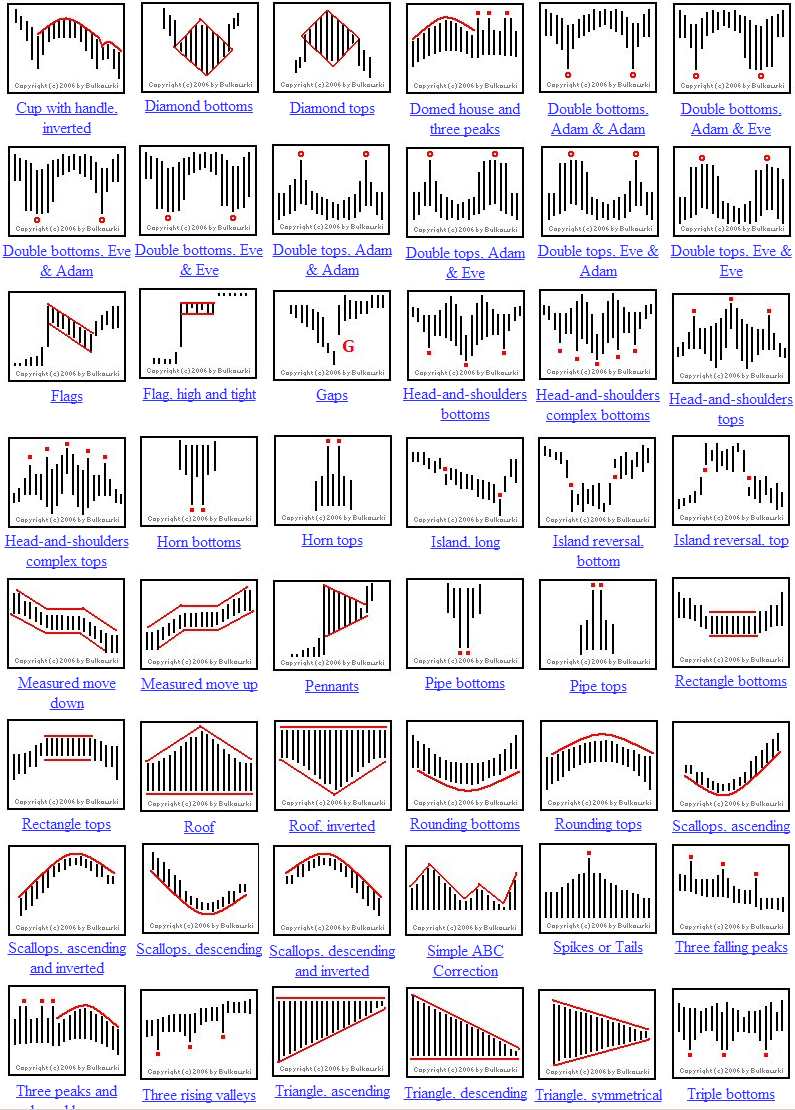

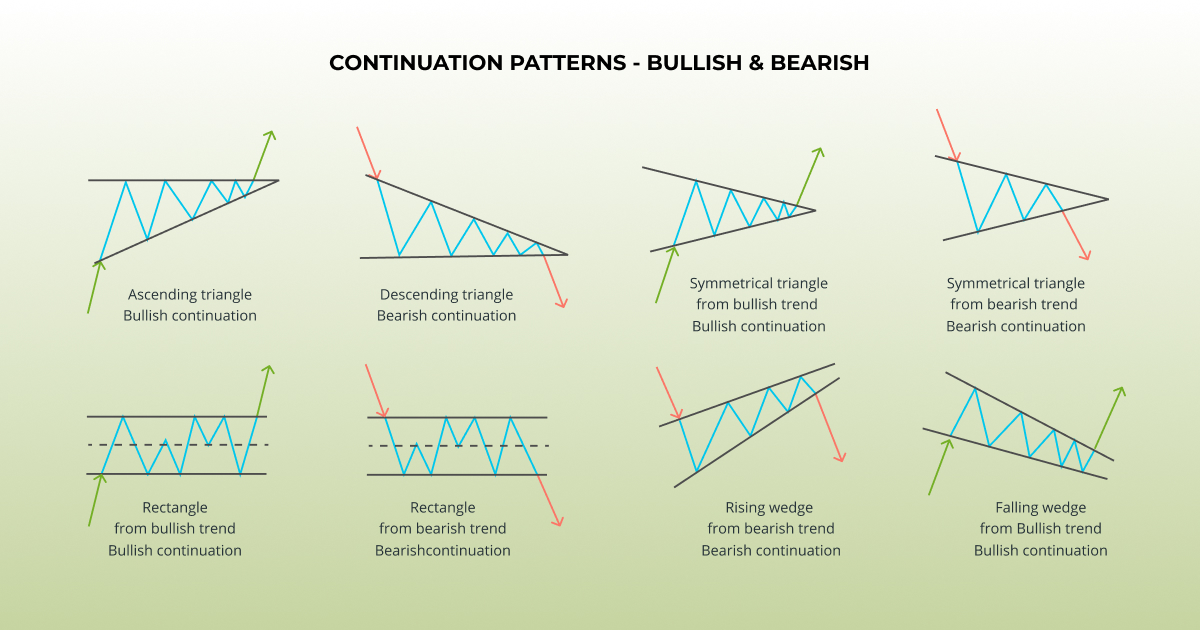

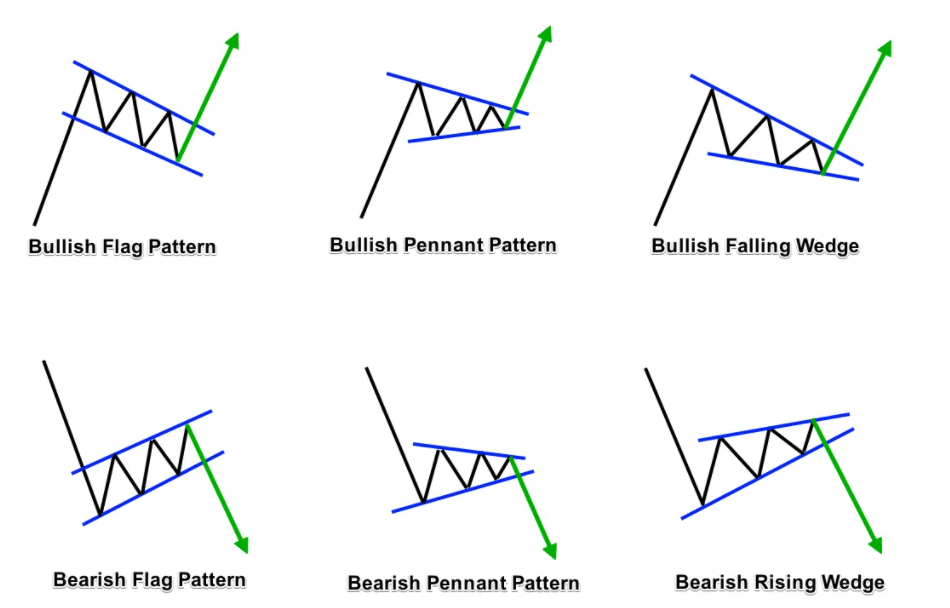

Three main categories of chart patterns are: Continuation chart patterns. Reversal chart patterns. Bilateral chart patterns. Chart patterns can be either bullish or bearish. When identifying chart patterns, we observe their shape and accompanying trading volume. To safely trade a chart pattern, it has to be completed and confirmed.

Chart Patterns for Crypto Trading. Crypto Chart Patterns Explained

Chart patterns play a significant role in crypto trading, just as they do in traditional markets. They offer traders insights into potential price movements based on historical price data.

Get to Know Crypto Patterns for Trading Patterns, Write This Down!

Trading chart patterns are visual representations of price movements that indicate the underlying market sentiment. These patterns can signal either the continuation of an existing trend or a potential reversal. Recognizing and understanding these patterns enables traders to anticipate future price movements, giving them an edge in the market.

Top Chart Patterns For Crypto Trading

A chart pattern is a shape within a price chart that suggests the next price move, based on the past moves. Chart patterns are the basis of technical analysis and help traders determine the probable future price direction. Reading chart patterns have been around for as long as trading has existed and predates the cryptocurrency market.

Articles The Crypto Corp The Crypto Corp.

Yes, cryptocurrency charts are filled with various crypto patterns. They can signal positive and negative upcoming market behavior depending on the pattern. What is a 3 top crypto pattern? The 3-top crypto pattern, also called Triple Top Pattern, is a bearish reversal pattern. It is similar to a double top, only it has 3 tops instead of 2.

The Basics Cryptocurrency Charting CryptoVoid

Chart patterns identify transitions between rising and falling trends. These patterns are a formation of price movements identified using a series of trend lines and/ or curves, connecting a series of peaks (highs) or troughs (lows).

Top Chart Patterns Every Crypto Trader Should Know

Crypto Charting 101: How to ID Basic Patterns and Trends Learn to spot flags, pennants, wedges and sideways trends and understand how those patterns can inform trading decisions. By Robert.

Chart Styles in Crypto Trading Crypto Radio

A crypto trader's guide to common chart patterns. What are chart patterns? The price chart of a crypto asset often exhibits repeating trends and patterns over time. Many traders use this information to help predict what the price might do next.

Bitcoin Chart Analysis How to Trade Bitcoin Using Charts Master The Crypto

In technical analysis, chart patterns are a set of recurring shapes that can be drawn on an asset's chart by connecting price highs and lows. These formations, or "setups," usually appear.

How to Read Crypto Charts? [Ultimate Beginners Guide]

Crypto chart patterns are the basis of technical analysis and can help traders to predict price trends. Crypto chart patterns can be classified into the following groups: Continuation patterns provide continuation signals of the current trend. Bilateral patterns indicate high volatility and uncertainty in the market.

Chart Patterns for Crypto Trading. Trading Patterns Explained

09.11.2023 Last week we made a guide to the most used basic chart patterns to start using technical analysis. As a follow-up, this week we will complement that guide with a chart pattern cheat sheet and lay these figures out in concise illustrations. Make sure to save it! How To Use This Trading Patterns Cheat Sheet

Crypto Trading Patterns Cheat Sheet The Cryptonomist

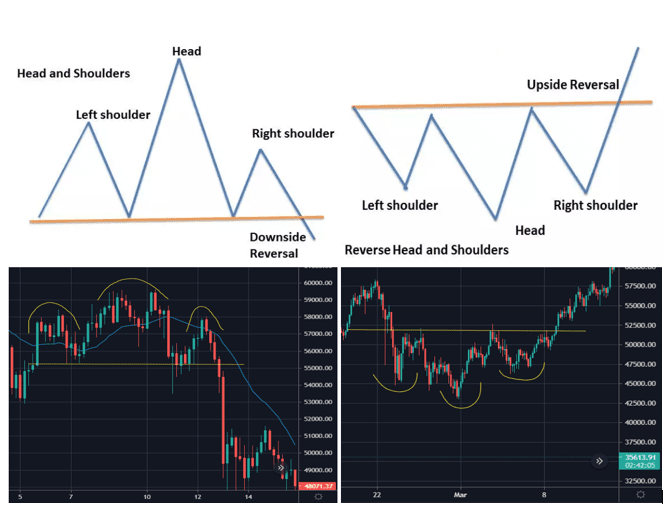

Top Chart Patterns for Analyzing Crypto Price Trends. 1. Head and Shoulders Pattern. The head and shoulders pattern is a classic reversal pattern that signals a potential change in trend direction.

Crypto Chart Pattern Explanation (Downloadable PDF)

Crypto Chart Patterns Chart Patterns Chart Patterns Updated December 2023: altFINS' automated chart pattern recognition engine identifies 26 trading patterns across multiple time intervals (15 min, 1h, 4h, 1d), saving traders a ton of time, including: Ascending / Descending Triangle Head and Shoulders, Inverse Head and Shoulders Channel Up / Down

Crypto Chart Pattern Explanation (Downloadable PDF)

Popular Crypto Chart Patterns Explained 1. Head And Shoulders The head and shoulders chart pattern is one of the easiest crypto trading signals to identify and is one of the most popular forms of technical analysis. It can be effective in all types of market conditions.

How to read cryptocurrency charts? DailyCoin

A chart pattern is a shape within a price chart that suggests the next price move, based on past moves. Chart patterns are the basis of technical analysis and help traders to determine the probable future price direction. Reading chart patterns have been around for as long as trading has existed and predates the cryptocurrency market.

5 Crypto Chart Patterns For Crypto Trading ZenLedger

July 6, 2022 Investing, Trading News All Articles Crypto graph patterns assess a market's psychology through its price action. Let's take a look at 7 popular crypto chart patterns, and how you can use them.