Fatma VAT Medium

Such information includes the VAT identification number, the trader's name, the trader's address. A computerised VAT Information Exchange System (V.I.E.S.) was set up to allow for the flow of the data held across the internal frontiers which: enables companies to obtain rapidly confirmation of the VAT numbers of their trading partners.

Vat Id คือ

Nello specifico, col VAT Number parliamo di strumento elettronico utile a verificare il numero della partita IVA, di tutte le imprese registrate all'interno della comunità europea. Lo scopo del codice e' di controllare che il numero di Partita IVA di imprese e professionisti di tutta la UE sia effettivamente valido.

VAT ID 2020 All about the VAT identification number [Instruction]

A value-added tax identification number or VAT identification number is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES website. VIES stands for VAT Information Exchange System, and is a VAT number lookup service provided by the European.

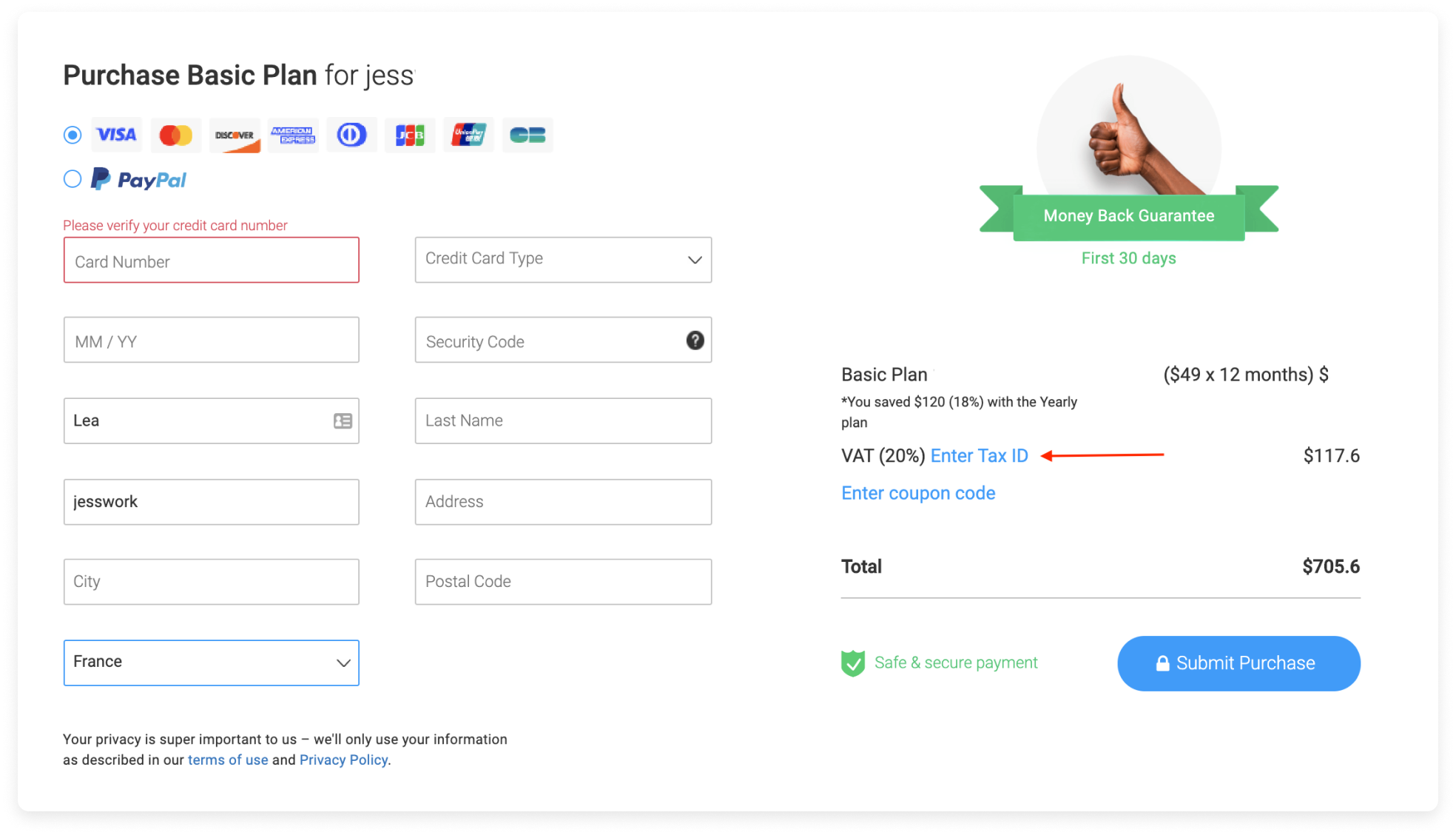

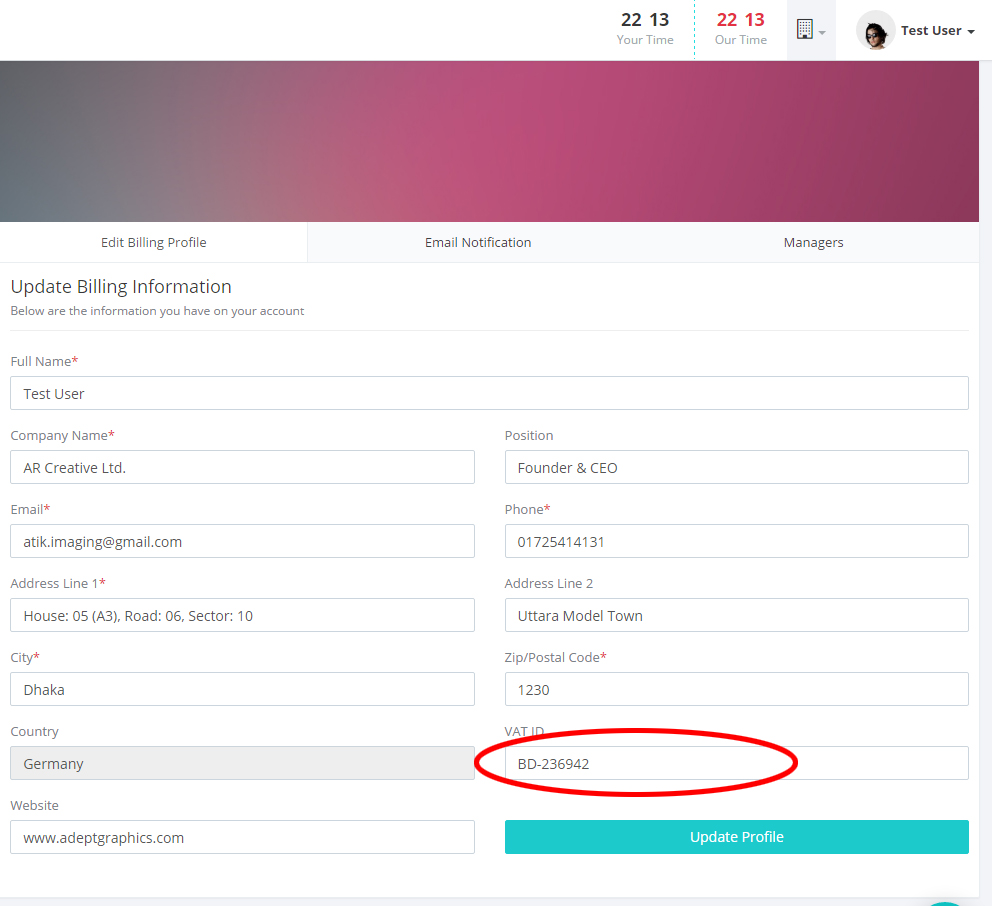

How to update my VAT ID number? Support

Che cos'è il VAT identification number? Il VAT identification number, fa parte del sistema VIES per lo scambio di informazioni relative all'IVA e serve per il controllo e verifica validità del numero di Partita IVA di imprese e professionisti di tutta l'Unione europea.

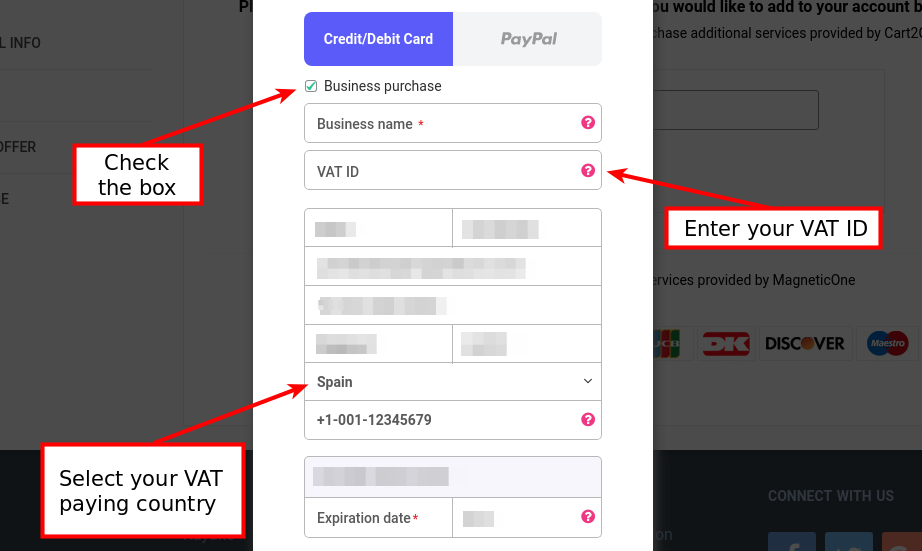

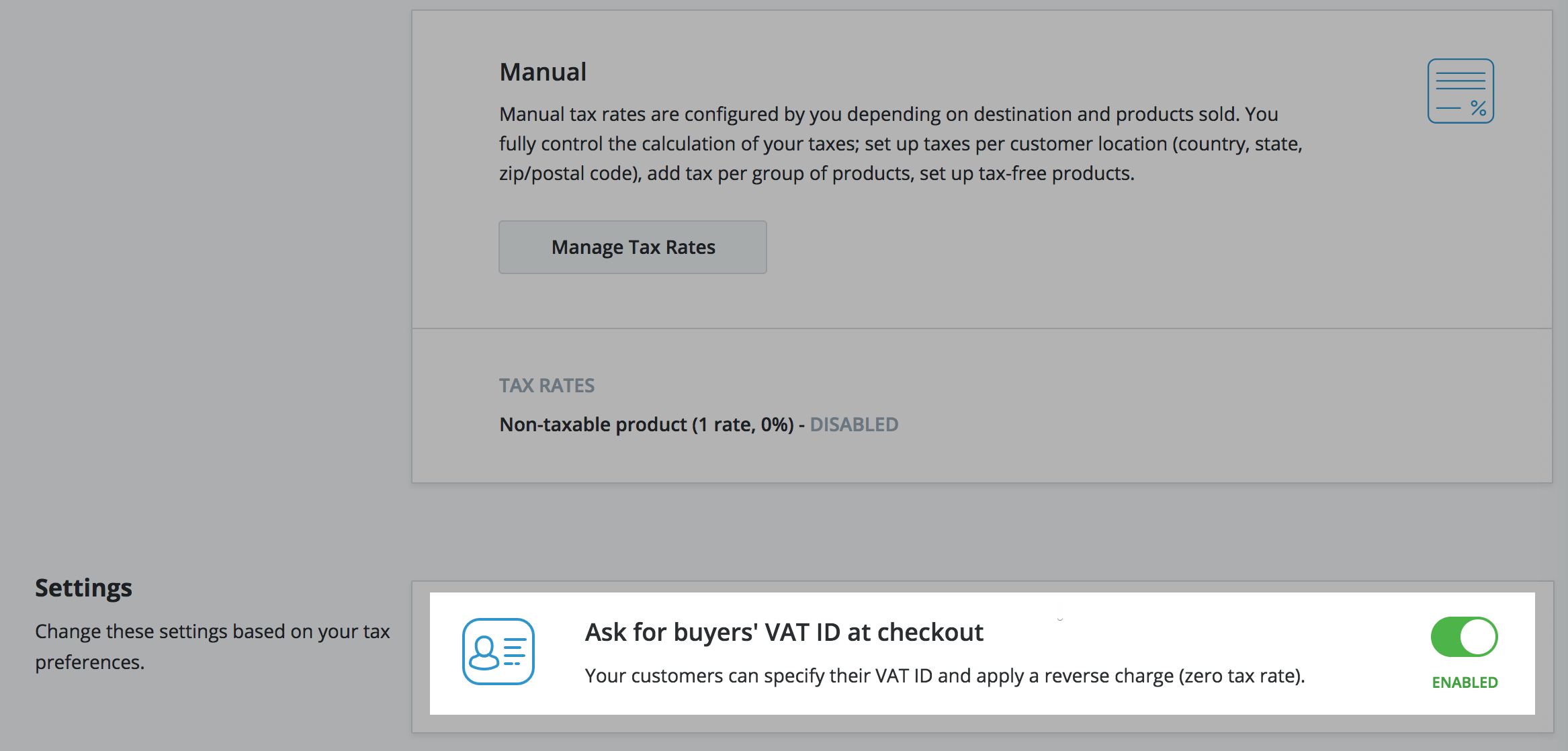

How to avoid paying VAT? Cart2Cart FAQ

Geniosoft A chi effettua transazioni e acquisti intracomunitari potrebbe essere richiesto il VAT number. Scopri cos'è e come verificarlo con questa guida.

What Is A VAT ID? Lee Daily

A value-added tax identification number or VAT identification number ( VATIN [1]) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES [2] website.

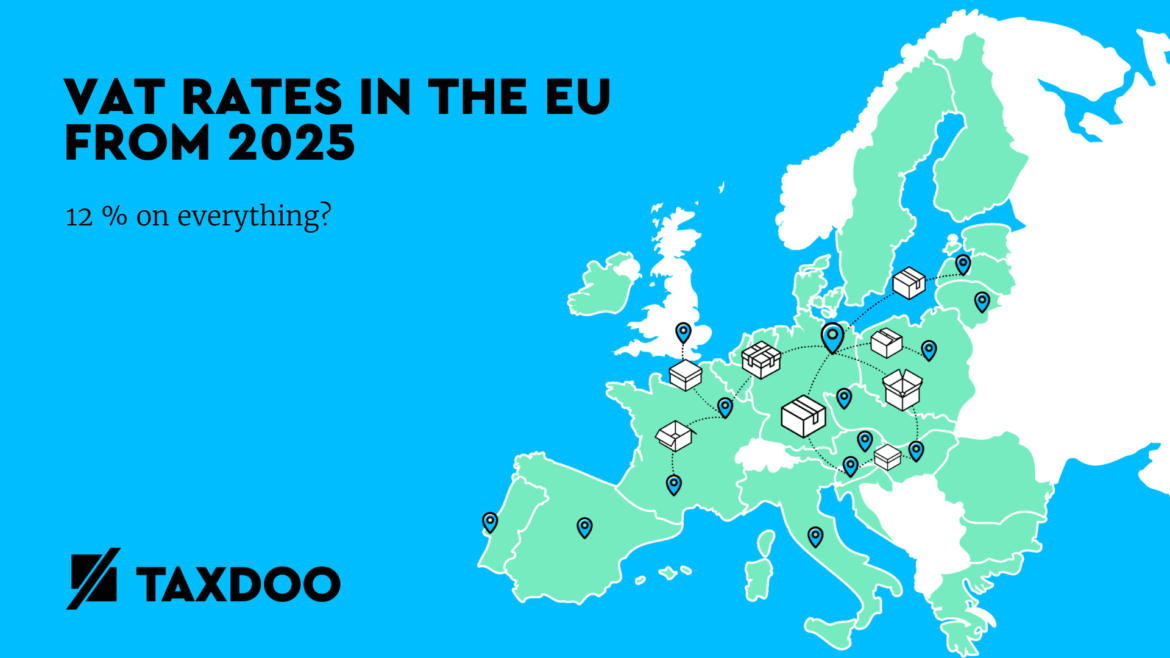

VAT ID and country of origin for Intrastat declarations as of 2022 Taxdoo

A VAT number or Tax Identification Number (TIN) is a unique identifier for companies, individuals and entities within the European Union's Value Added Taxation scheme. This utility provides access to VIES VAT number validation service provided by the European commission. It also supports VAT checking for countries which are not part of the EU.

Što je VAT ID, kada ga koristiti i čemu služi?

Look at the company's invoices, insurance forms, or tax documents for the VAT number. It will contain 2 letters and multiple digits. Try searching for the company on a VAT search engine to find their identification number. Contact the company directly and ask for their VAT number.

VAT ID LookUp Check VAT IDs intuitively and professionally even as

General information about TINs by country (when the Member State's tax administration has chosen to publish this information): descriptions of the structure and specificities of the national TIN, examples of official documents showing the TINs, national websites and contact points. 24 NOVEMBER 2023 Tin by Country EN English (10.64 MB - ZIP)

EU taxes (VAT) in Ecwid Ecwid Help Center

You can find your own VAT identification number in the Tax Administration's online portal for entrepreneurs. Checking validity of clients' VAT ID numbers

Do you need help with your VAT? Scott Vevers can take the stress out of

VAT ID is an alphanumeric identifier of companies in the European Union, which are registered VAT payers. You can read more about VAT ID format later in this article. VIES hosts an up to date database of European Union businesses registered as VAT payers.

VAT EFiling System Introduction for Tanzanian Businesses SmartErp

Help to identify the place of taxation Mentioned on invoices (except simplified invoices in certain EU countries) Sometimes also known as a VAT registration number, this is the unique number that identifies a taxable person (business) or non-taxable legal entity that is registered for VAT.

VAT Returns First Base Knowledge

Antonia Klatt Last Updated on 6 September 2023 What is a VAT ID? The VAT Identification number identifies all companies in the European Union and is indispensable for intra-European trade. It can be obtained by registering vor VAT. When trading within the EU (intra-community supply/service) a VAT ID for making sure that taxes are paid is mandatory.

VAT ERP Software Partner Wanted Bahrain and XXX VAT Compliant

What is the EU VAT number? Who should have an intra-Community VAT number? How do I apply for my VAT number? How do I check a company's VAT number? What happens if the VAT number is.

Handling VAT Identification No. and Group VAT ID AppVision Kft.

VIES (VAT Information Exchange System) is a search engine (not a database) owned by the European Commission. The data is retrieved from national VAT databases when a search is made from the VIES tool.

Can I Add My VAT ID on The Invoices?

The Commission´s web site is a real-time system which checks the validity of VAT identification numbers against the databases maintained by Member States / Northern Ireland. In other words, when you check a number, it is the database of that Member State / Northern Ireland that is being checked.If the VAT number of your customer comes up as.