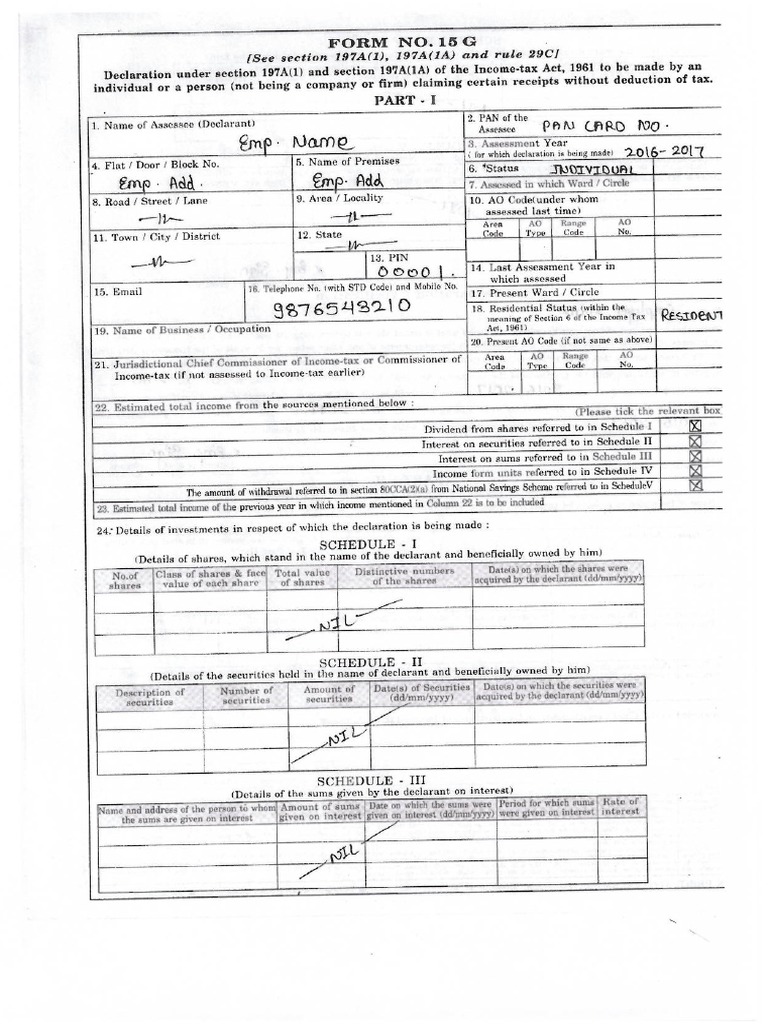

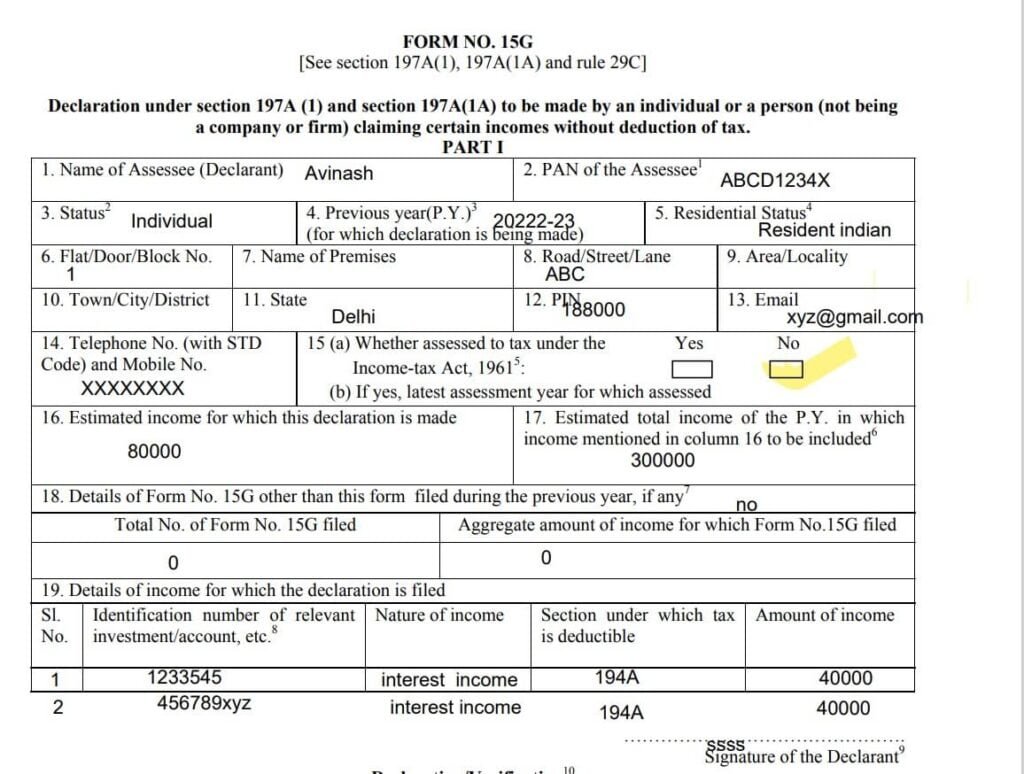

15G Sample Form

No. Explanation. Form 15G can be submitted as the taxable amount and income from all sources are less than Rs. 2,50,000. Form 15G can not be submitted as the income from interest income is more than Rs. 2,50,000. Form 15H can be submitted if age is more than 60 years and tax calculated on total income is nil. Form 15H can be submitted if age is.

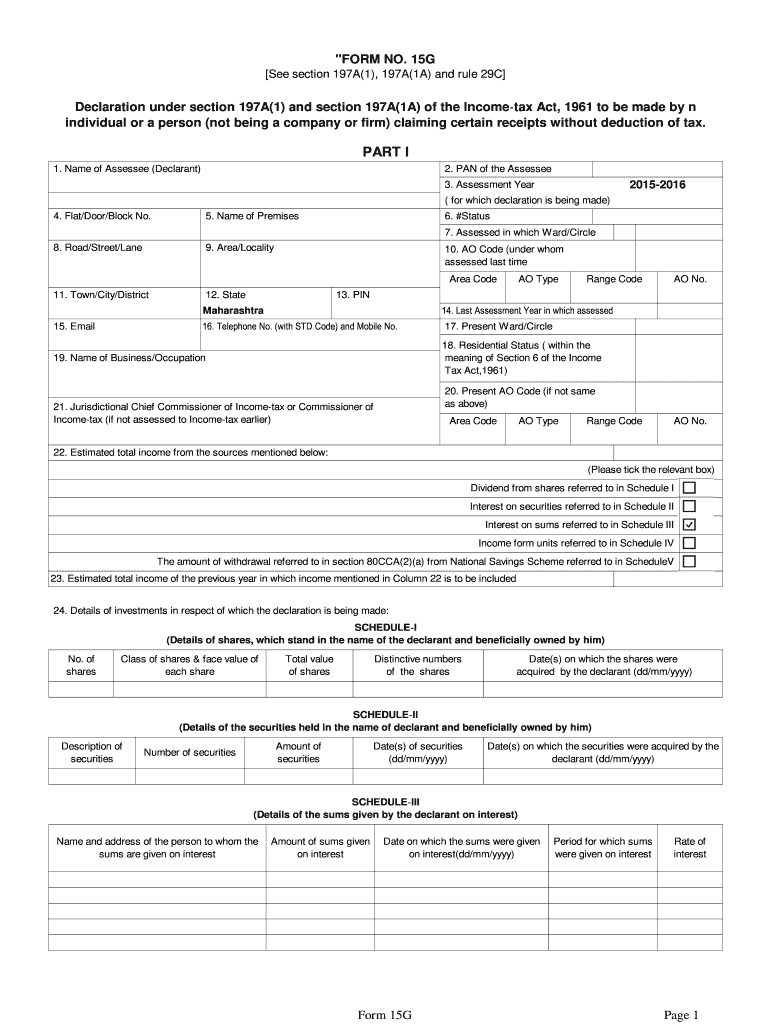

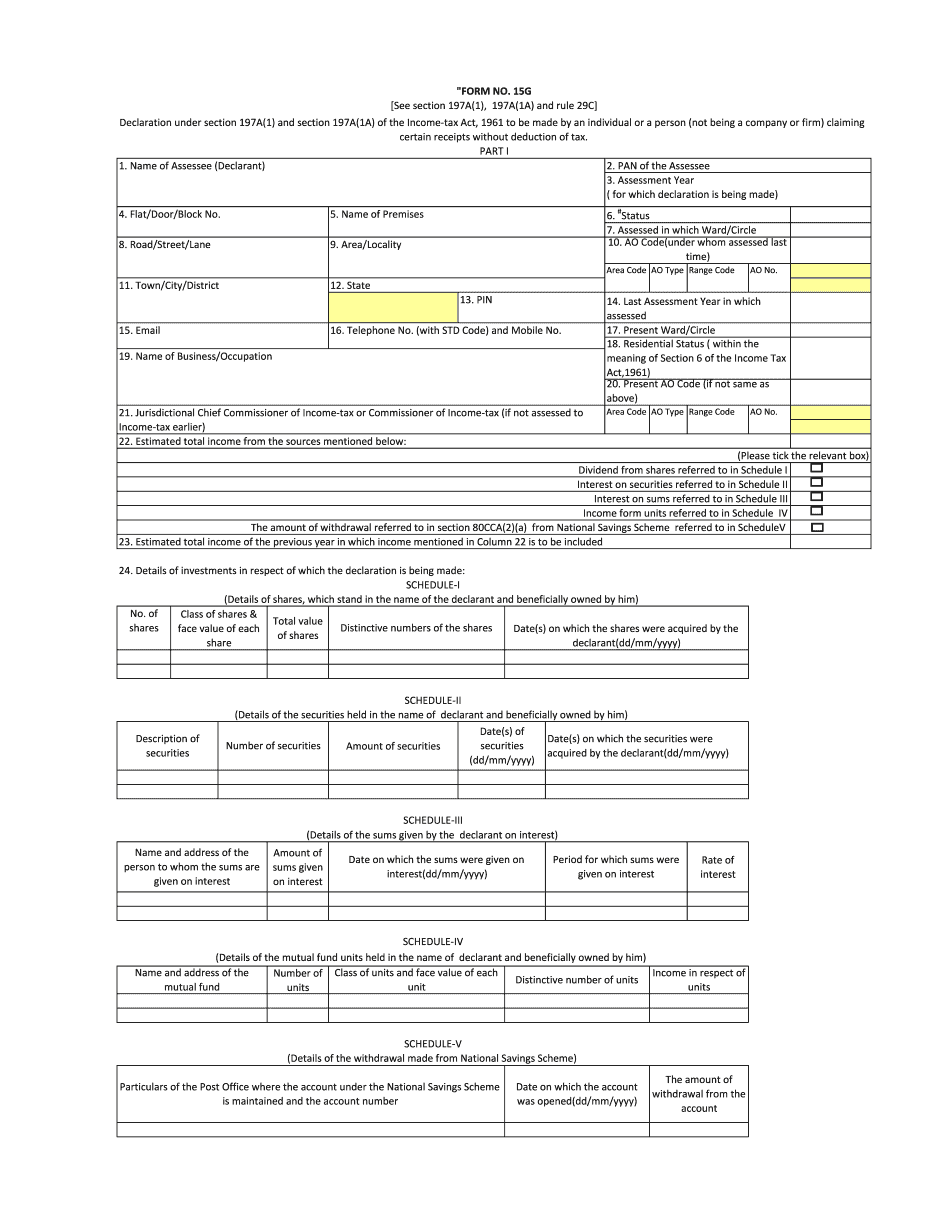

FORMNO15G.doc Tax In The United States Tax In India

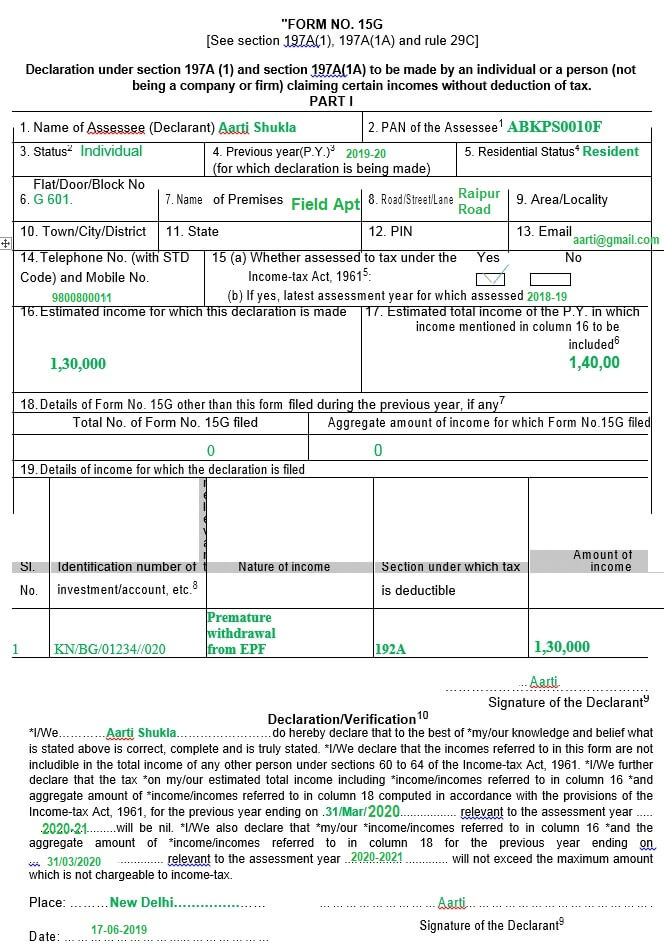

What is EPF Form 15G? In the financial year of 2016-17, the officials of EPFO had issued a notice stating that Tax Deducted at Source (TDS) is applicable on EPF withdrawal above Rs.50,000. Thus any employee who wishes to withdraw PF money above 50,000 will have to pay the TDS charges.

Submit Form 15G for EPF Withdrawal online, TDS, Sample Filled Form 15G

Web-based PDF Form Filler. Edit, Sign and Save UK Complaint Form. pdfFiller allows users to Edit, Sign, Fill & Share all type of documents online. Try Out!

Form 15g filled sample Fill out & sign online DocHub

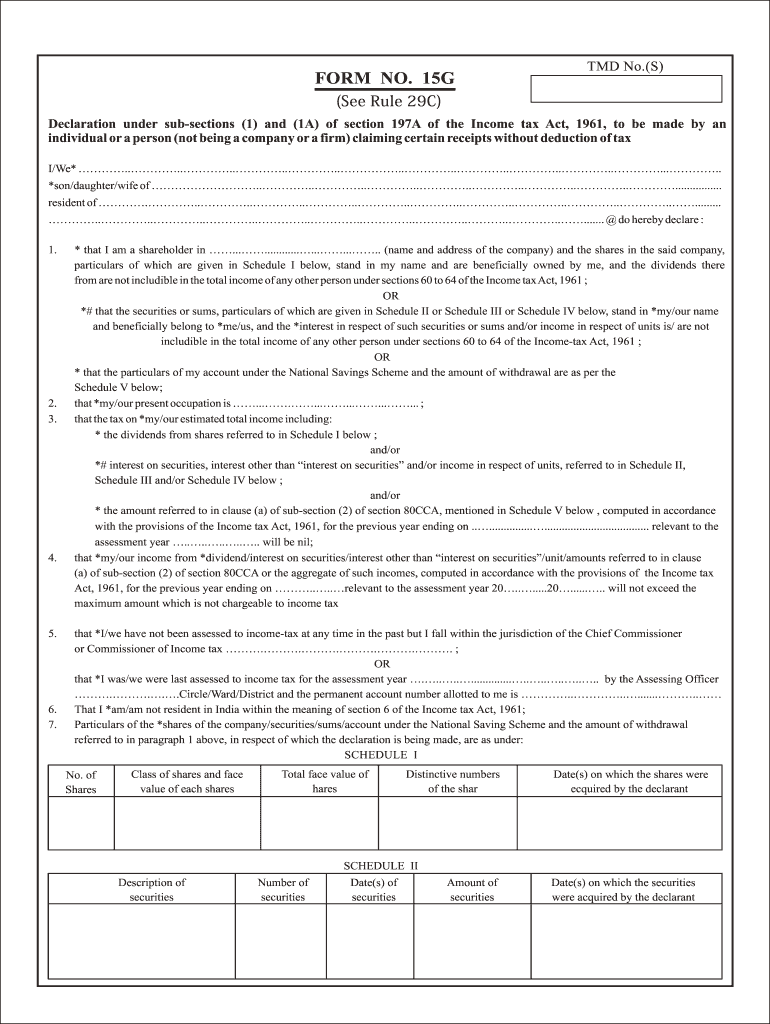

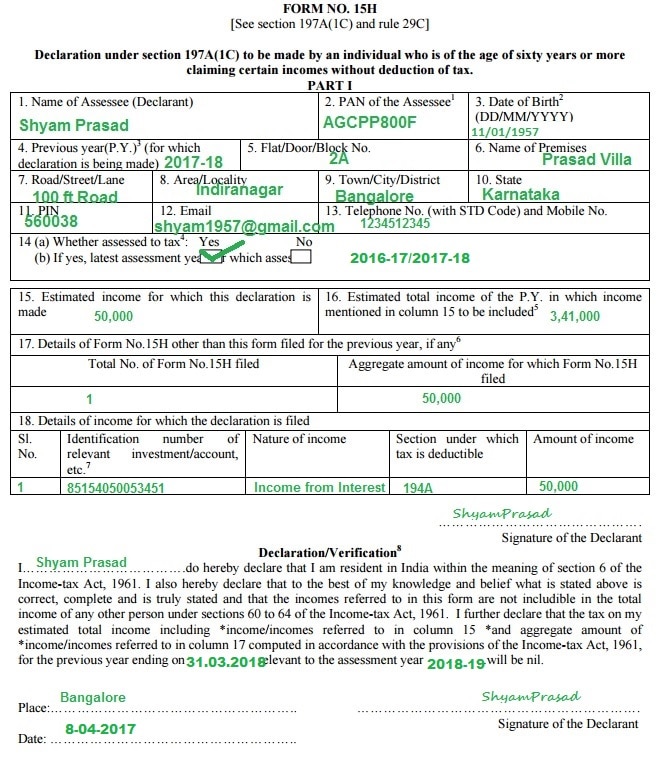

Form 15G and Form 15H are self-declaration forms which can be submitted to banks and other institutions to avoid Tax deduction at source (TDS) by banks on fixed and recurring deposit. The post covers the following: Who is eligible to submit Form 15G and Form 15H? Where can Form 15G and Form 15H be used?

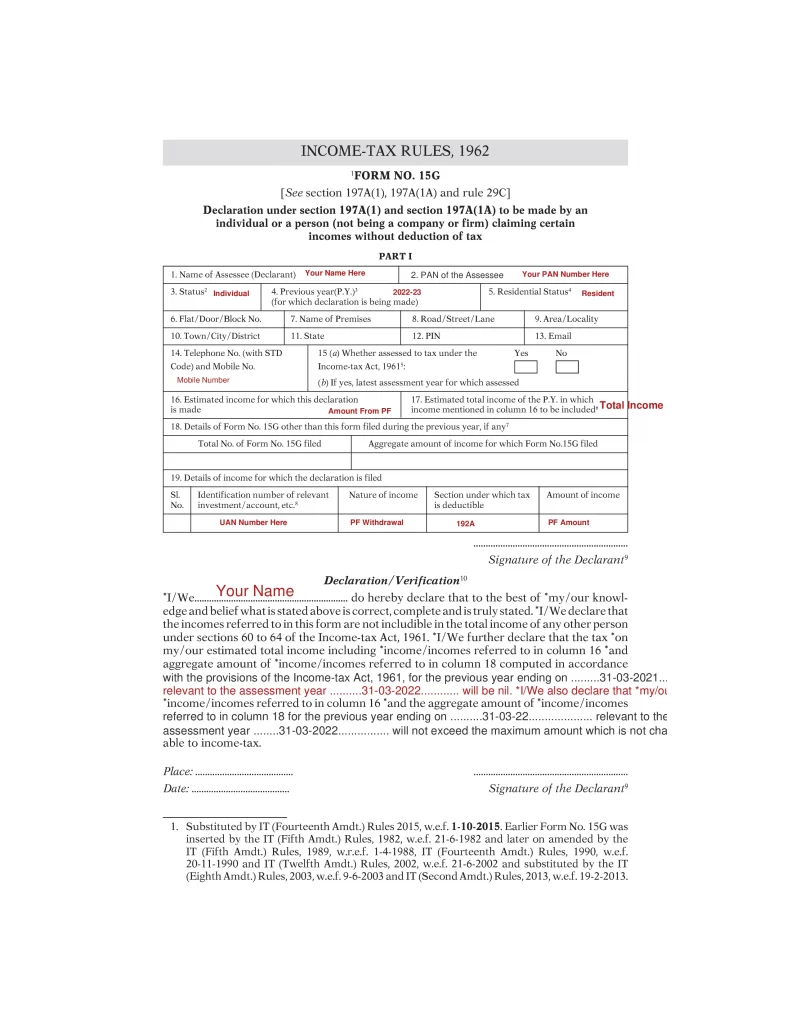

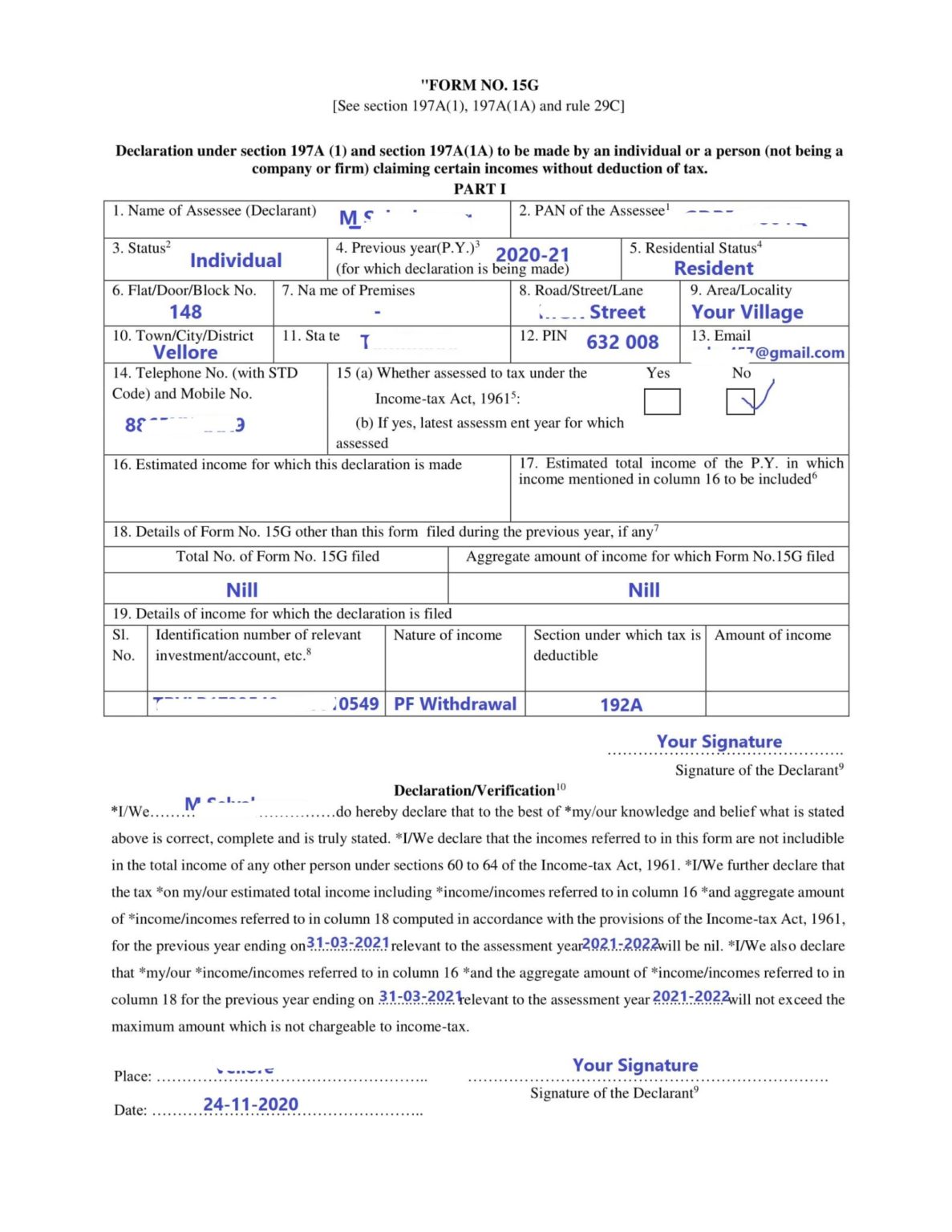

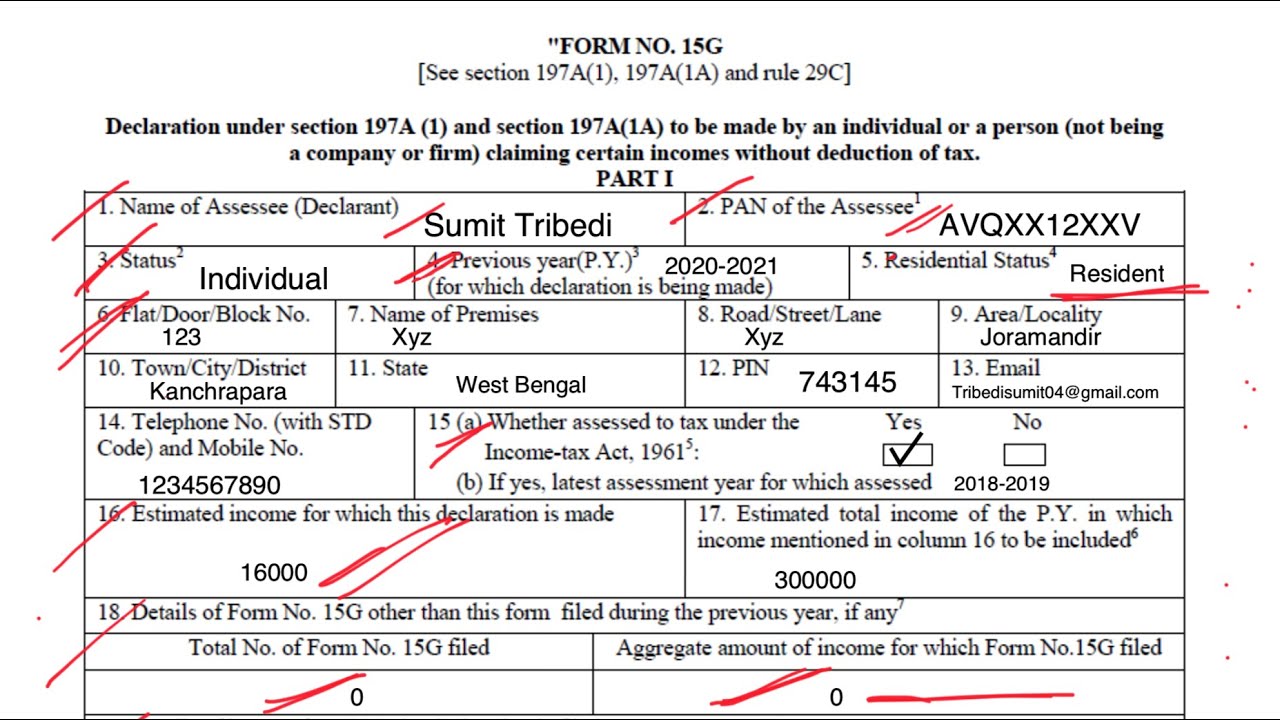

Sample Filled Form 15G for PF Withdrawal in 2022

Banking How to fill new Form 15G / Form 15H? The Central Board of Direct Taxes (CBDT) has recently issued a notification regarding the new format and declaration procedure of new Form 15G & Form 15H. The revised procedure has been made effective from the 1st October, 2015.

Download फॉर्म 15G PDF डाउनलोड सैंपल ऑनलाइन व जमा करें

How to Fill & Submit Form 15G under EPF? To fill and submit the form, visit the EPF Portal and log in Go to Online Services Claim (Form 31, 19, 10C) Verify Last 4 Digits of Bank Acc. Click "I want to apply for" Upload form 15G 5. Calculate the years of service for PF Claim

Form 15g download in word format Fill out & sign online DocHub

Fill in Part I (You don't have to fill Part II). Upload the Form in PDF format (if you have image, steps to convert image to pdf are given below) Enter other details and follow the process as explained in Online EPF Withdrawal: How to do Full or Partial EPF Verify Bank Details before EPF Withdrawal Verify Bank Details

Sample Filled Form 15G & 15H for PF Withdrawal in 2021

Form 15G is a declaration that can be filled out by fixed deposit holders (individuals less than 60 years of age and HUFs) to ensure that no TDS (tax deduction at source) is deducted from their interest income in a year.

EPF Form 15G Download Sample Filled Form 15G For PF Withdrawal GST Guntur

by Rajesh Form 15G is a self-declaration to declare that the total income in a financial year is less than the income tax slab limit. It should be filled by the citizens of India whose age is ≤ 60 years. If the age is above 60 years then they have to submit form 15 H in place of form 15G.

How to fill form 15G? কিভাবে 15G ফর্ম পূরণ করবেন? [Bangla] YouTube

How to fill Form 15G online without printer | Form 15g for PF withdrawal | save tdsIn this video, we are going to discuss about Form 15g.How to fill up form.

Sample Filled Form 15G & 15H for PF Withdrawal in 2020

Find the Right Agreement for You. Browse Dozens of Ready-to-Use Legal Documents. Edit & Print Your Employment Forms in 5 Minutes. Create Now.

Form 15g Fill Online, Printable, Fillable, Blank pdfFiller

Once the EPF Form 15G is filled, you can do the following: Log in to the EPFO UAN portal online. Click on 'Online Services' and select the 'Claim' option. Enter the 4 digits of your registered bank account for verification. Select the 'I want to apply for' option, and you will get the option 'Upload Form 15G'.

How To Fill Form 15g And 15h Filled Form 15g Sample Form 15h Sample

Know how to fill form 15G for PF withdrawal in 2021-22, and how to submit form 15G in the PF portal online.Download form 15G: https://www.incometaxindia.gov..

IN Form NO. 15G Printable Blank PDF Online

Sample of Form 15G. Have a look at the image below to find a sample of Form 15G. TAX on EPF Withdrawal Rules. It is important to know about the TDS in relation to the EPF withdrawal before you start filling out the form 15G for PF. These EPF withdrawal rules are stated under section 192A, Finance Act of 2015.

Form 15g Filled Form 2023 Printable Forms Free Online

Filling out the form online. In the event of filling the form online On the websites of major banks, one needs to first log in to one's Internet banking site with a user ID and password. On clicking the online fixed deposits option, one will be directed to the details of his or her fixed deposit with the given bank.

Download Form 15h For Pf Withdrawal 2023 Printable Forms Free Online

FORM NO. 15G. [See section 197A(1C), 197A(1A) and rule 29C] Declaration under section 197A(1) and section 197A (1A) of the Income ‐ tax Act, 1961 to be made by an individual or Person (not being a company or firm) claiming certain receipts without deduction of tax.