Submit Form 15G for EPF Withdrawal online, TDS, Sample Filled Form 15G

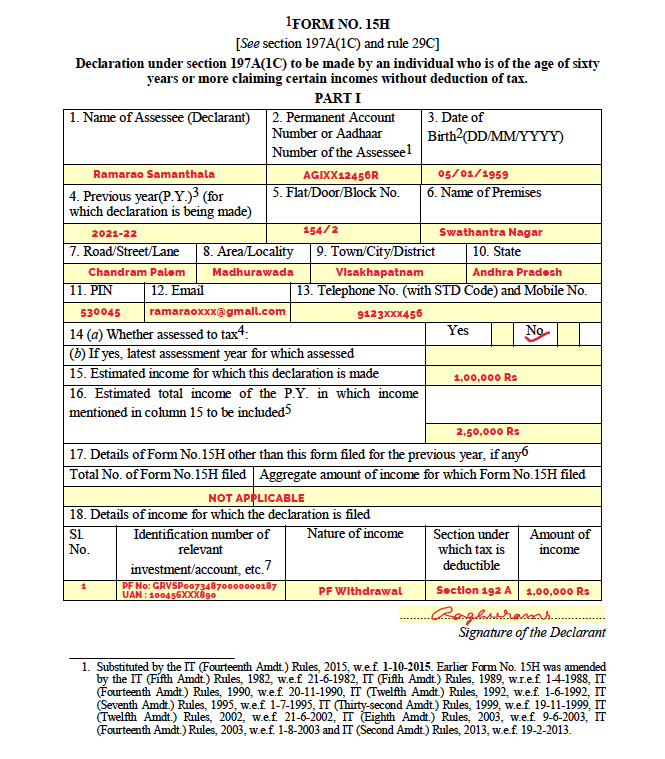

Form 15G or EPF Form 15G is a document people submit to ensure no TDS is deducted on the interest you earn from your EPF, RD or FD. This form can be filled out by individuals below 60 years of age and Hindu Undivided Families (HUFs). For individuals aged 60 years and above have a different form- Form 15H.

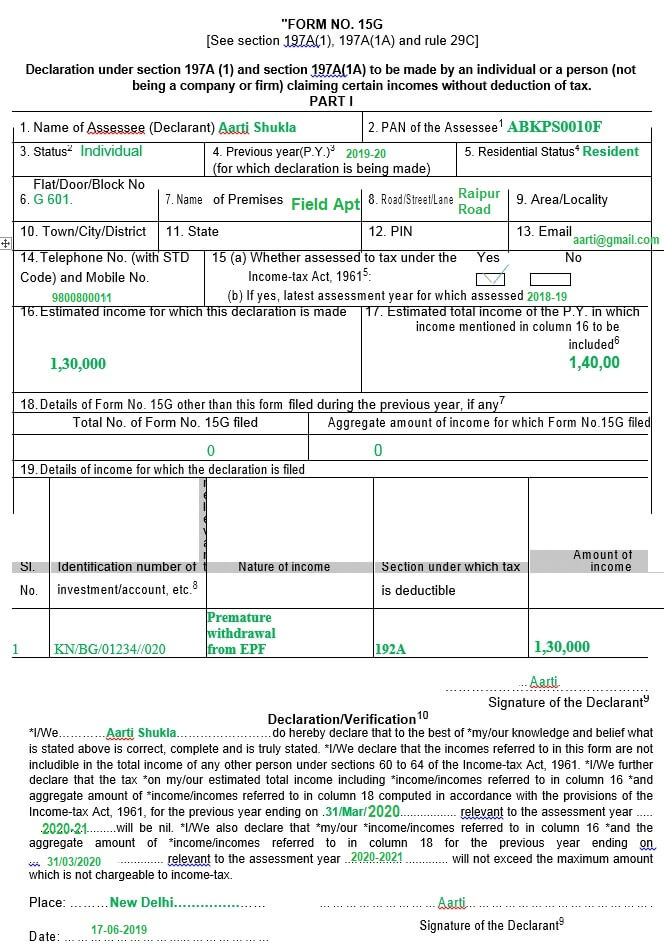

15G Sample Form

Form 15G and Form 15H are self-declaration forms that an individual submits to the bank requesting not to deduct TDS on interest income as their income is below the basic exemption limit. For this, providing PAN is compulsory. Some banks allow you to submit these forms online through the bank's website.

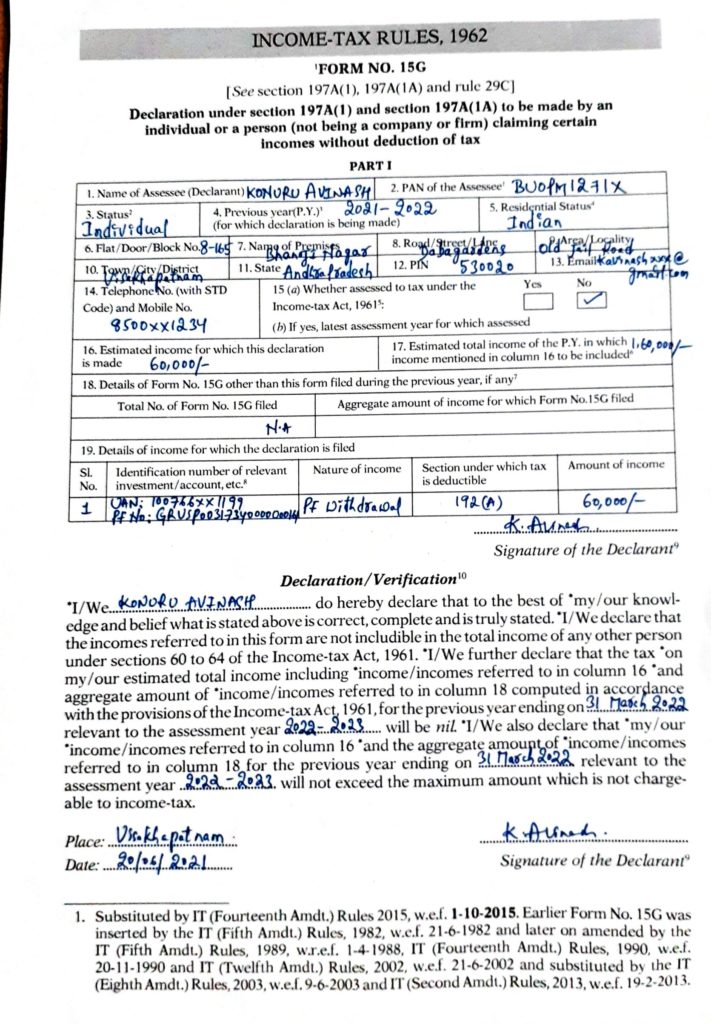

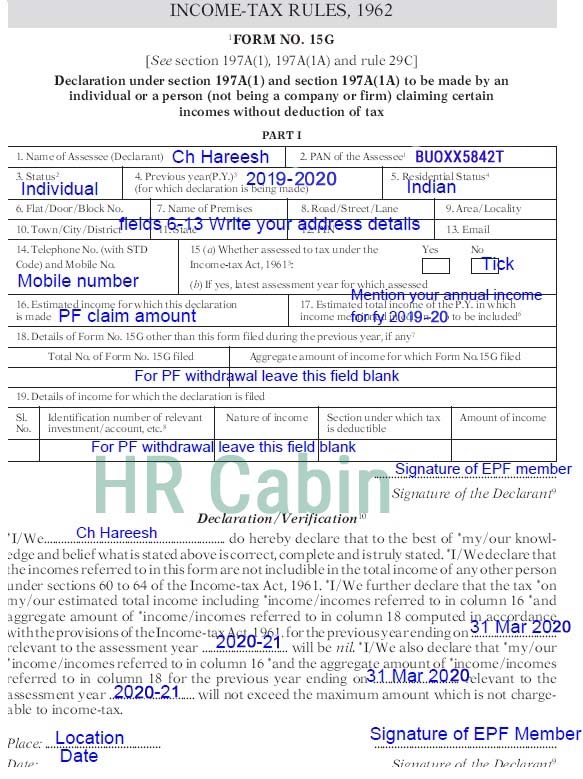

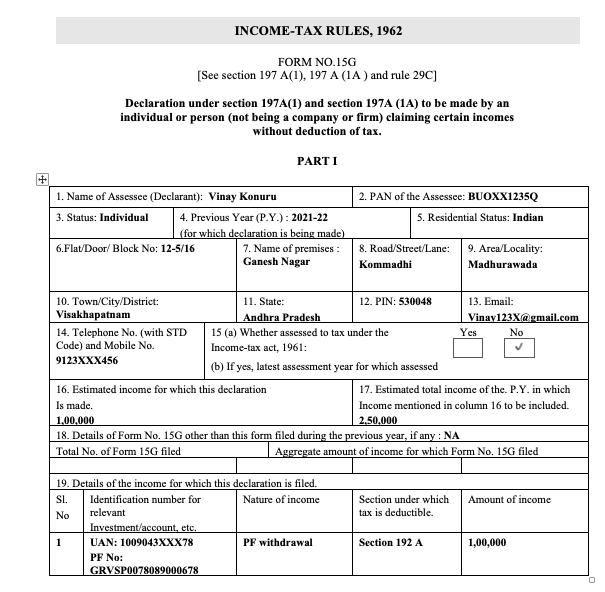

Sample Filled Form 15G for PF Withdrawal in 2022 (2022)

Step 4: Fill out Part 1 of Form 15G and ensure all the details are accurate, and then convert the completed form into a PDF format. Upload the PDF version of the form to finalise the process.. Instructions for Part 2 of Form 15G. The deductor must complete this part and is responsible for depositing the tax deducted at source to the.

Form 15g filled sample Fill out & sign online DocHub

The user must fill out Part 1 of Form 15G and verify all the details. Convert the filled form into PDF. Upload the PDF format of the form to complete the process. How to fill Form 15G for PF withdrawal? Here are the detailed steps that one must follow while filling out Form 15G:

What is Form 15G & How to Fill Form 15G for PF Withdrawal

Form 15G is a declaration that can be filled out by fixed deposit holders (individuals less than 60 years of age and HUFs) to ensure that no TDS (tax deduction at source) is deducted from their interest income in a year.

Sample Filled Form 15G for PF Withdrawal in 2022

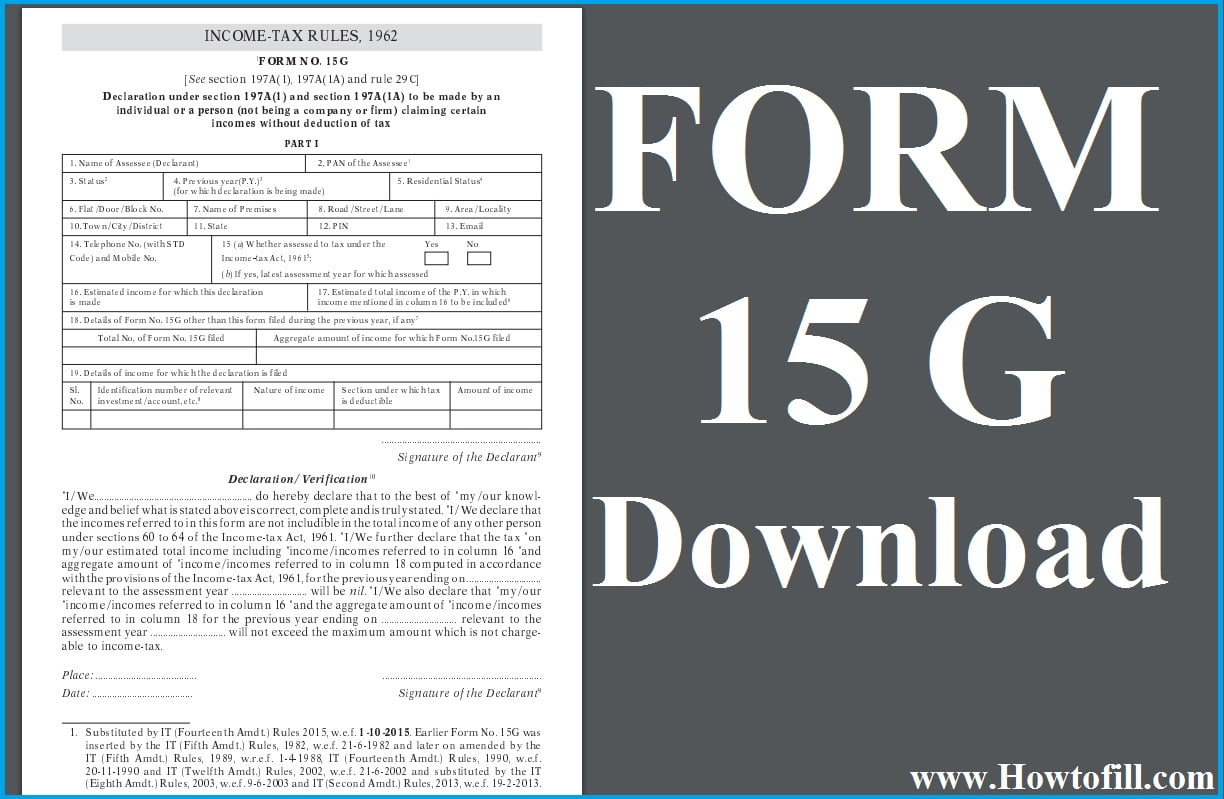

The direct link to download Form 15G is given below: Click Here To Download Form 15G PDF For EPF Withdrawl You can either download EPF Form 15G ODF from the above link or also can check the procedure to download the same from the official website. The steps to download 15G Form Online for PF withdrawal are listed below:

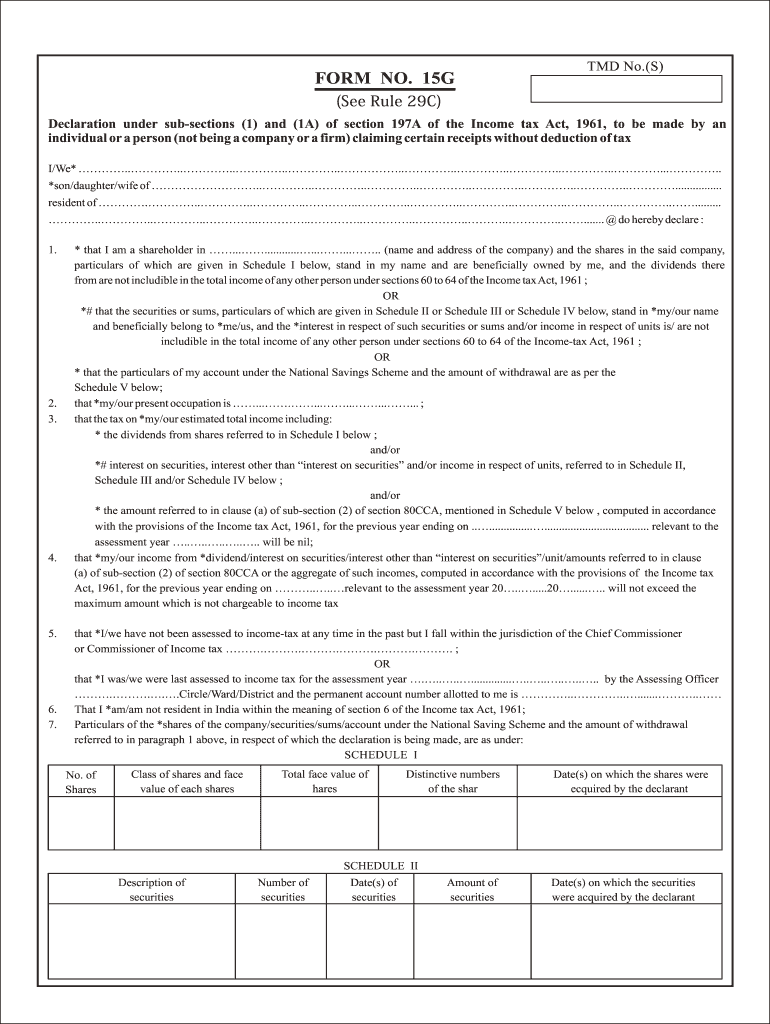

Form 15g download in word format Fill out & sign online DocHub

Know how to fill form 15G for PF withdrawal in 2021-22, and how to submit form 15G in the PF portal online.Download form 15G: https://www.incometaxindia.gov..

Sample Filled Form 15G PDF

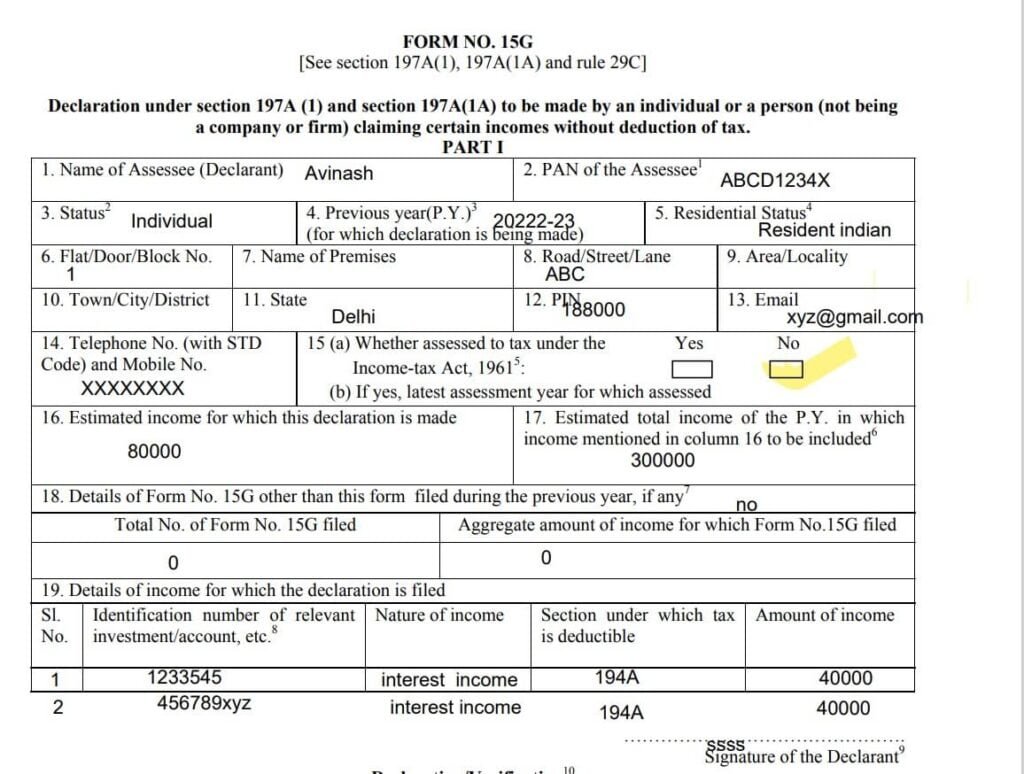

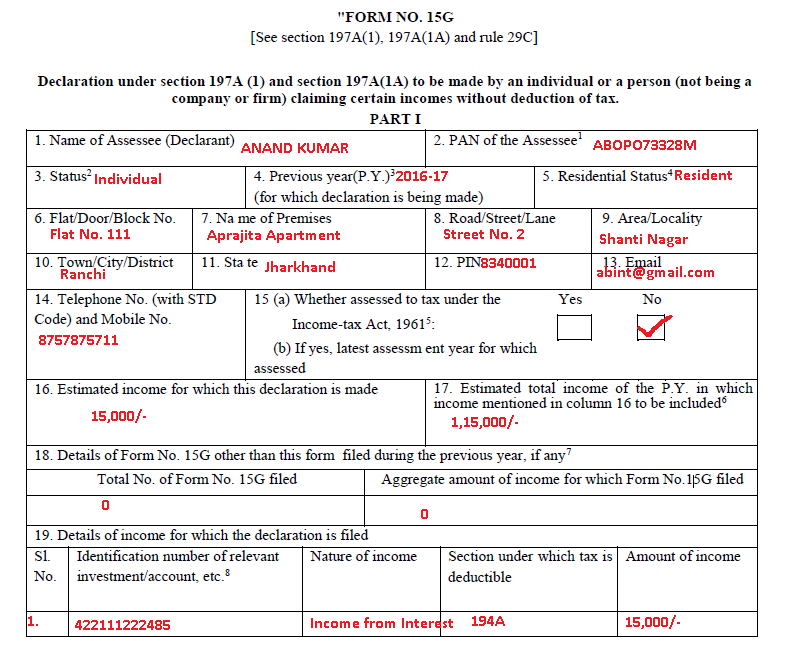

Form 15G Filled Sample for PF Withdrawal in 2022 Form 15G consists Two parts, we need to fill only part 1 of form 15G there is no need to fill part 2 of form 15G, just leave that page blank. Here is an example of a sample filled form 15G part 1 and part 2, which will guide you on how to fill form 15G correctly for PF claim…

Form 15G For PF How to Download and Fill Form 15G For PF

Claim (Form 31, 19, 10C) Verify Last 4 Digits of Bank Acc. Click "I want to apply for". Upload form 15G. 5. Calculate the years of service for PF Claim. The minimum years of service is 5 years doesn't mean that you have to complete the 5 years on the same organisation. If you have completed 4 years in company1 and another 4 years in.

How to Fill Form 15G for PF Withdrawal in 2022 YouTube

Download Form 15G PDF: https://incometaxindia.gov.in/forms/income-tax%20rules/103120000000007845.pdfKnow how to fill form 15G for EPF withdrawal to avoid TDS.

Sample Filled Form 15G & 15H for PF Withdrawal in 2021

3. Declare the withdrawal amount: Mention the total estimated income of the financial year in which you plan to withdraw the PF. 4. Avoid TDS deductions: If you want to avoid TDS deductions, fill out Form 15G and submit it to the bank branch or EPFO regional office. Form 15G is mandatory if you don't want TDS to be deducted from the PF withdrawal amount.

தமிழில் How to Fill Form 15G for PF Claim EPFO YouTube

Form 15G is a self-declaration form submitted by the assessee to ensure no deduction of TDS on interest income earned in the financial year. The tax on total income must be nil along with a few other conditions. You can file the Form 15G or Form 15H by logging into your internet banking account. Scripbox Recommended Tax Saving Fund

15g form fill up Download form 15G

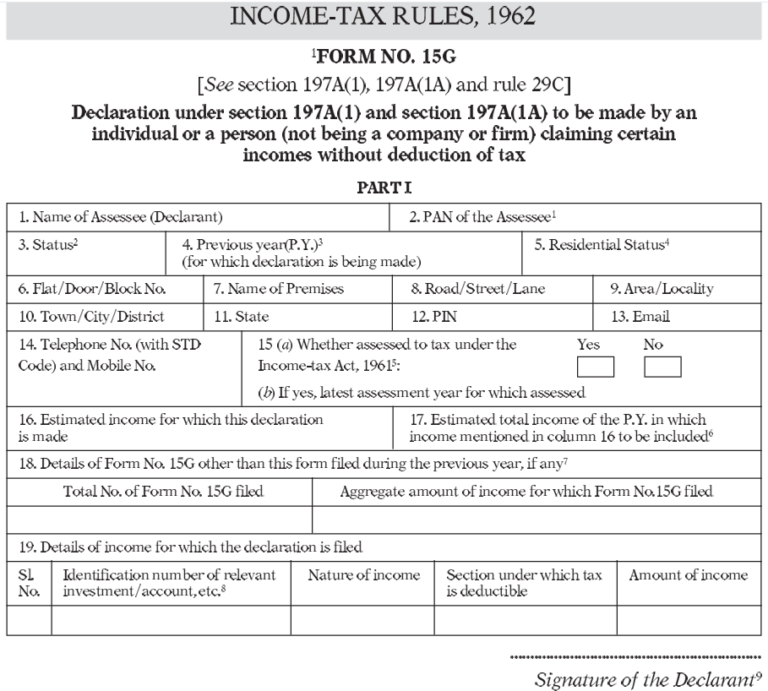

Details To Be Filled in Form 15G PDF for FY 2023-24. 1. Name of Assessee (Declarant) - Name as stated on PAN Card. 2. PAN of Assessee - Enter PAN Card number here, a valid PAN number is mandatory to fill Form 15G. 3. Status - Individual/HUF (Hindi United Family) 4. Previous Year - Enter the current Financial Year 2023-24 in case you are.

New Form 15G in Word Format for AY 202223 Download

Part 1 - This section is to be filled by the person (individual) who wants to claim certain 'incomes' without TDS. Let us now go through each point of Part-1 of Form no 15G. 1 - Name of the individual who is making the declaration. 2 - PAN (Permanent Account Number) of the tax assessee.

EVERYTHING BANKING NEWS 15G 15H Form Fill Up Step wise Guideline with Sample Filled Form 2016

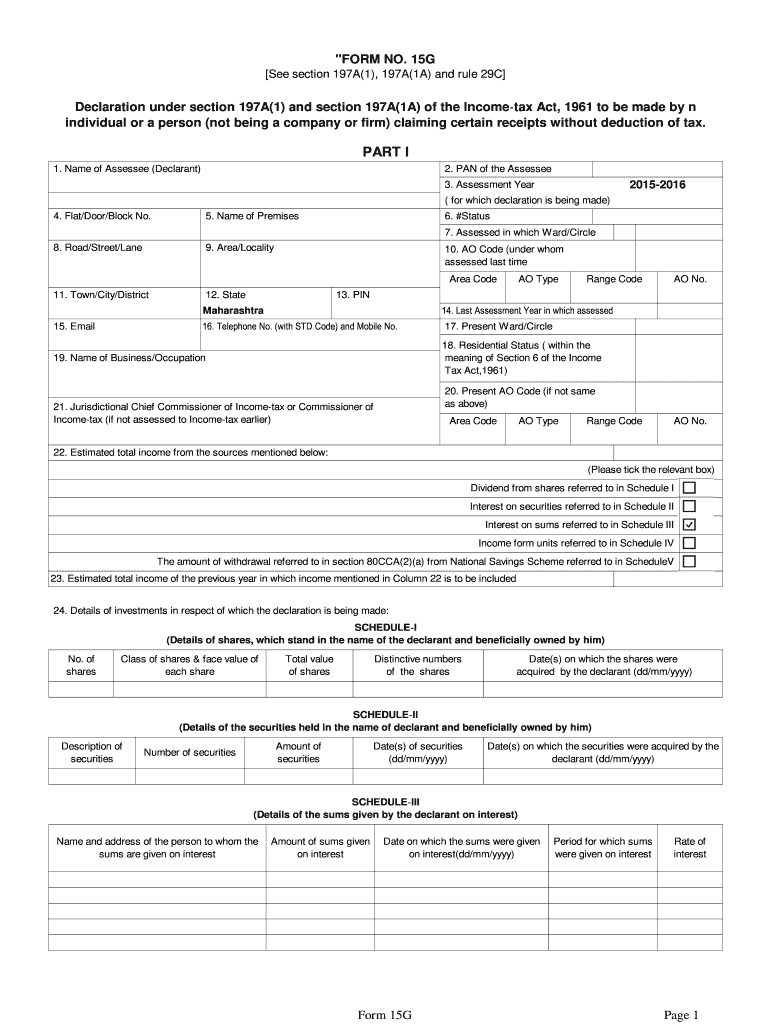

""FORM NO. 15G [See section 197A(1), 197A(1A) and rule 29C] Declaration under section 197A (1) and section 197A(1A) to be made by an individual or a person (not being a. PART II [To be filled by the person responsible for paying the income referred to in column 16 of Part I] 1. Name of the person responsible for paying 2.

How to Download Form 15G Online PDF How to fill Form 15G

Step 2: Once you log in, click on the online services drop-down list and find "Online Claim (Form 31, 19, 10C).". Step 3: Now, enter the last 4 digit bank account number, as shown below: Step 4: Once you verify your bank details, an EPF Withdrawal form will be displayed. Step 5: Here, you will see the option of uploading FORM -15G, Upload.