Class 12 Accountancy Chapter 5 Cash Flow Handwritten Notes PDF by Prachi Shankar

On Mohan's death the goodwill of the firm was valued at Rs. 75,000. The partnership deed provided that on the death of a partner his share in the profits of the firm in the year of his death will be calculated on the basis of last year's profit. The profit of the firm for the year ended 31-3-2017 was Rs. 2,00,000.

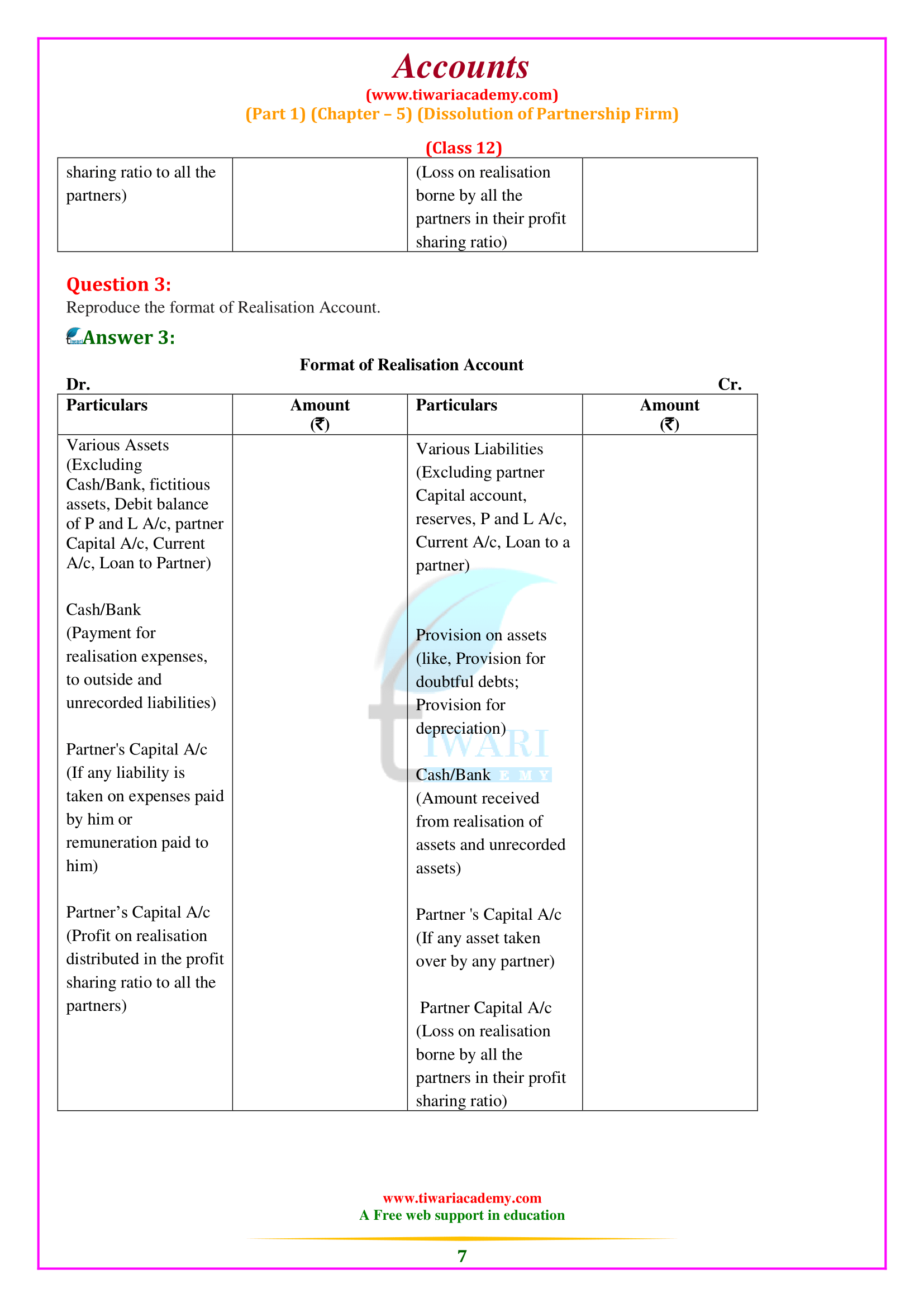

NCERT Solutions for Class 12 Accountancy Part 1 Chapter 5 for 202324

Question 2. A partnership is dissolved when there is a death of a partner. Answer True. As a new partnership deed is to be made. Question 3. A firm is dissolved when all partners give consent to it. Answer True. As all partners agree to it. Question 4: A firm is compulsorily dissolved when a partner decide to retire.

Account Class12 Solutions (Dk APK for Android Download

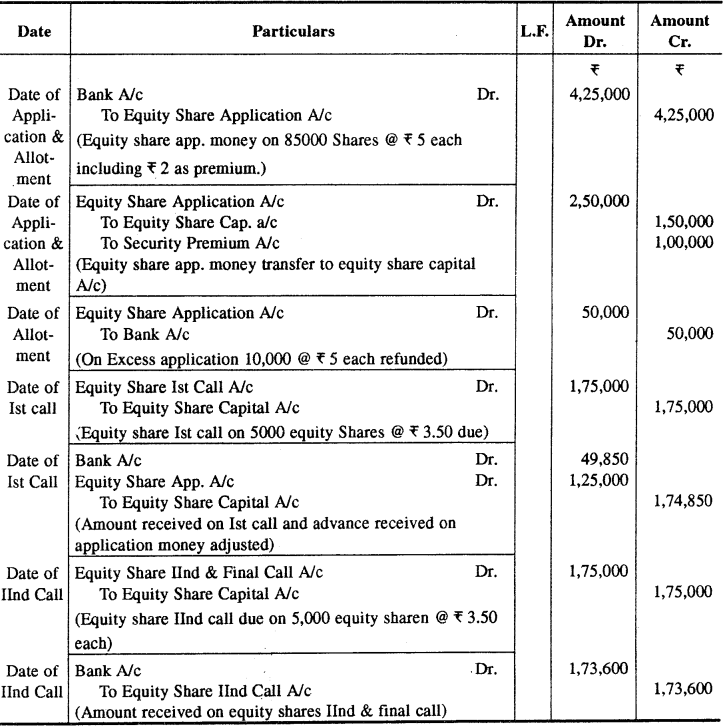

This NCERT Solutions for Class 12 Accountancy contains answers of all questions asked in Chapter 5 in textbook, Accountancy II (Company Accounts and Analysis of Financial Statements). Therefore you can refer it to solve Accounting Ratios exercise questions and learn more about the topic.

RBSE Solutions for Class 12 Accountancy Chapter 5 कम्पनी लेखे अंशों एवं ऋणपत्रों का निर्गमन

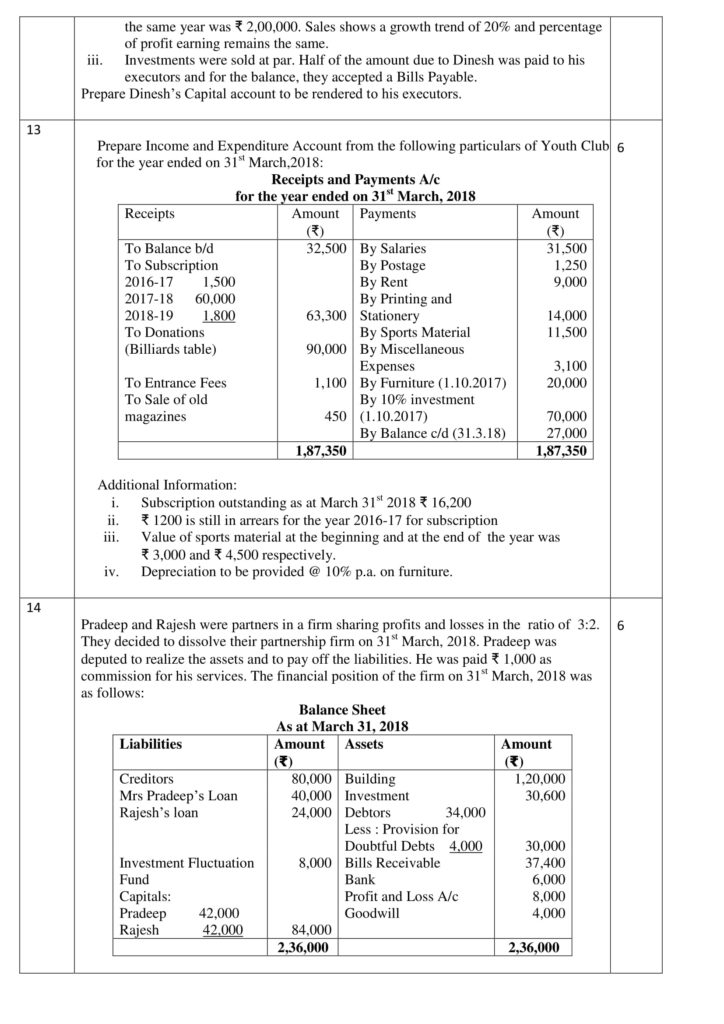

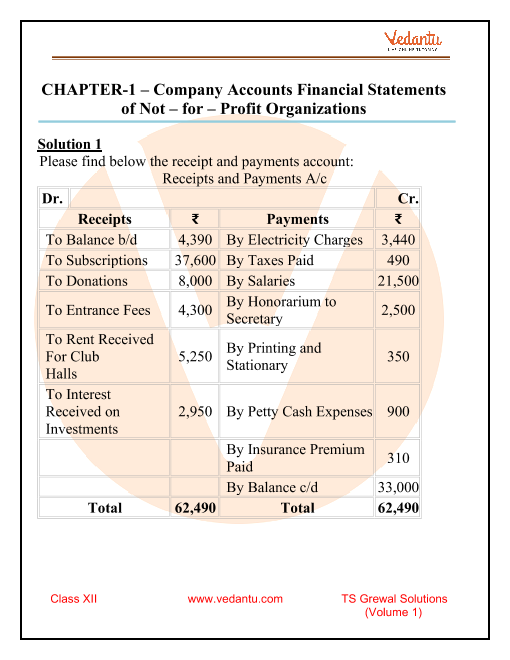

TS Grewal offers the 3 volumes of the Accountancy Book of Class 12. Volume - 1 of TS Grewal book class 12 Accountancy consists of two units. Not for Profit Organizations. Partnership. Partnership Units are further divided into the following chapters. Accounting of Partnership Firms - Fundamentals. Goodwill.

Adjustment of Capital Admission of a Partner Chapter 5 Class 12 Accountancy YouTube

Highlights of NCERT Solutions for Class 12 Accountancy Chapter 5 - Accounting Ratios. Know a few basic details about the NCERT Solutions presented below before you start using them for preparation.

NCERT Solution For Class 12 Accountancy Chapter 5 Dissolution Of Partnership Firm Download Free PDF

Accounting Courses to Suit Your Career Goals with 3 Routes to Qualify at BPP. Lear More. Work Towards a Successful Career in Accountancy. With a Wide Range of Accountancy Courses.

chapter 5 design of goods and services solutions vanslimitededition2018

Question 1. A, B and C were partners sharing profits in the ratio of 1/2, 2/5 and 1/10. Find the new ratio of the remaining partners if C retires. Solution: Question 2. Ram, Mohan and Sohan were partners sharing profits in the ratio of 1/5, 1/3 and 7/15 respectively.

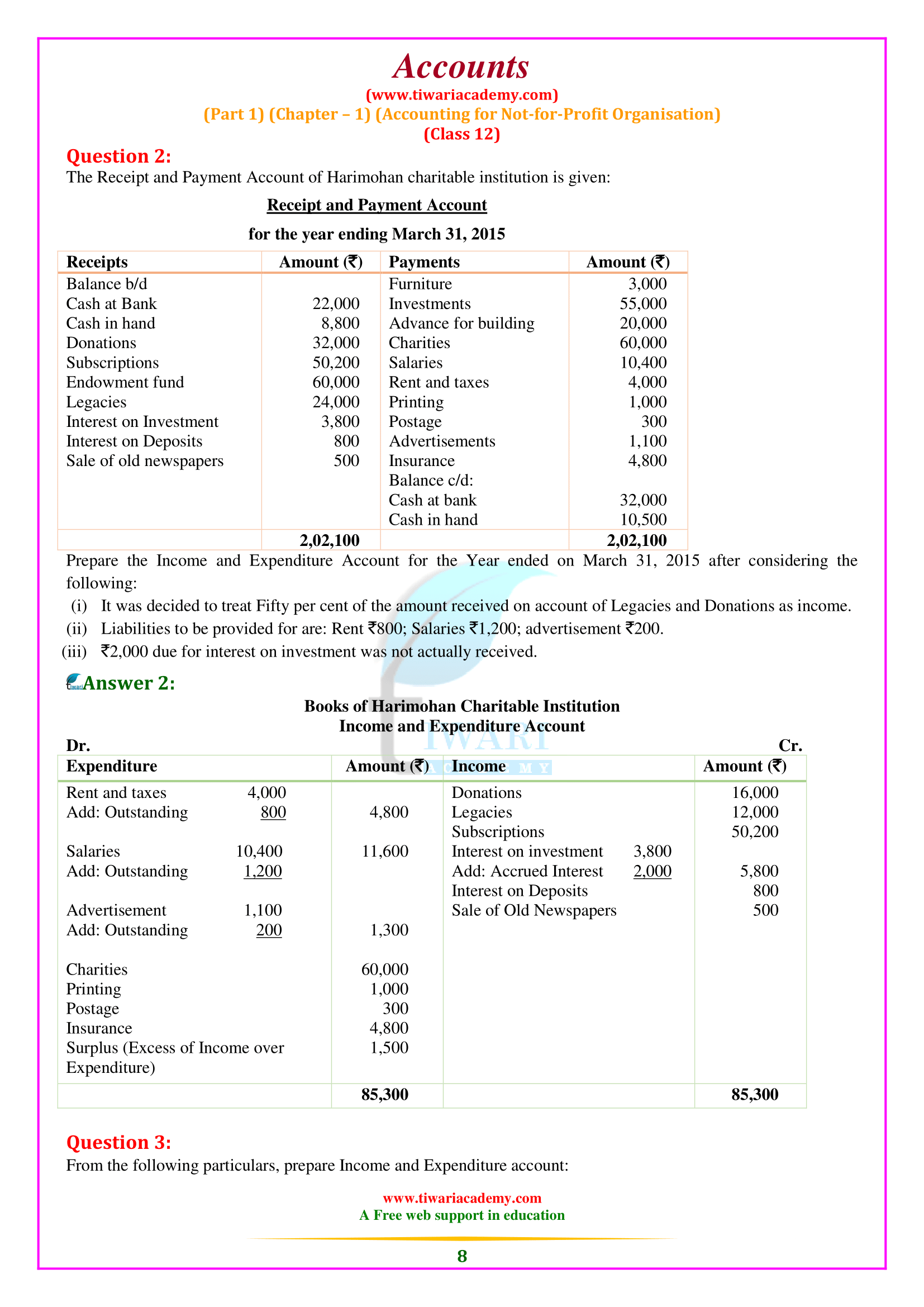

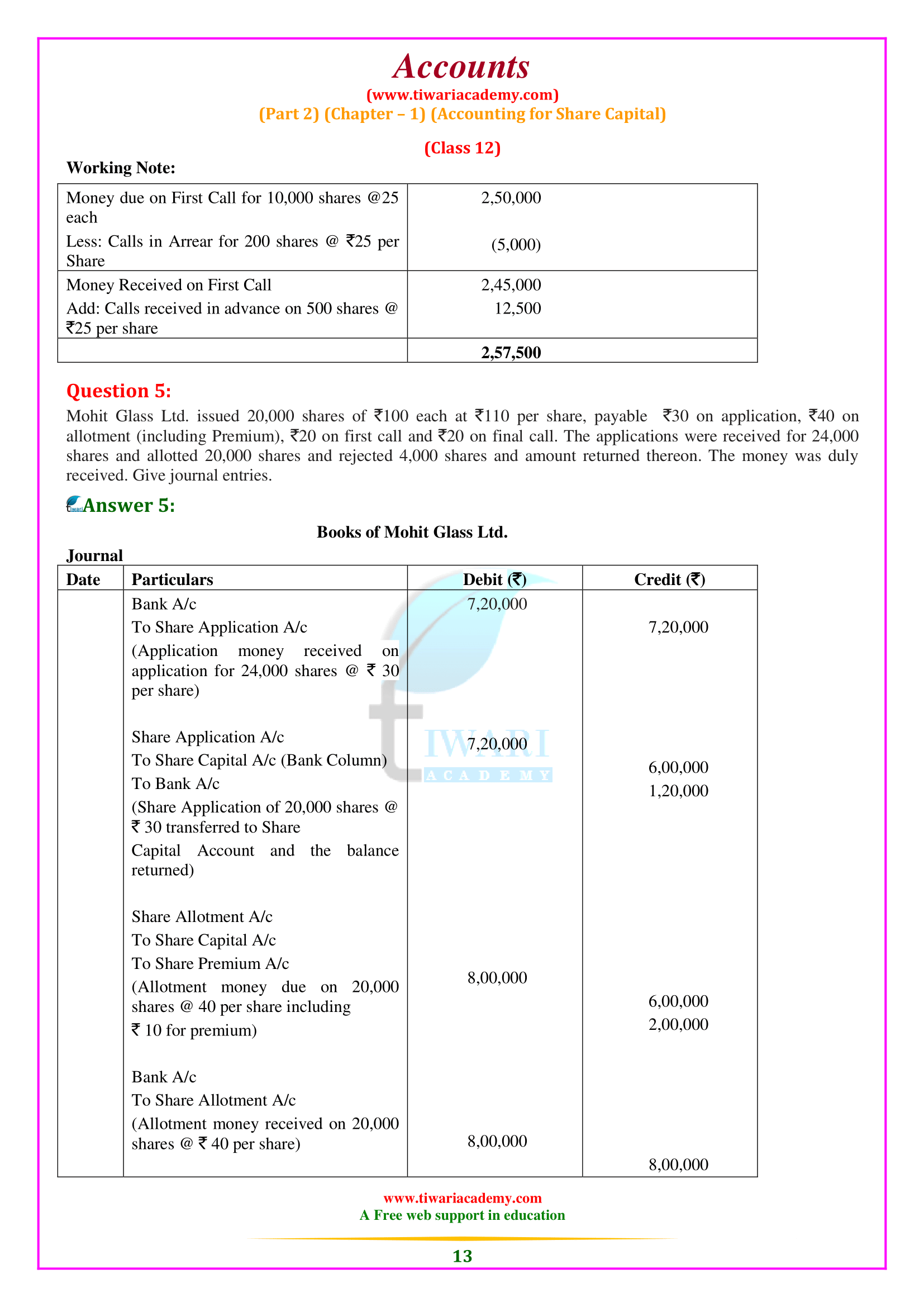

NCERT Solutions for Class 12 Accountancy Chapter 1 for 20232024.

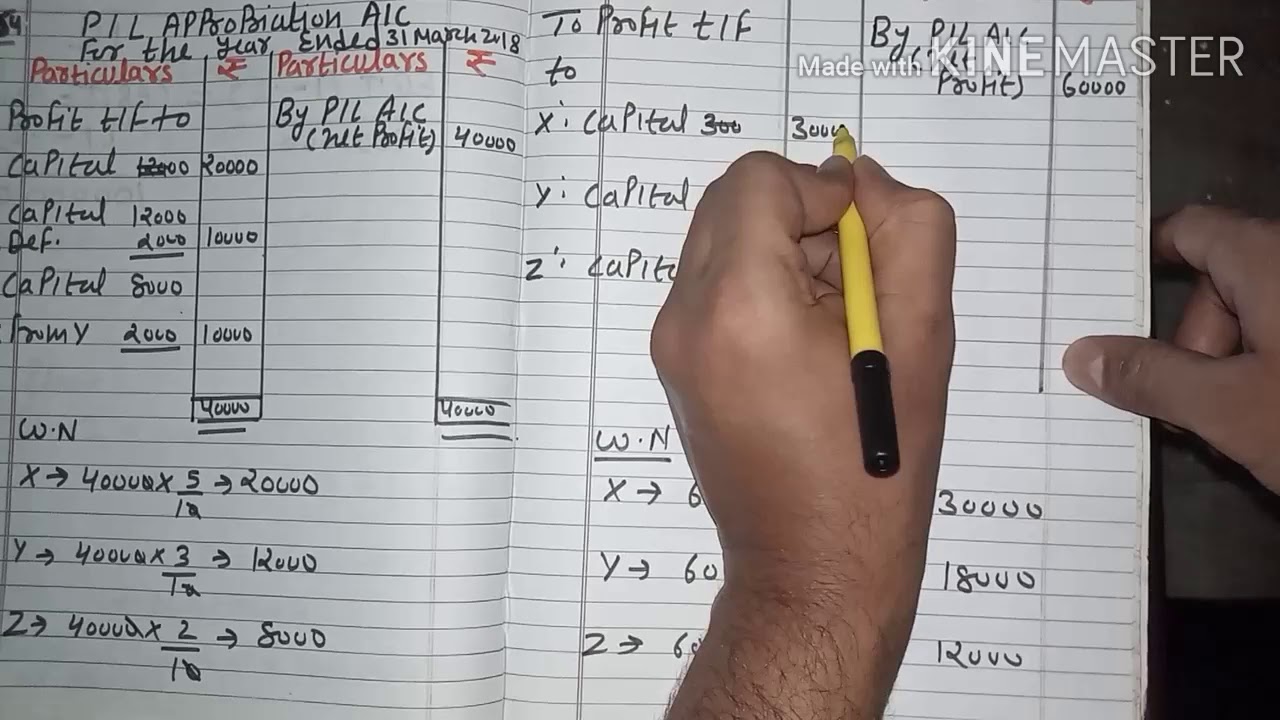

TS Grewal Solutions for Class 12 Accountancy Chapter 5 - Admission of a partner. Question 1. X, Y, and Z are partners sharing profits and losses in the ratio of 5 : 3: 2. They admit A into partnership and give him 1/5th share of profits. Find the new profit-sharing ratio. Solution:

Cbse Sample Paper Class 12 Accountancy 201819 exampless papers

NCERT Solutions are said to be extremely helpful while preparing for the CBSE Class 12 Accountancy examinations. This study material is the best resource available to students, and the NCERT Solutions collected by the subject-matter experts are accurate.. NCERT Solution For Class 12 Accountancy Chapter 5 - Accounting Ratios furnishes us with all-inclusive data for all the concepts.

RBSE Solutions for Class 12 Accountancy Chapter 5 Company Accounts Issue of Shares and

June 20, 2022. T.S Grewal Solutions (12) 7. Share your love. Are You looking for the solutions of chapter 5 Admission of Partner of TS Grewal Book Class 12 Accountancy Book 2021-22 Edition? I have solved each and every question of the 5th chapter of TS Grewal Book of latest 2021-22 Editon. The link to All unsolved questions has been given below.

Click here to check out the Solution of Class 12 Accountancy Volume 1 Chapter 1 from TS Grewal

Get free NCERT Solutions for Class 12 Accountancy - Company Accounts and Analysis of Financial Statements Chapter 5 Accounting Ratios solved by experts. Available here are Chapter 5 - Accounting Ratios Exercises Questions with Solutions and detail explanation for your practice before the examination

CLASS12 Accounts video23 CH2 Fundamentals of partnership YouTube

Question 5. Current liabilities of a company are Rs. 75,000. If Current ratio is 4 : 1 and liquid ratio is 1:1, calculate value of current assets, liquid assets and stock. Question 6. Handa Limited has stock of Rs. 20,000. Total liquid assets are Rs. 1,00,000 and quick ratio is 2:1 Calculate current ratio. Question 7.

NCERT Solution For Class 12 Accountancy Chapter 5 Dissolution Of Partnership Firm Download Free PDF

NCERT Solutions for Class 12 Accountancy provides a wide range of concepts and advanced information regarding the subject, which includes all the questions provided in the NCERT books. Students who aspire to score full marks are advised to use the NCERT Solutions from BYJU'S. NCERT Solutions for Class 12 Accountancy, chapter-wise, are given.

NCERT Solutions for Class 12 Accountancy Part 2 Chapter 1 (Updated)

NCERT Solutions for Class 12 Accountancy Chapter 5 - Dissolution of Partnership Firm furnishes us with all-inclusive data on all the concepts. As the students would have learnt the fundamentals of the subject of accountancy in Class 11, the NCERT Class 12 Solutions is a continuation of it. You can access the free PDF of the solutions from the.

Account Class12 Solutions (TS Grewal Vol1) 2019 for Android APK Download

Solution: For, 2017-18. Q.12 From the following information calculate the Inventory Turnover Ratio Revenue from operations ₹6,00,000; Gross profit 25% on cost; Opening inventory was 1/3rd of closing inventory; Closing Inventory was 30% of revenue from operation. Solution: Revenue from operation=6,00,00.

Account Class12 Solutions (TS APK for Android Download

Accounting NCERT Solutions for Class 12 Accountancy Chapter 5 - Ratios d. Working Capital Turnover Ratio: The working capital turnover ratio is used to measure the efficiency of a company in using its working capital to support sales. It is a ratio based on which a firm's operations are funded, and the corresponding revenue generated from the