Best Chart Pattern

Final Word Chart Patterns Cheat Sheet Download (PDF File) First, here's our chart patterns cheat sheet with all the most popular and widely used trading patterns among traders. You can print it and stick it on your desktop or save it in a folder and use it whenever needed. Chart Patterns Cheat Sheet PDF [Download]

Stock Chart Patterns 101 New Trader U

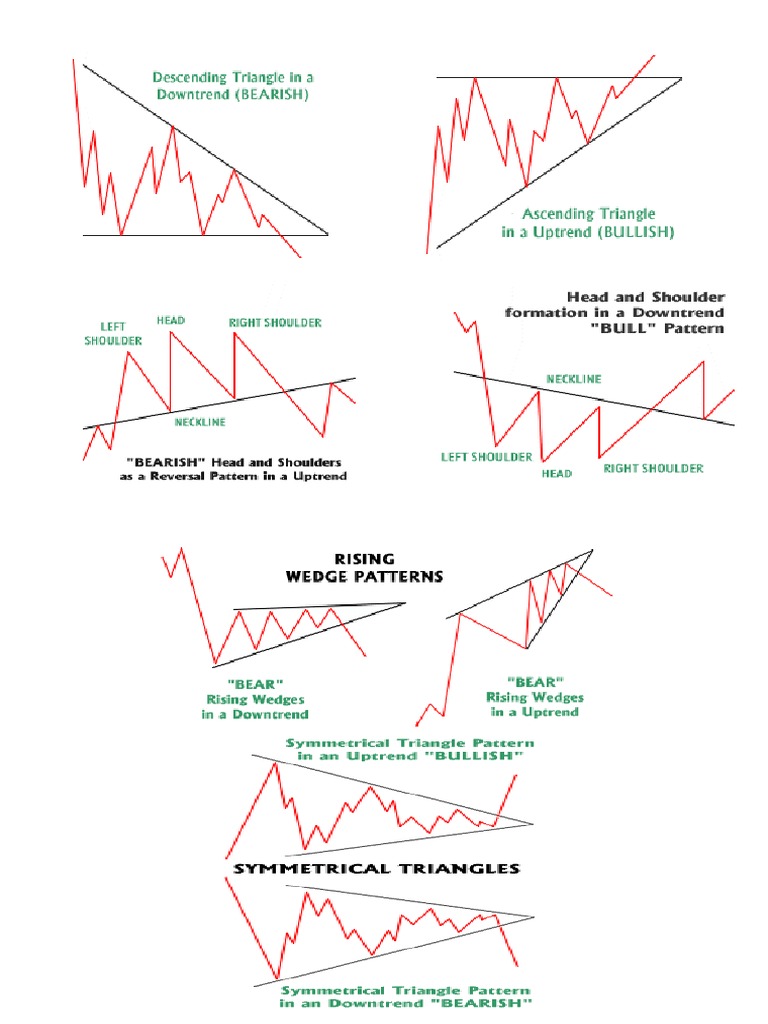

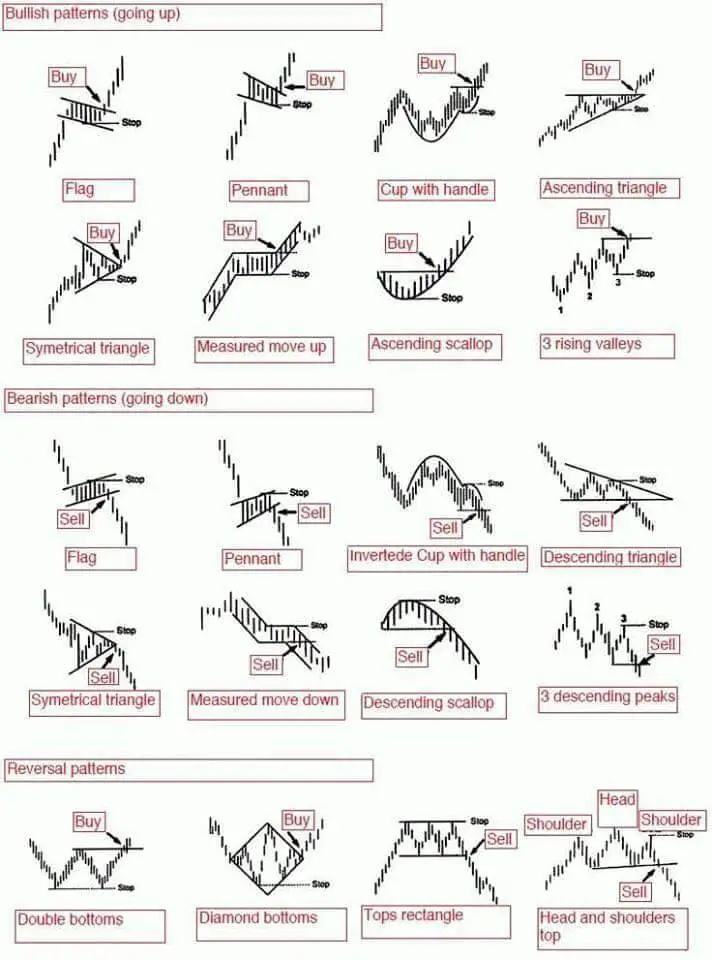

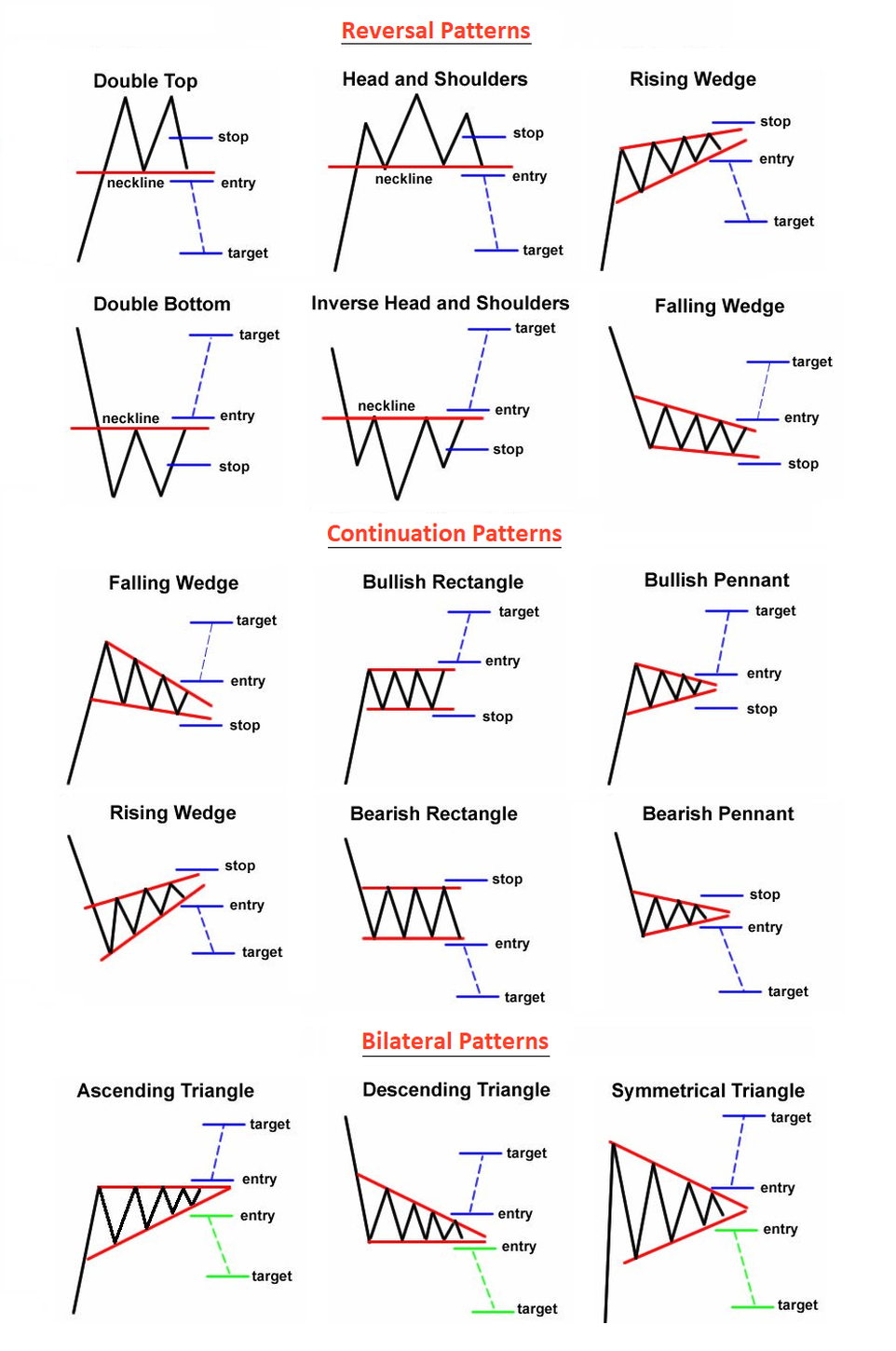

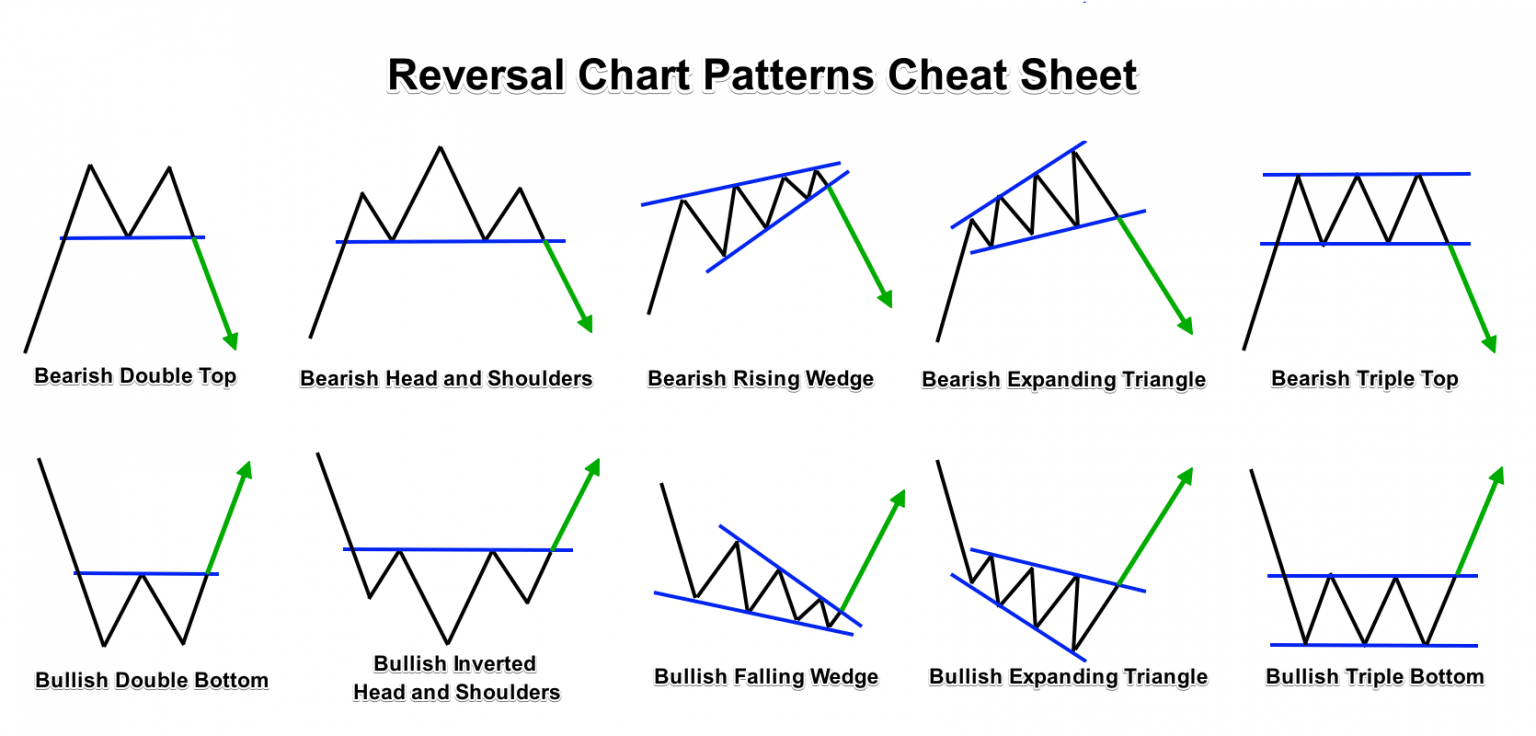

3 Major Chart Pattern Types There are three main types of chart patterns: reversal, continuation, and bilateral. Here is an overview of each of these types and some examples. Bilateral The market exhibits a bilateral pattern when buyers and sellers are unable to gain an advantage.

Chart Patterns B.P. RISING

Chart patterns are unique formations within a price chart used by technical analysts in stock trading (as well as stock indices, commodities, and cryptocurrency trading ). The patterns are identified using a series of trendlines or curves.

Chart Patterns. January 24, 2016 by Thomas Mann All Things Stocks Medium

Learn the patterns of accumulation (buying), distribution (selling), and stalemate (sideways action), and you'll be well on your way to exploiting opportunities. In this guide to chart patterns, we'll outline for you the most important patterns in the market: From candlestick patterns to bear traps, triangle patterns to double bottoms, we.

How Important are Chart Patterns in Forex? Forex Academy

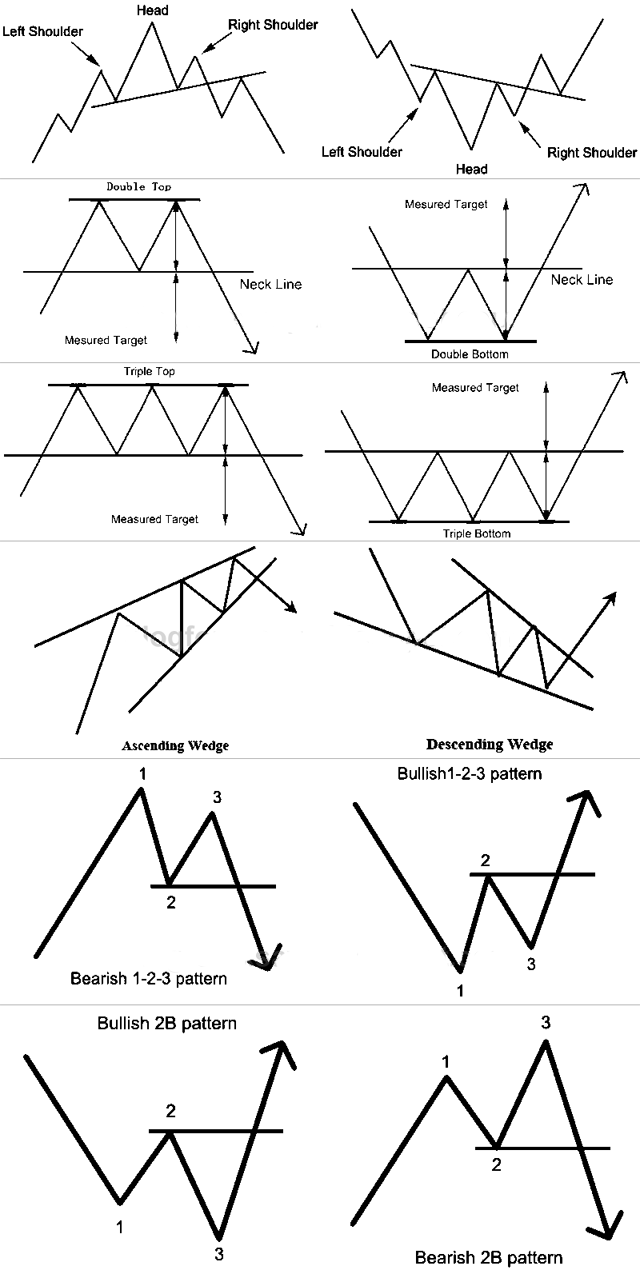

A chart pattern is a shape within a price chart that helps to suggest what prices might do next, based on what they have done in the past. Chart patterns are the basis of technical analysis and require a trader to know exactly what they are looking at, as well as what they are looking for. Best chart patterns Head and shoulders Double top

Forex Candlestick Patterns Over 1,834 RoyaltyFree Licensable Stock Vectors & Vector Art

A pattern is identified by a line connecting common price points, such as closing prices or highs or lows, during a specific period. Technical analysts and chartists seek to identify patterns.

13 Most Popular Trading Chart Patterns R Blog Roboforex Riset

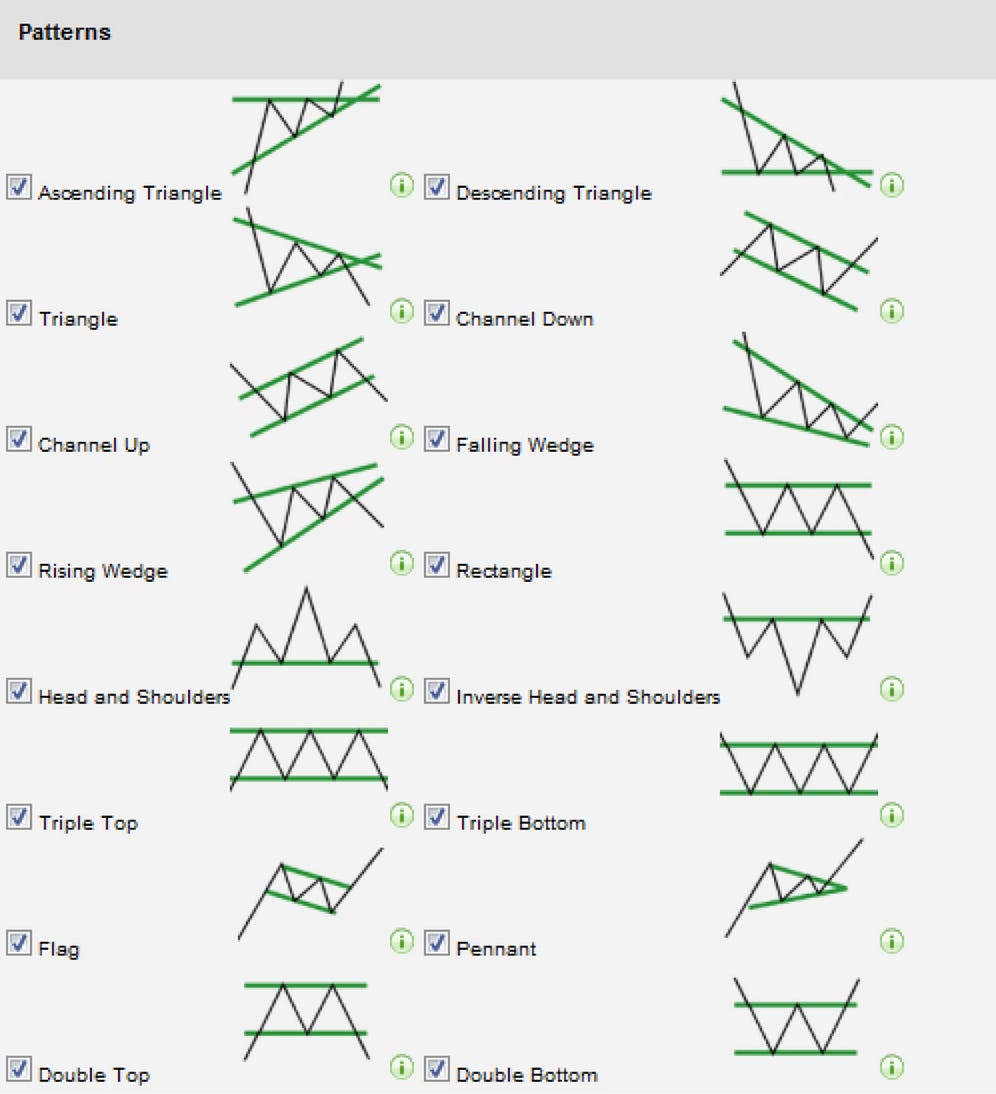

17 Stock Chart Patterns All Traders Should Know Technical analysis is one of the best tools traders can use to spot shifts within the market, allowing them to predict support and resistance levels within a predictable timeframe. There are many different continuation and reversal patterns to look out for when reading the stock charts.

40. Common Chart Pattern. Pathshala

Below is a good example of a daily chart that uses volume and moving averages, support and resistance levels, multiple indicators, and basic breakout patterns along with price action. It shows how traders might determine support and resistance levels (gray lines). The volume indicator is below the chart; two moving averages (10-day and 30-day.

Chart Patterns All Things Stocks Medium

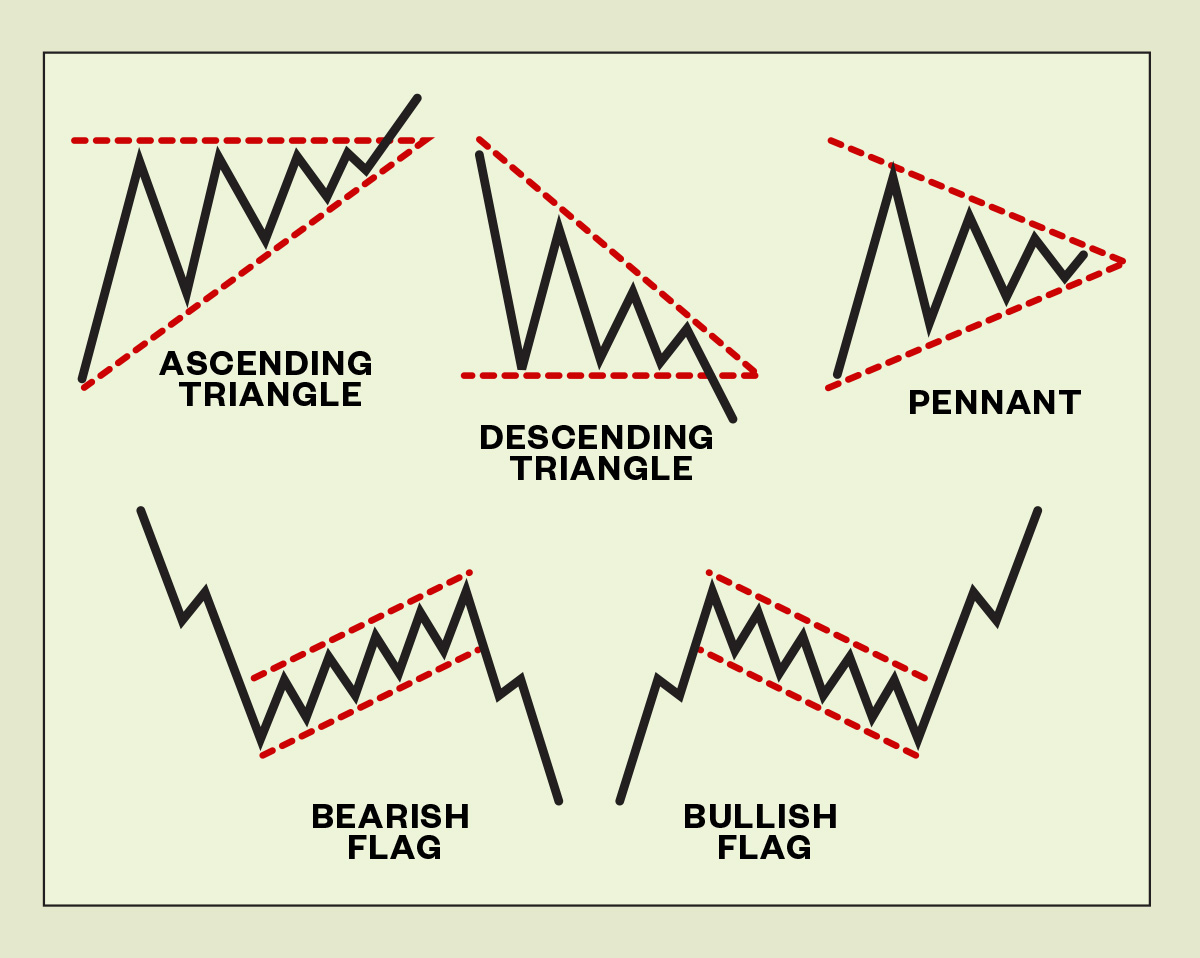

There are 3 types of patterns, depending on how price is likely to behave after completion: reversal patterns, where price is likely to reverse, continuation patterns, where price is likely to continue its course and bilateral patterns, where price can go either way, depending on whether it breaks to the upside or to the downside.

Chart Patterns. January 24, 2016 by Thomas Mann All Things Stocks Medium

A pattern is bounded by at least two trend lines (straight or curved) All patterns have a combination of entry and exit points Patterns can be continuation patterns or reversal patterns Patterns are fractal, meaning that they can be seen in any charting period (weekly, daily, minute, etc.)

MOST USEFUL PATTERNS in 2023 Trading charts, Online stock trading, Stock trading strategies

Chart patterns are simply combinations of trend lines that are measured based on price action. For example, two converging trend lines may form an ascending triangle, descending triangle, or symmetrical triangle. These patterns carry insights into market sentiment. For example, an ascending triangle, with its higher lows and tightening price.

CHARTPATTERNS Stock chart patterns, Trading charts, Technical analysis charts

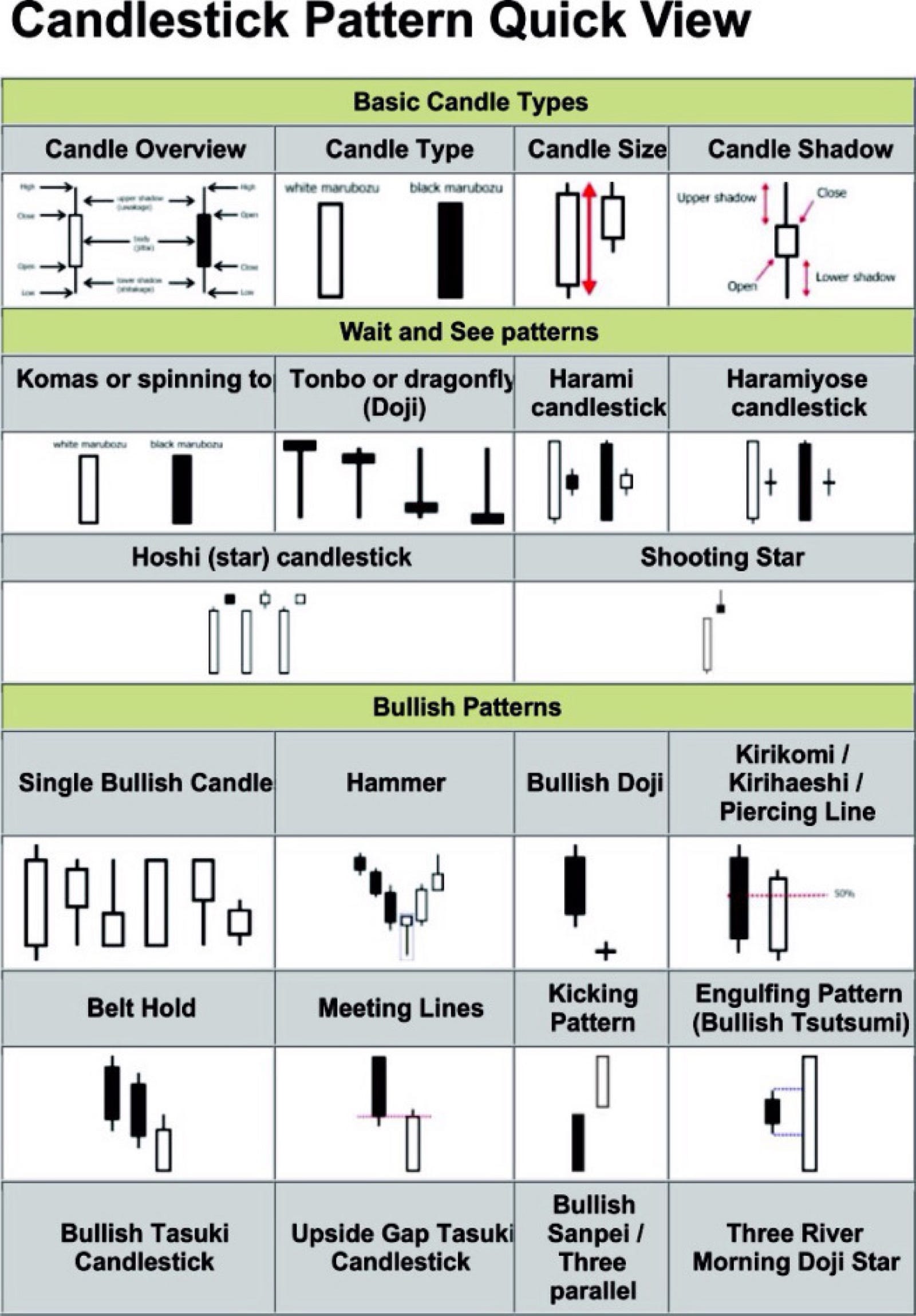

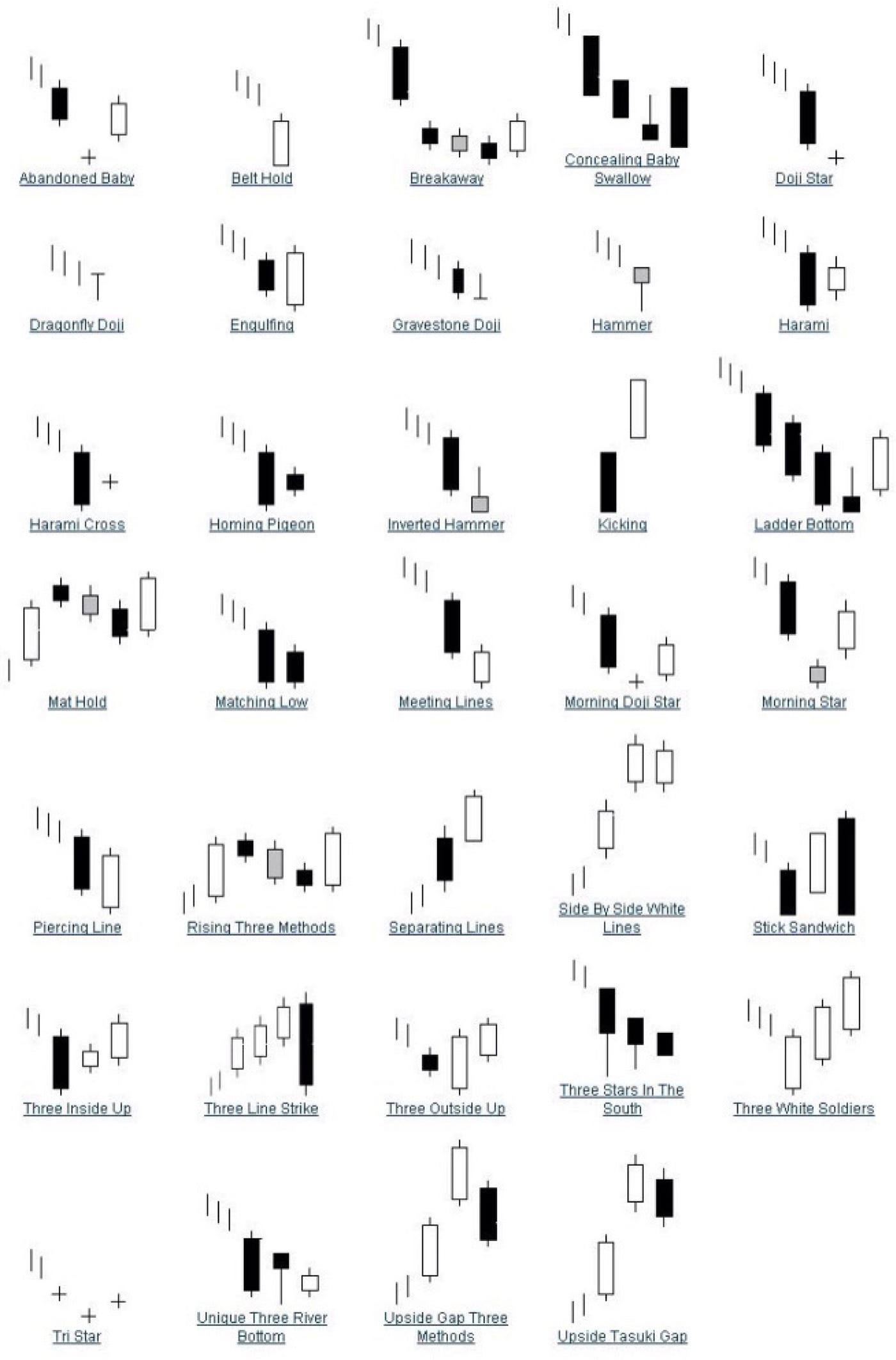

All 35 Candlestick Chart Patterns in the Stock Market-Explained 98 Listen to this: 35 Candlestick Chart Patterns in the Stock Market Preview E Jun 2022 · Your Journey to Financial Freedom Save on Spotify The candlesticks are used to identify trading patterns that help technical analyst set up their trades.

The World Best FOREX Trading System Lovely Chart Patterns

Chart patterns are the foundational building blocks of technical analysis. They repeat themselves in the market time and time again and are relatively easy to spot. These basic patterns appear on every timeframe and can, therefore, be used by scalpers, day traders, swing traders, position traders and investors.

Chart patterns pleaseseka

What are Chart Patterns? How to Use Chart Patterns Trading Classic Chart Patterns Head and Shoulders Double Top and Double Bottom Day Trading Chart Patterns Intraday Chart Patterns Lastly What are Chart Patterns? Chart patterns and candlestick patterns may seem similar, but they have distinct characteristics.

Reversal Chart Patterns

Chart patterns are visual representations of price movements in financial markets that traders use to identify potential trends and make informed trading decisions. These patterns can be found on various charts, such as line charts, bar charts, and candlestick charts.

Chart Patterns. January 24, 2016 by Thomas Mann All Things Stocks Medium

Below is the 10 most useful trade chart patterns poster: 1. Head and Shoulders. This is a bullish and bearish reversal pattern which has a large peak in the middle and smaller peaks on either side. The head and shoulders chart pattern is considered to be one of the most reliable reversal chart patterns.