How To Trade Inverted Cup And Handle Chart Pattern TradingAxe

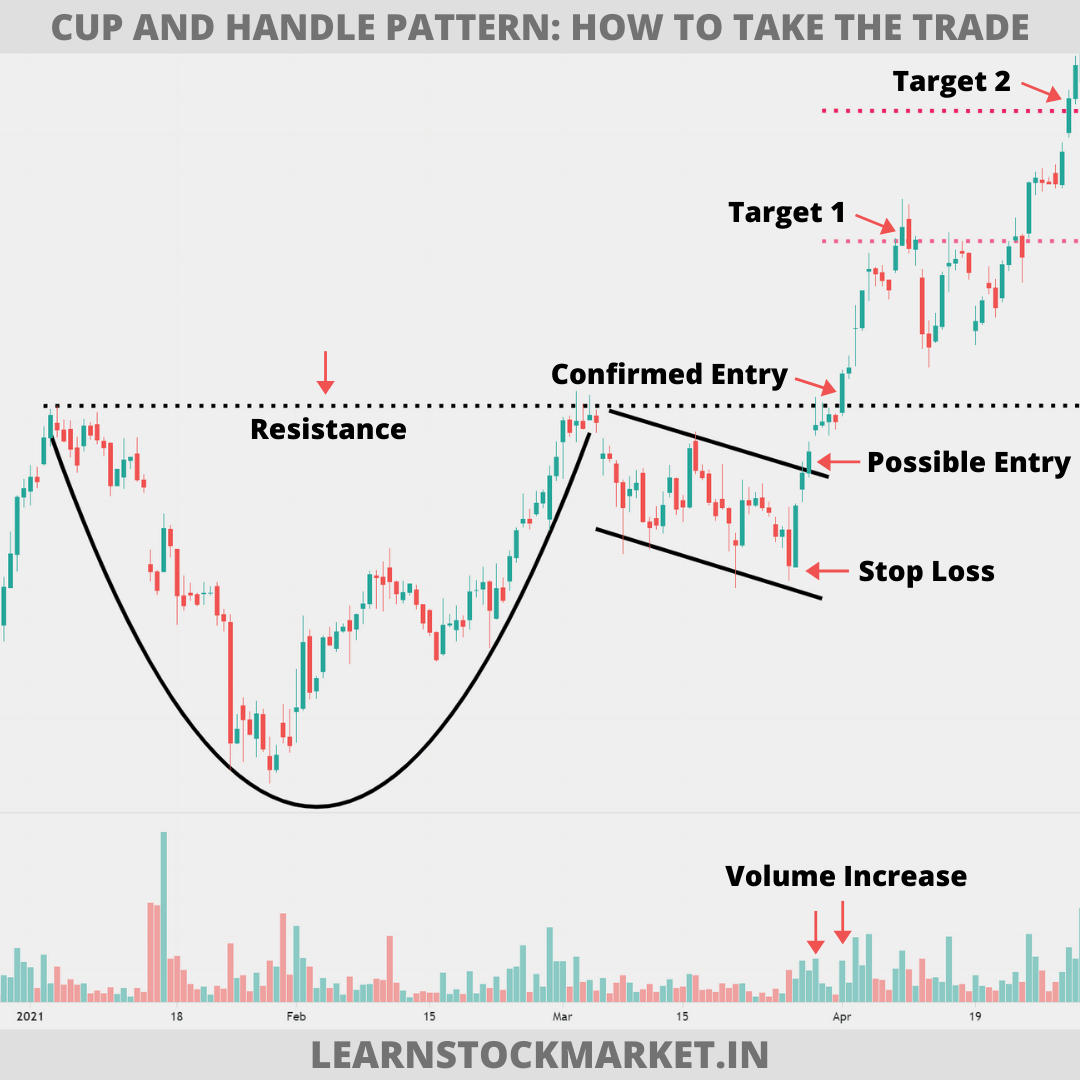

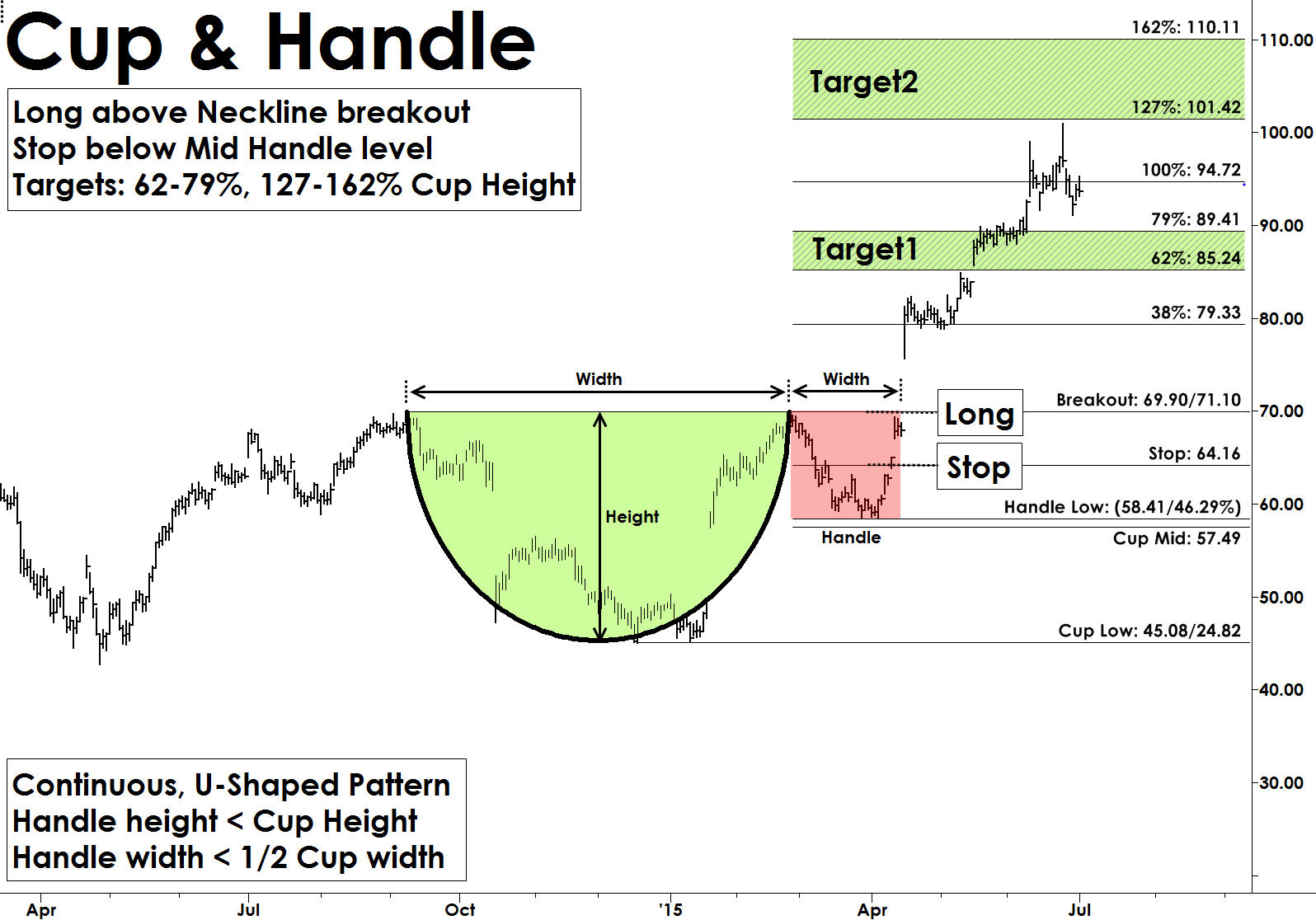

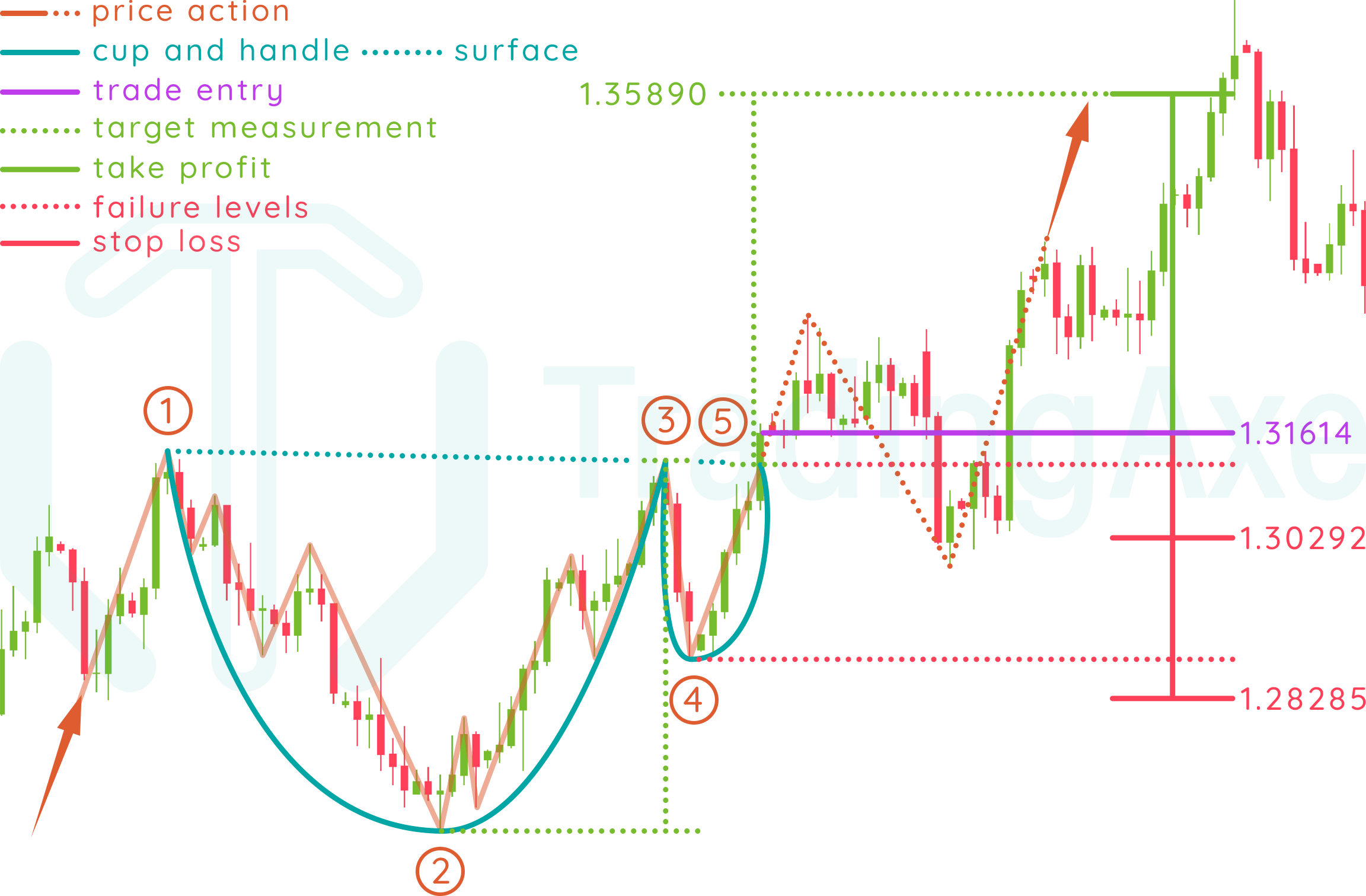

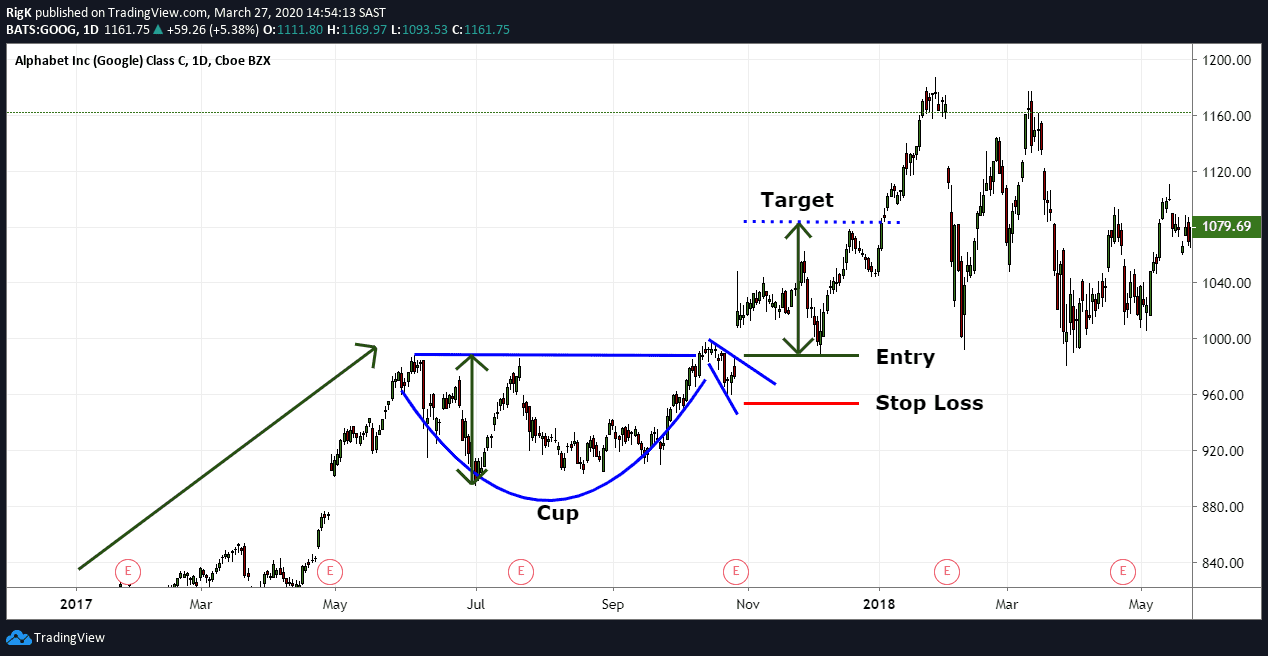

A cup and handle pattern price target measurement is set by measuring the distance between the swing bottom price and the swing resistance level of the cup component of the pattern (cup height) and adding this to the breakout point over the resistance level.. For example, if the buy entry price is $30 and the height of the pattern high and low.

Trading the Cup and Handle Chart Pattern for Maximum Profit

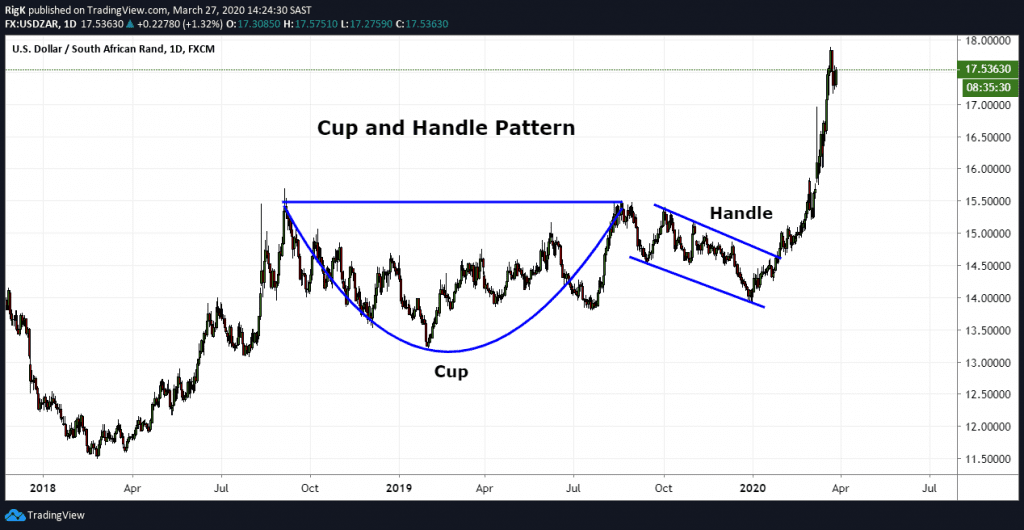

The cup and handle chart pattern is a technical analysis trading strategy in which the trader attempts to identify a breakout in asset price to profit from a strong uptrend. The cup and handle chart pattern is considered reliable based on 900+ trades, with a 95% success rate in bull markets.

Cup and Handle Patterns Comprehensive Stock Trading Guide

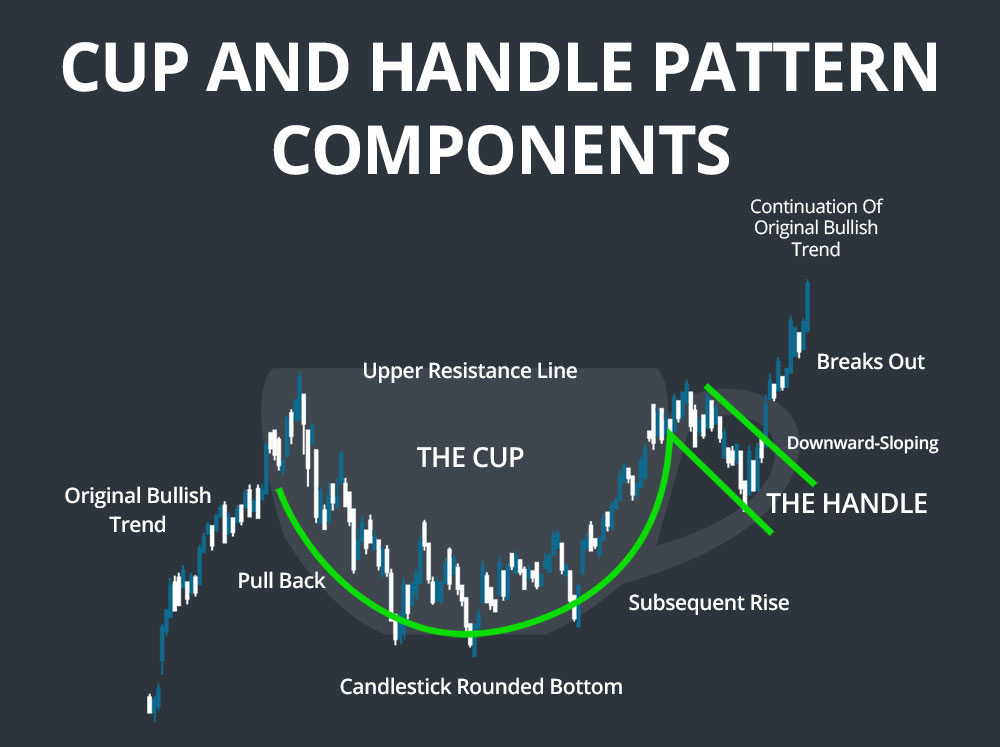

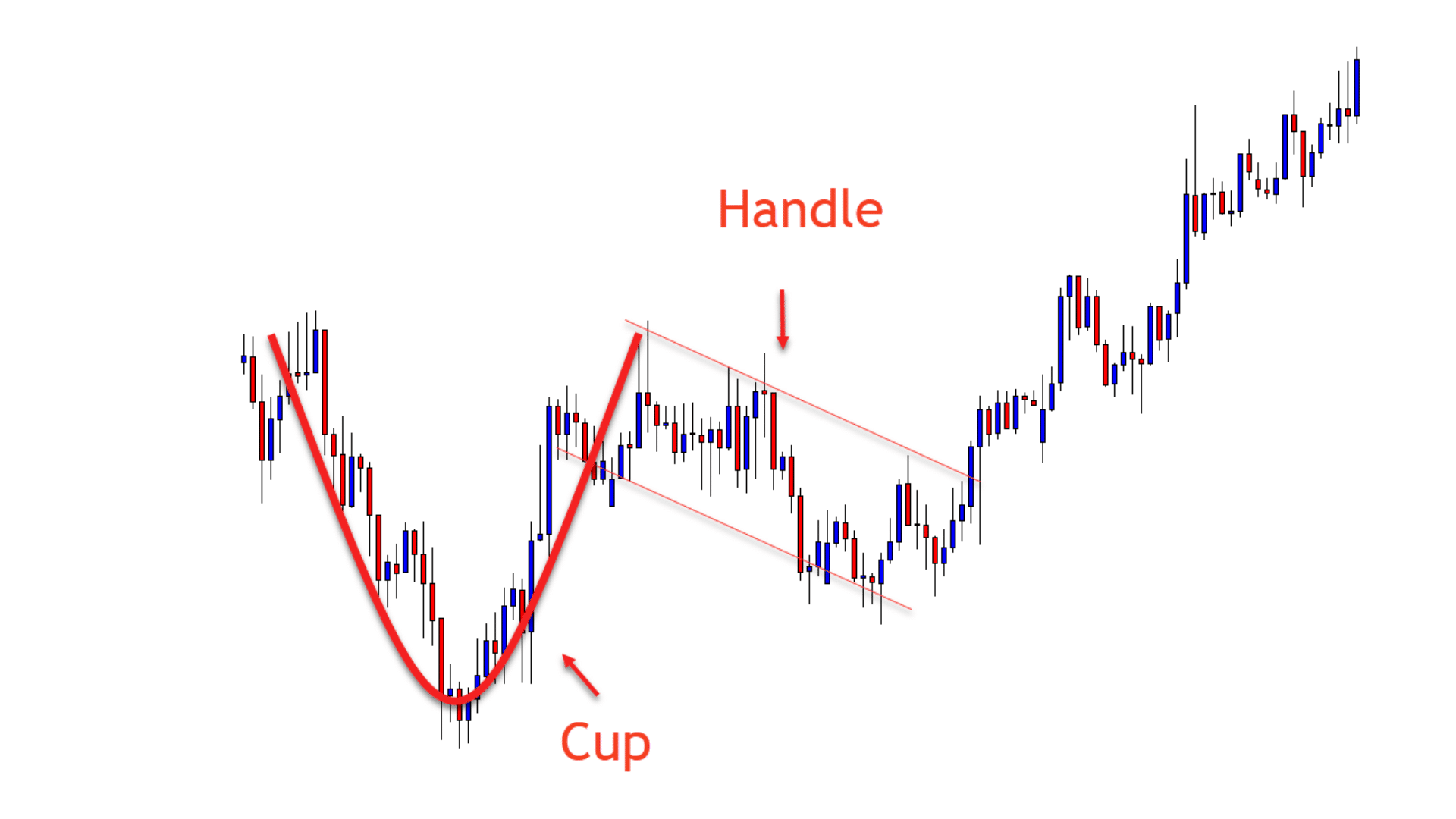

The cup and handle pattern is a bullish continuation pattern that is widely used by traders to identify potential buying opportunities in the market. Here are some guidelines for identifying the cup and handle pattern: Cup Formation: Look for a U-shaped curve in the chart that resembles a cup.

Cup and Handle Pattern Meaning with Example

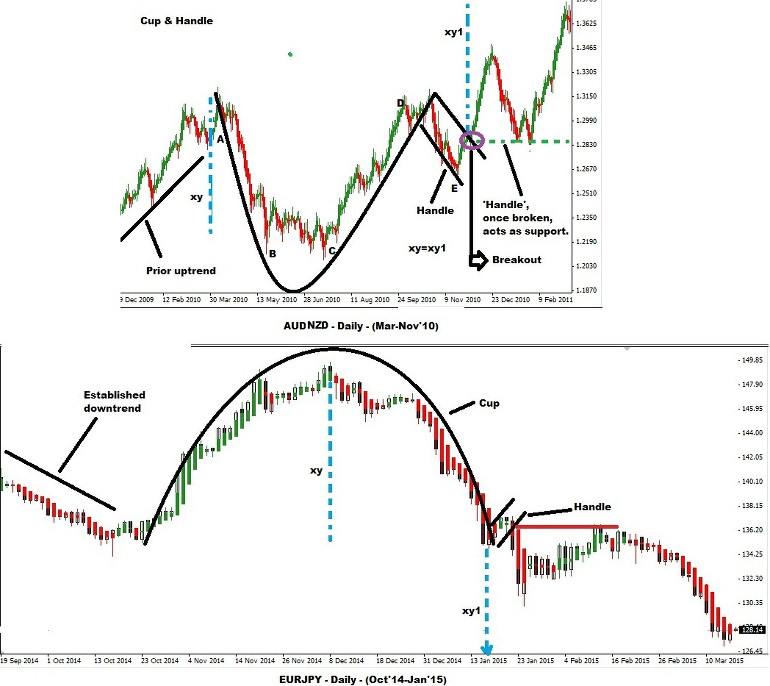

The Cup with Handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. It was developed by William O'Neil and introduced in his 1988 book, How to Make Money in Stocks . As its name implies, there are two parts to the pattern—the cup and the handle.

Cup and Handle Pattern How to Find and Trade

Cup and handle chart patterns can last anywhere from seven to 65 weeks. It starts when a stock's price runs up at least 30%. This uptrend must happen before the cup base's construction. Then it has a 12%-33% drop from its high. Eventually, the stock finds a floor of support for weeks or longer before climbing again.

Cup And Handle Pattern How To Verify And Use Efficiently How To

Written by Timothy Sykes Updated 7/8/2020 17 min read The cup and handle is a technical chart pattern. It was first defined by William O'Neil in his classic book "How to Make Money in Stocks." O'Neil called it a "cup with handle" pattern. He had clear criteria defining this pattern. I'll cover that in this post. But fair warning…

Trading Bank Stocks Cup&Handle Chart Patterns

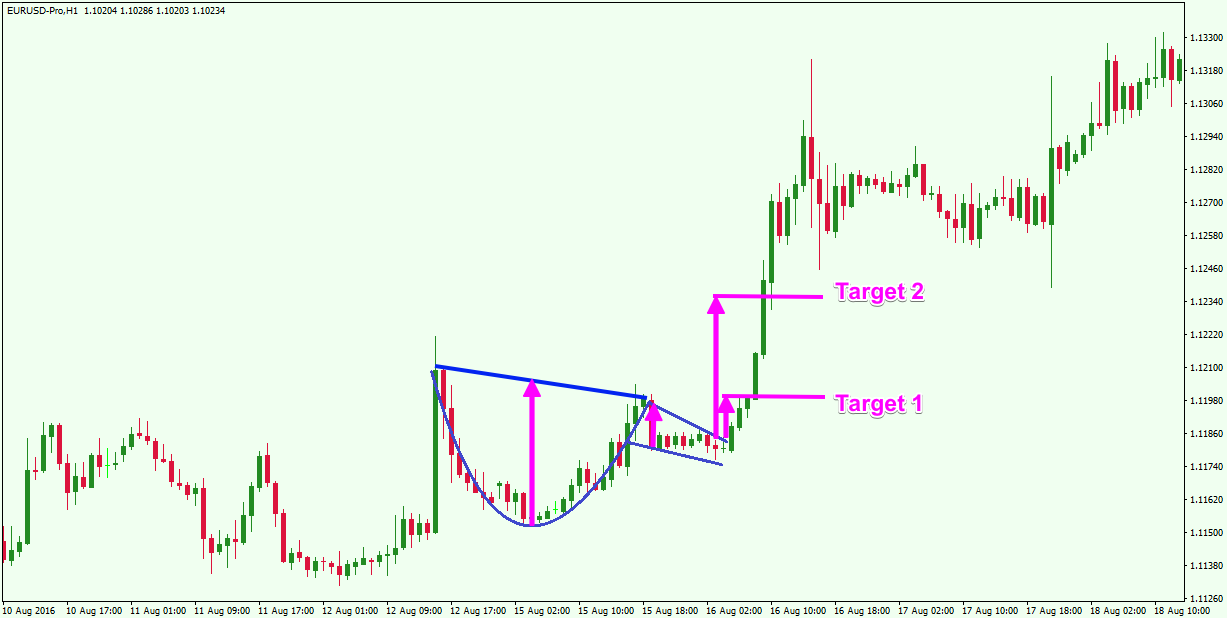

A Cup and Handle can be used as an entry pattern for the continuation of an established bullish trend. It´s one of the easiest patterns to identify. The cup has a soft U-shape, retraces the prior move for about ⅓ and looks like a bowl. After forming the cup, price pulls back to about ⅓ of the cups advance, forming the handle.

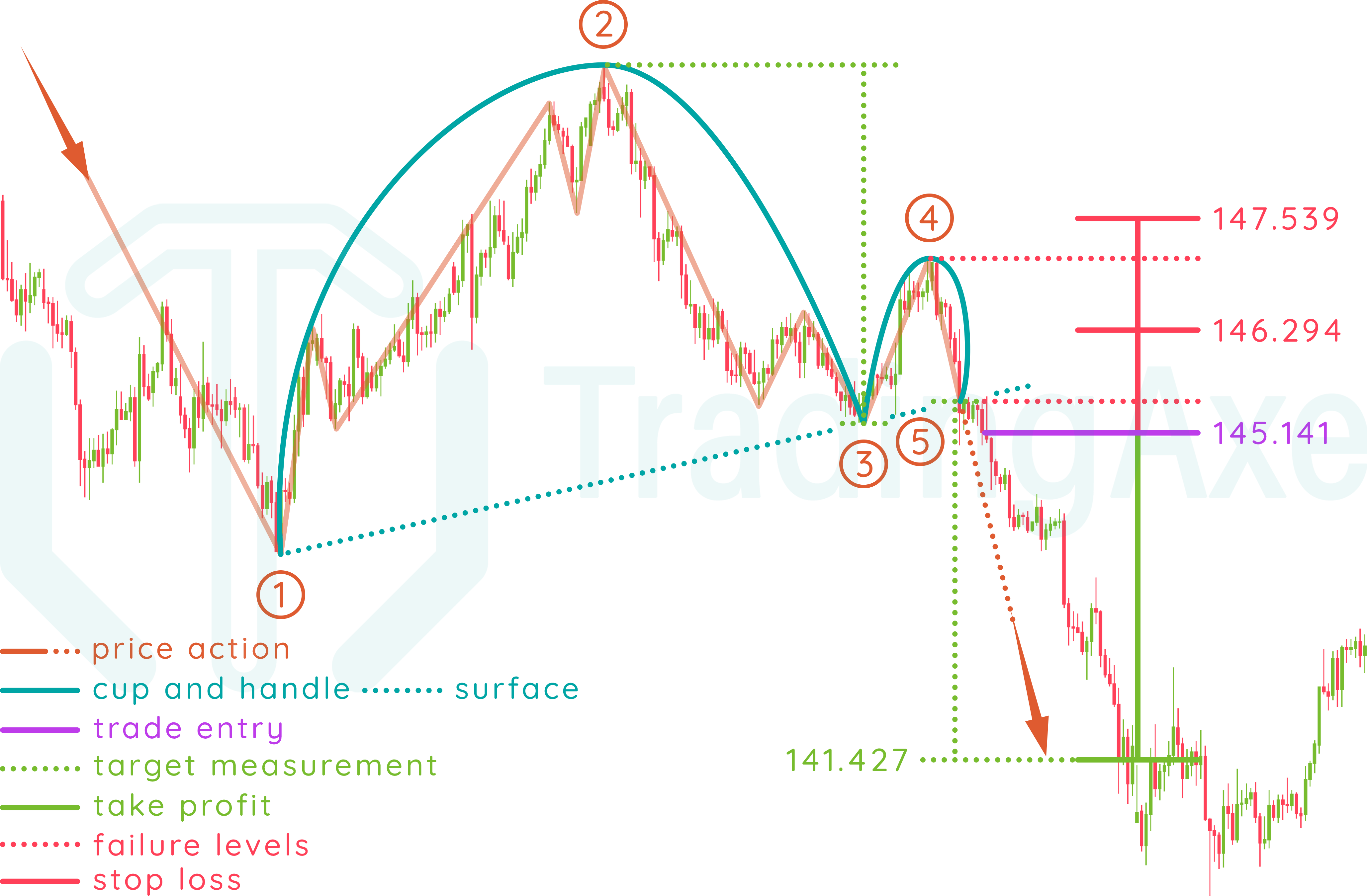

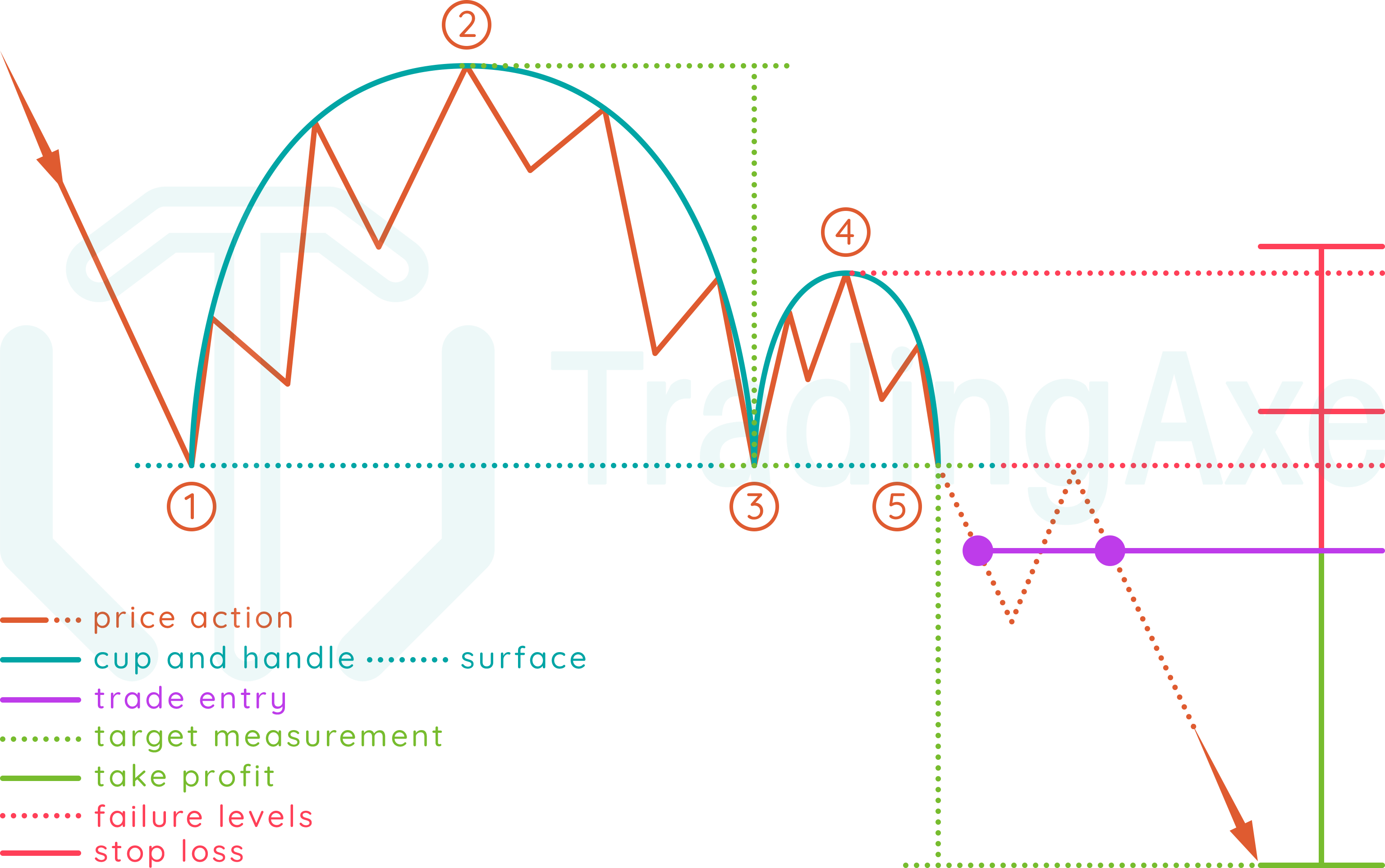

How To Trade Inverted Cup And Handle Chart Pattern TradingAxe

The Cup and Handle pattern is a bullish reversal chart pattern (it could be after a correction or a long-term downtrend). There are 2 parts to it: The Cup — the market show signs of bottoming as it has bounced off the lows and is making higher highs towards Resistance

.png)

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

A cup and handle is a technical chart pattern that resembles a cup and handle where the cup is in the shape of a "u" and the handle has a slight downward drift. A cup and handle is.

The Cup and Handle Chart Pattern (Trading Guide)

What Is a Cup and Handle Pattern? Chart patterns, like a triangle, rectangle, head and shoulders, or—in this case—a cup and handle are a visual way to trade. The cup and handle pattern, also sometimes known as the cup with handle pattern was first identified by stockbroker William O'Neil in 1988.

How To Trade Cup And Handle Chart Pattern TradingAxe

It drops from $300 to $260 over four months, sculpting the 'cup'. Climbing back to $300, instead of soaring, it eases into the 'handle', retreating to $285 within three weeks. Traders, eyes sharp on this pattern, are poised and ready. Once the price edges past $301 with enhanced volume, it screams "action time!".

Cup and Handle Patterns Comprehensive Stock Trading Guide

The cup and handle chart pattern does have a few limitations. Firstly, it does not occur within a specific timeframe. Sometimes it forms within a few days, but it can take up to a year for the pattern to fully form. Secondly, you need to learn to identify the length and depth of a true cup and handle, as there can be false signals.

Cup & Handle Pattern in Binary Trading Binary Trading

Cup and Handle Trade Example. Now let's look at how a trader might a short term Cup and Handle pattern, and what the numbers look like. Checking TSLA's 15 minute chart, we can find a valid Cup and Handle in March, 2023. Note that the edges of the cup are quite steep in this example, and the bottom of the cup is not as round as we want.

The Cup and Handle Chart Pattern (Trading Guide)

Named for its distinctive shape, the cup and handle pattern is a powerful, bullish signal that can indicate a stock or crypto is likely to see a price increase in the future. This top chart pattern is a favorite among swing traders, who have been relying on this pattern for decades to spot potential opportunities for profit.

:max_bytes(150000):strip_icc()/CupandHandleDefinition1-bbe9a2fd1e6048e380da57f40410d74a.png)

Cup and Handle Definition

Cup and handle is a bullish chart pattern, commonly found either at the bottom of a trend as a reversal pattern, or mid-trend as a continuation pattern. Price action takes on the rounded appearance of the bottom of a cup, with a small correction forming the handle. A breakout occurs when neckline resistance is broken.

Cup and Handle Pattern Trading Strategy Guide Synapse Trading

Cup & Handle Pattern New: LIVE Alerts now available! Scanner Guide Scan Examples Feedback Scan Description: Cup & Handle Pattern Stock passes all of the below filters in cash segment: 7 months ago High Less than 6 months ago High 7 months ago High Less than 5 months ago High 5 months ago High Less than 4 months ago High 5 months ago High