FOUR INTERESTING REASONS WHY YOU NEED TO OPEN A SAVINGS ACCOUNT Online Finance Solution at a

A gift savings account is a custodial account designed to help you accrue savings for a minor. The account is managed by a custodian — a parent, other relatives or a family friend — who monitors deposits and the balance as it grows. It's protected until the child reaches 18 years old or your state's age of majority.

What is the Best Savings Account? Blog

The Bank Account Buffer™ is your very first step toward financial security and peace of mind. Learn why you need a Bank Account Buffer™ and how to create one. Here's a common question from new readers: "What's the number one most important thing I can do to improve my financial situation quickly?"

Best Checking Accounts of 2020 Money's Top Picks

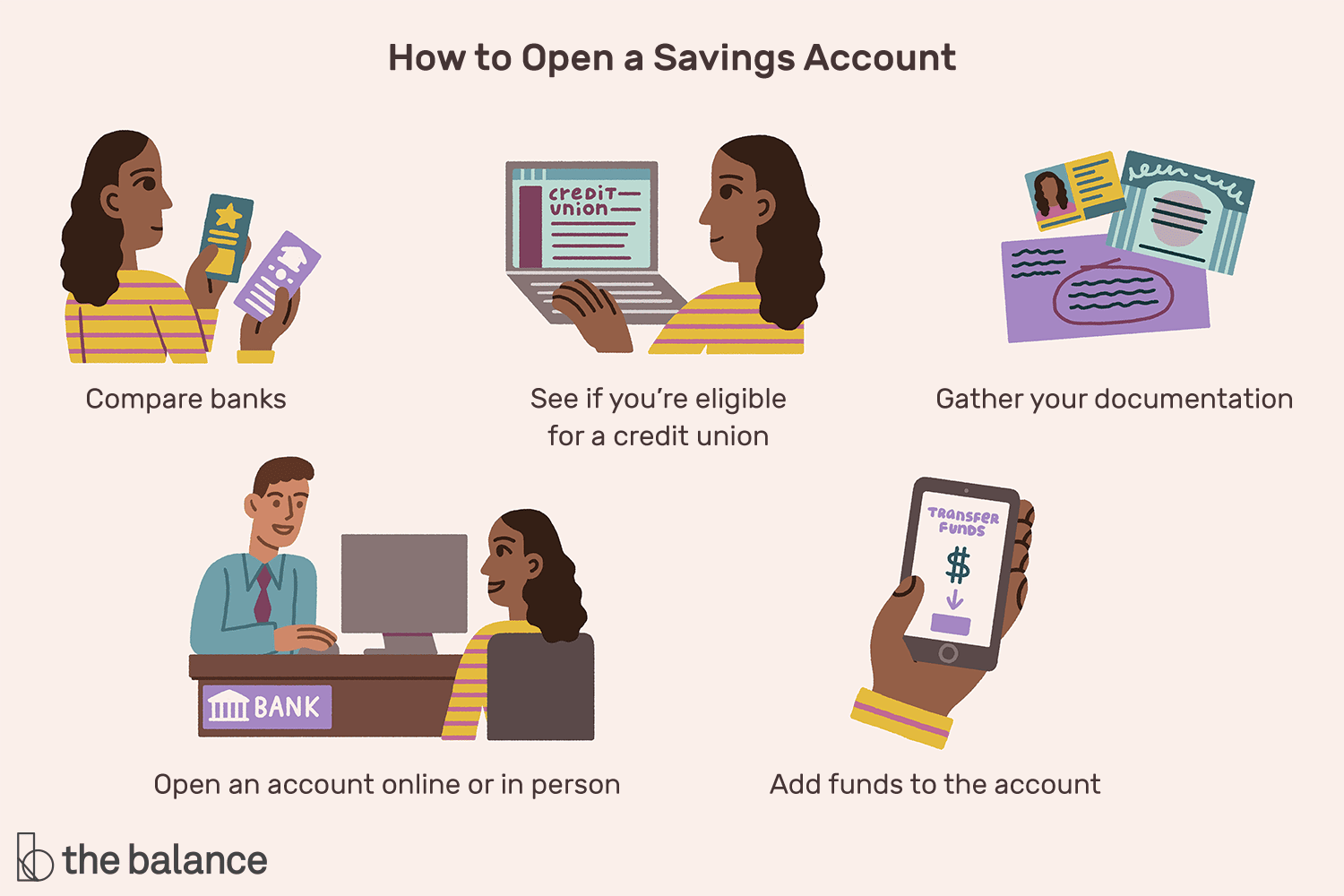

To open a savings account, you must submit an application. Depending on the bank or credit union, you may have the option to apply in person, by phone, via mail or online. 1. Provide details and.

What’s the Best Type of Savings Account? WealthFit

A no-penalty CD, often referred to as a "liquid" or "breakable" CD, is a type of certificate of deposit that lets you withdraw funds before the end of your term without paying a penalty. Like.

What are the 3 Main Types of Savings Accounts in Canada? TFSA, HISA, & Joint

High-Yield Savings Accounts Luring Spenders. Should You Move Your Cash? High-yield savings accounts are offering rates as high as 5.33%, drawing 3 in 5 Americans to save rather than spend,.

Difference between Current account and Savings account

1. Choose the Right Type of Savings Account 2. Set Your Savings Goals 3. Create Automatic Savings Deposits 4. Consider Opening Multiple Accounts 5. Follow a Budget Plan 6. Link Your Accounts to a Budgeting App 7. Consider Your Savings Untouchable

What Is A Savings Account? Definition, How They Work

Can You Lock A Savings Account? Understanding the Possibility Before diving into the idea of a locked savings account, it's important to familiarize ourselves with the restrictions typically imposed on traditional savings accounts. These accounts often limit the number of monthly withdrawals to encourage personal financial discipline.

What is a Savings Account? Banking Tides

$50 $0 Best Bank Accounts for Bad Credit in January 2024 Many financial institutions, including traditional banks, online banks and credit unions, offer accounts with flexible requirements for.

What’s the Best Type of Savings Account? WealthFit

Aug 18, 2023 Fact checked A dedicated Christmas club account, often called a Christmas savings account, could help you prepare for the often-expensive holiday. Not only can these accounts help you avoid taking on more debt for the holiday season, but they're also interest-bearing, so your savings can grow without lifting a finger.

StepByStep Guide for Beginners to Open a Savings Account

Your office 401(k) may feel like an untouchable savings account, but it's actually a powerful, tax-advantaged investing tool. A whopping $5.3 trillion was held in 401(k) plans at the end of 2017.

Saving Accounts Full Guide How Does it Work, Pros & Cons and How To Open an Online Account

The technique of buying a fixed amount of an investment at regular intervals is known as dollar-cost averaging (DCA). Lump-sum investing is when you put your amount right to work without waiting. You may be wondering: is DCA or lump-sum investing a better strategy?

Best Savings Accounts (UPDATED 21/04/2023) Easy Money Saving

How do I make an untouchable savings account? Here are seven ways you can stop dipping into your savings account each month, and start building savings instead. Set Up an Emergency Fund.. Switch to Cash-Only.. Move Your Savings to Another Bank.. Find Additional Income.. Find Ways to Cut Your Other Expenses..

Do's and Don'ts of Bank Savings Account Save A Little Money Save A Little Money

A "restricted account" is a savings account where a family who is getting cash aid can keep money to be spent for certain purposes. The savings account can be in any financial institution, such as a bank, credit union, savings and loan, etc. You can have more than one restricted account. Takedown request | View complete answer on cdss.ca.gov.

What Are The Types of Savings Accounts? Topcount

Untouchable savings account: Is it right for you? Wanting to save, but not sure how to 'lock in' your savings if you'll just as easily spend them? We share ideas. There's a lot to love about savings accounts. They're a secure place to grow a cash stash, and with the benefit of interest earnings, you can reach savings goals sooner.

The Four Types of Savings Accounts That Everyone Should Have

Untouchable savings accounts and CDs Grow your balance with a locked or fixed-term savings account to reduce the temptation of spending it all. By Steven Dashiell Edited by Holly Jennings Reviewed by Alexa Serrano Cruz Updated Dec 28, 2023 Fact checked Two types of accounts prevent you from accessing your money: savings accounts and CDs.

Best Savings Accounts 2021 High Yield & Online GOBankingRates

EverBank (formerly TIAA Bank), 5.15% savings APY with no minimum to open account (read full review), Member FDIC. First Foundation Bank, 5.00% savings APY with $1,000 minimum to open account (read.