503020 Budget Rule How to Make a Realistic Budget Mint Notion

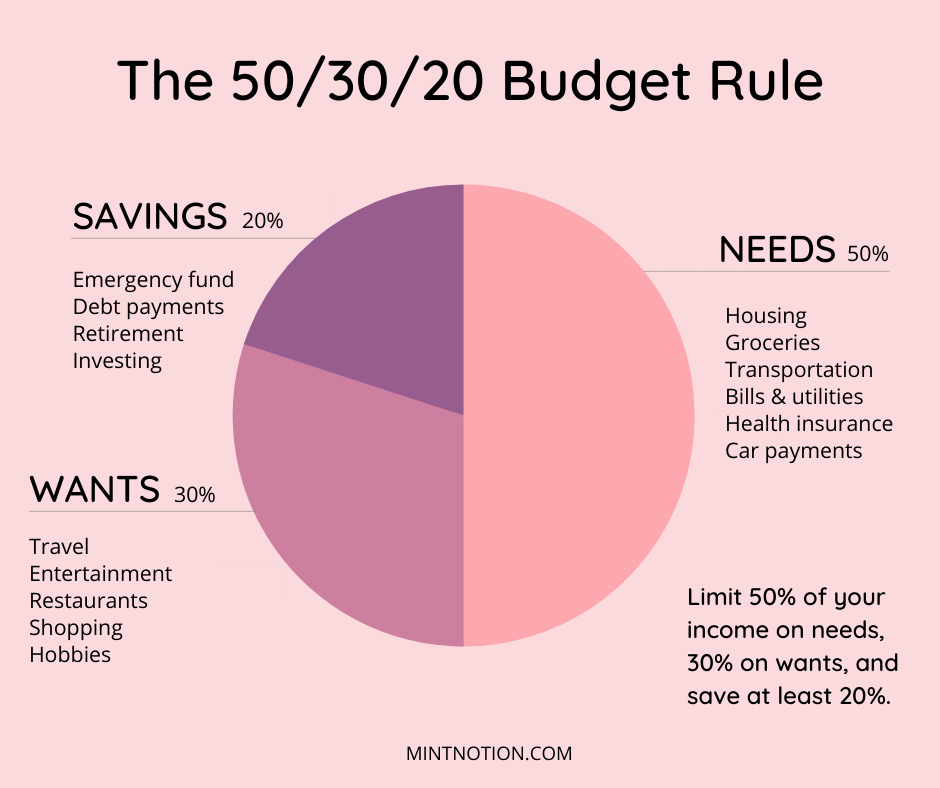

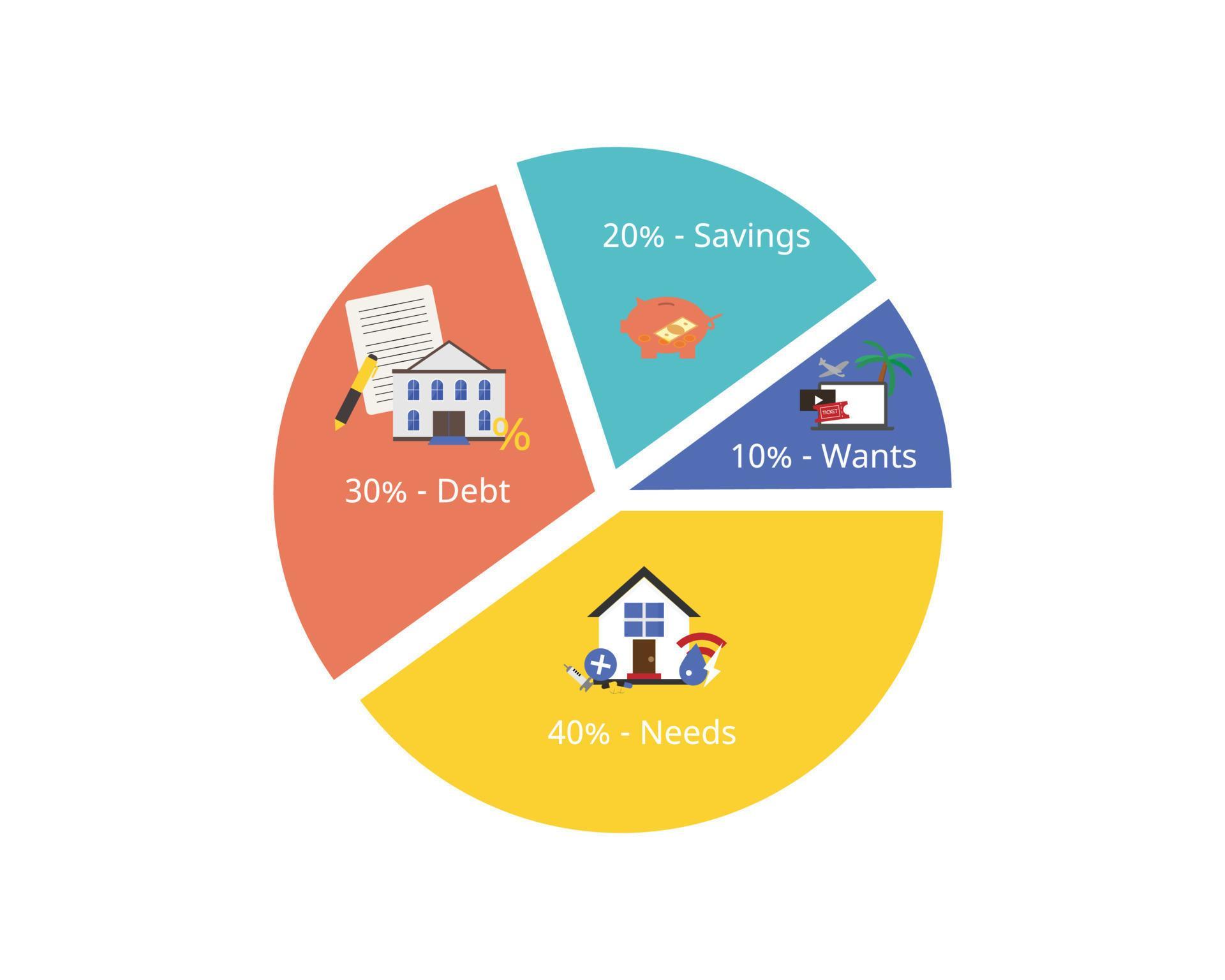

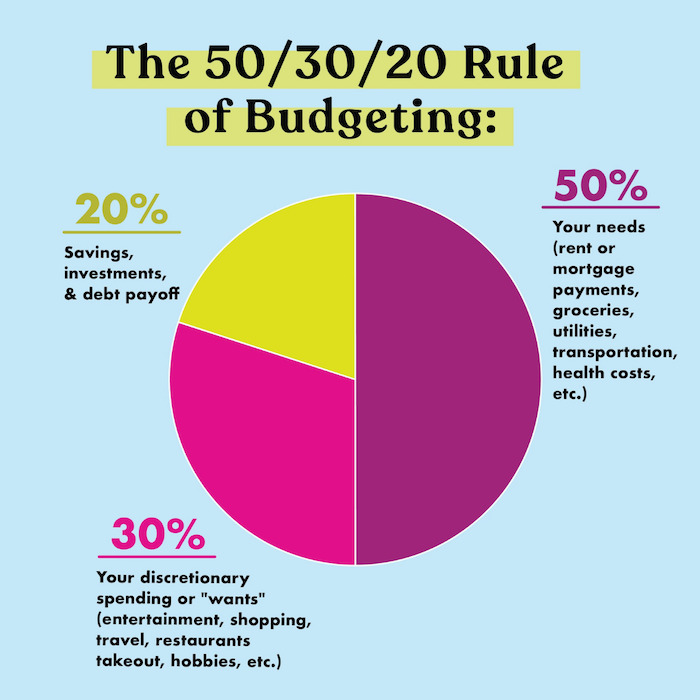

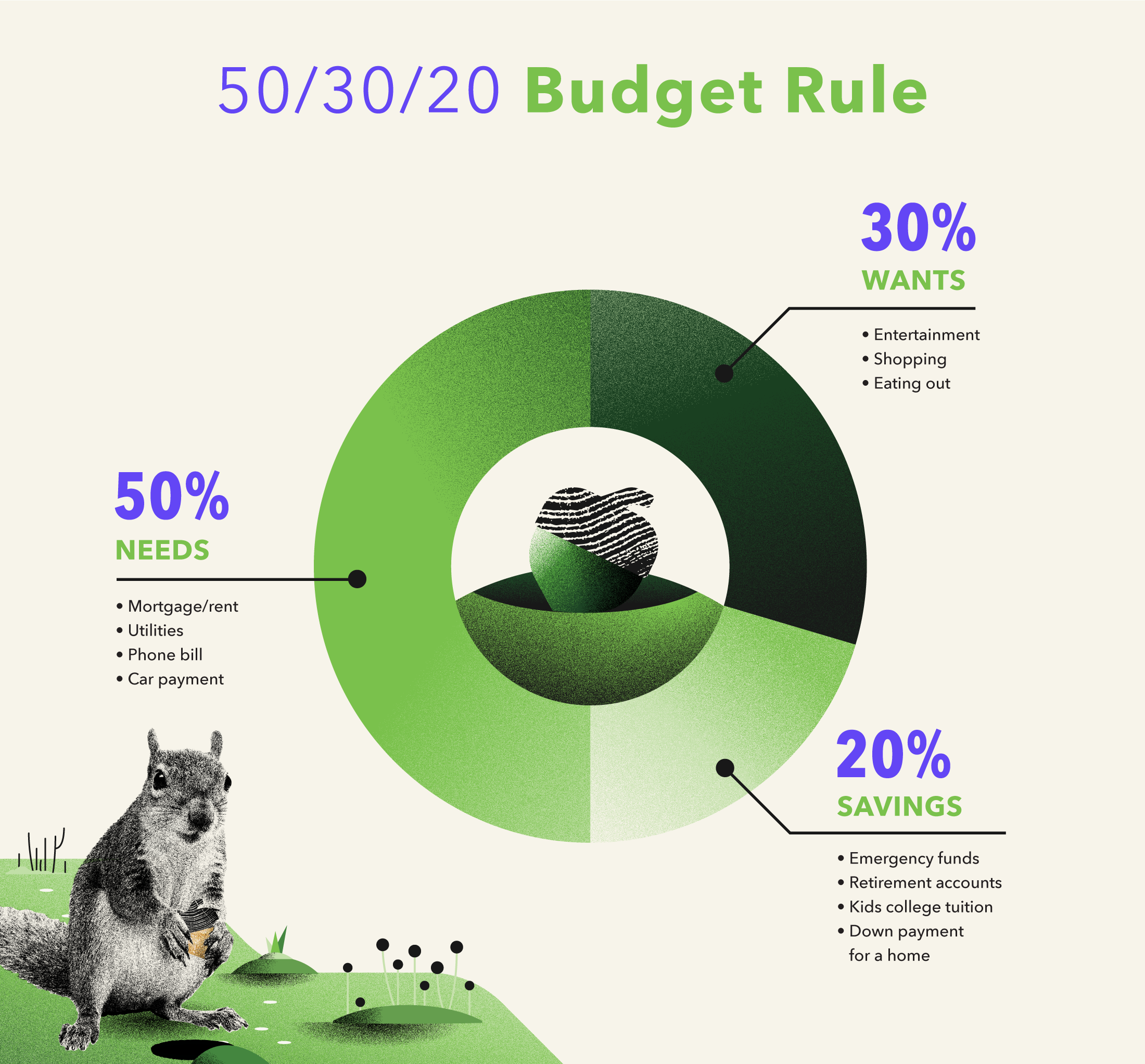

The 50/30/20 rule is a budgeting method that breaks your spending into three categories: needs, wants, and financial goals. The method is designed to help people live within their means, get ahead financially, and still have money for discretionary spending. To organize your budget using the 50/30/20 rule, you'll find out your monthly income.

50 30 20 Rule is it the Best Budget? MeMoreMoney Helping You Have More Money

The 50/30/20 rule is a budgeting strategy that devotes set portions of your income to the categories of needs, wants and savings. This money-management rule was covered by Sen. Elizabeth Warren.

Budget with the 50/30/20 Rule Versa

The 50/30/20 budget is an easy strategy for better money management. The basic rule of thumb is to divide your monthly after-tax income into three spending categories: needs, wants, and savings or financial goals like paying down debt. It's not a hard-and-fast rule but a guideline to help you build a solid monthly budget.

Jeremiah 3020 Their children will be as in days of old, and their congregation will be

50/30/20 explained. The basic idea of the 50/30/20 rule is simple. You allocate 50% of your post-tax income to "needs" and another 30% to "wants.". That leaves you with at least 20% of.

Exodus 3020 Whenever they enter the Tent of Meeting or approach the altar to minister by

AboutTranscript. The 50-30-20 rule is a suggested budgeting guideline that advises allocating 50% of your income to necessities (like rent, groceries, and utilities), 30% to discretionary spending (like hobbies, entertainment, and travel), and 20% to savings. The goal is to create a balanced budget that allows you to cover your needs, enjoy.

30DOBnew3020 The Plank Center for Leadership in Public Relations

The 50-30-20 rule Having a plan for your money is central to building a solid financial foundation and the 50-30-20 rule can help. Use it as a starting point to put your expenses into "buckets" so you can take control, plan your spending and progress towards your financial goals.

Monthly 40302010 Budget rule of guideline for saving and spending the expense you need and

The 50/30/20 budget rule slices your monthly pay to cover three different categories of expenses: 50% of your after-tax income (take-home pay) covers needs. These are essentials, such as housing.

What Is The 50/30/20 Budget Rule?

"The 50/30/20 budget can work for people who don't need a constant check in on their money," says Chris Muller, vice president of personal finance at XLMedia. "If you're doing a 50/30/20.

Why You Need the 503020 Rule of Financial Planning & How it Works? FinCalC Blog

The 50/30/20 rule is a way to divide your income into three categories: needs, wants, and savings and debt. Learn how to apply this rule, where it came from, and what benefits it offers.

Say hello to the 503020 Rule! NestEgg

Learn how to budget your income by splitting it into three categories: 50% for needs, 30% for wants, and 20% for savings. Find out what counts as needs, wants, and savings, and how this rule can help you achieve your financial goals.

The 50/30/20 Budget What It Is & Why You Need To Start Using It ASAP (+Downloadable Template)

Learn how to use the 50/30/20 rule to allocate your income to needs, wants, and financial goals. This rule can help you manage your budget and save for the future.

Tables 20 to 30, 20 se 30 tak table, Maths 20 to 30 tables Multiplication Chart

The 50/30/20 Rule is a suggested plan that encourages living within your budget and saving for the future. It considers your needs, allows for your wants, and doesn't let you forget about savings or debt repayment. In a nutshell, the 50/30/20 Rule advises spending 50% of your take-home income on needs, 30% on wants, and 20% on savings or.

50/30/20 Budget Rule A better way to budget your money Boss Personal Planner

1. 50/30/20 puts half your income toward needs, 30% toward wants, and 20% into savings. 2. Clearly defining wants vs. needs is critical to making this budget work. 3. Broad categories may not offer enough detail for some. The 50/30/20 rule splits your budget into three categories: 50% of your after-tax income pays for your needs, 30% pays for.

LCM of 30 40 60 YouTube

50/30/20 budget calculator. Our 50/30/20 calculator divides your take-home income into suggested spending in three categories: 50% of net pay for needs, 30% for wants and 20% for savings and debt.

The 503020 Budgeting Method Inspired Budget

Learn about a popular budgeting method that divides your spending and saving into three categories: needs, wants and savings. Find out the pros and cons of this rule and how it compares to the 7 Baby Steps.

What Is the 50/30/20 Rule? Personal Wealth Creation

The 50/30/20 system was designed to make budgeting more accessible to people who get overwhelmed by complicated spreadsheets and budgeting apps. It was popularized by Senator Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan.